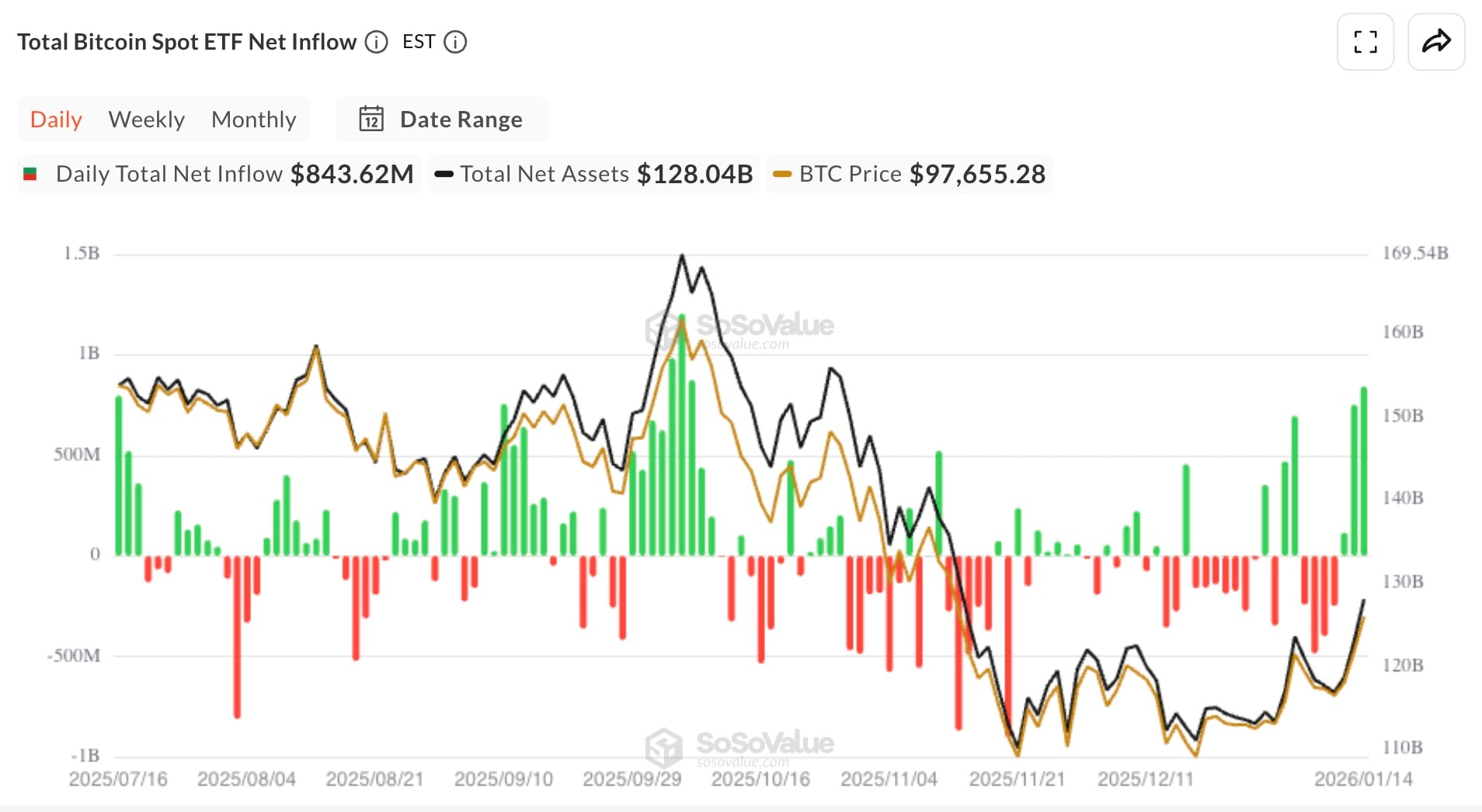

So, it turns out Bitcoin has found its true calling-not as a decentralized currency of the future, but as the darling of institutions with more money than sense. According to SoSoValue (a name that sounds like it was generated by a random word bot), on January 14th, spot Bitcoin ETFs slurped up a net inflow of $843.62 million. That’s right, nearly a billion dollars in a single day. Because apparently, the only thing more irresistible than a black hole is a Bitcoin ETF. 🕳️✨

The total cumulative net inflow is now hovering above $58.1 billion, while total assets across all funds have ballooned to $128.04 billion. That’s 6.56% of Bitcoin’s market cap, or roughly the GDP of a small, confused country. 🌍💸

Leading the charge is the BlackRock iShares Bitcoin Trust (IBIT), which hoovered up $648.39 million in a single day. Its net assets have now surged past $76 billion, because why not? Fidelity’s FBTC came in second with $125.39 million, and Ark 21Shares’ ARKB brought in $27 million. Even the smaller players like Valkyrie and Franklin got a piece of the pie, despite fees being squeezed tighter than a pair of skinny jeans after Thanksgiving dinner. 🦃👖

2 Ridiculously Obvious Reasons for the $840.6 Million Bitcoin ETF Surge

This sudden influx of cash comes after a volatile early January, when outflows exceeded $1.3 billion between January 7th and 9th. But last week, we saw a total net inflow of $1.71 billion-a complete U-turn that suggests institutions are back to hoarding Bitcoin like it’s digital toilet paper. Why? Probably because they’re anticipating Q1 CPI relief and a rate cut, or maybe they just really like the color orange. 🧻📉

Meanwhile, Bitcoin’s price hit $96,951 before taking a breather, keeping the $100,000 mark tantalizingly close. If ETF inflows keep up this pace, BTC’s total spot ETF ownership might finally crack 7%, with liquidity pressure pushing toward the next psychological ceiling at $107,000 per BTC. Because nothing says “financial stability” like a number with five zeros. 💯💥

Bitcoin’s ETF-backed rally is now accomplishing what raw demand and excitement couldn’t: squeezing supply-side exhaustion into a market structure that’s about as sturdy as a house of cards in a wind tunnel. This might not just be a bounce; it’s starting to look like a proper breakout-with institutional backing, no less. Or, as I like to call it, “The Great Bitcoin Suck-In of 2024.” 🚀🌪️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2026-01-15 12:53