As a seasoned researcher with over two decades of experience in the financial markets, I’ve seen my fair share of market trends and shifts. The current state of Bitcoin (BTC) is reminiscent of the dot-com boom, albeit in a digital form. The consistent decline in BTC exchange balances and the rise in the BTC Exchange Stablecoins Ratio are indicators that suggest a bullish outlook for the flagship crypto asset.

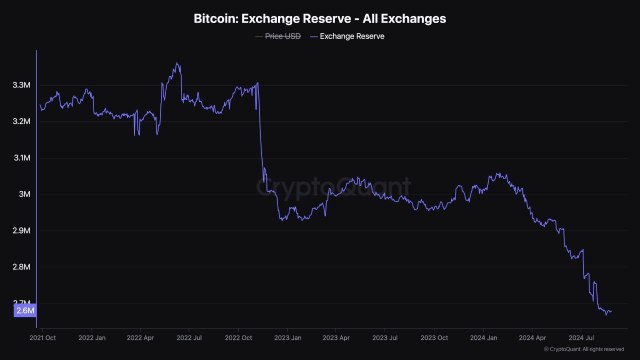

It seems that Bitcoin, the largest cryptocurrency, is currently witnessing increased optimism among its investors. This is suggested by the fact that Bitcoin balances on various cryptocurrency exchanges have been consistently decreasing. This decrease in exchange reserves could indicate that investors are less likely to sell their Bitcoins immediately, a behavior often associated with positive market sentiment and expectations of further growth within the crypto market.

Investors Offloading Bitcoin From Crypto Exchanges

Observing Bitcoin’s latest surge, I, as a researcher, have noticed a change in investor sentiment towards BTC, which appears more optimistic according to observations made by Kyle Doops, a market expert and host of Crypto Banter Show. This positive shift was recently shared by him with the wider crypto community on the X platform (previously known as Twitter).

As per the expert’s analysis, Bitcoin appears to be withdrawing from cryptocurrency exchanges, implying decreased selling pressure since BTC owners are transferring their assets off these platforms more frequently. This trend suggests that investor confidence is growing and points towards a positive, stable price forecast for the long term.

The post read:

Moving their Bitcoin off exchanges suggests that sellers are reducing their presence, leading to a potential decrease in selling pressure. This trend may indicate increasing investor trust in the cryptocurrency, potentially indicating a positive outlook for its long-term price consistency.

As enthusiasm for the cryptocurrency increases due to expectations of potential price surges in the near future, more people are suggesting that Bitcoin could soon experience a strong upward trend, further cementing its status as the leading digital currency.

Kyle Doops noted elsewhere that there’s been a decrease in another Bitcoin statistic, notably the Bitcoin Exchange Stablecoin Ratio, which suggests a shift in market trends. More precisely, this decline indicates that investors are planning to buy Bitcoin by swapping stablecoins into the digital currency, expecting both short-term and long-term price increases.

He underlined that the decline in the exchange stablecoins ratio for BTC suggests that there is strong purchasing power and that prices may surge in the future. Furthermore, the expert claims that such circumstances in the past have signaled a major increase in the value of Bitcoin, offering a bullish sign as investors and traders reposition themselves.

Is The BTC’s Recent Uptrend Over?

Regardless of Bitcoin’s high demand, the digital currency experienced a dip earlier today that caused its value to drop from around $66,000 to approximately $64,500.

At the moment, Bitcoin is being traded at around $64,517, which represents a nearly 2% drop in its value over the past day. Despite this short-term negative trend, if we look at the longer perspective such as one week or one month, Bitcoin has shown an increase of 1.62% and 9.04% respectively.

Those who invest in Bitcoin might see the current dip as an opportunity to buy, given that its trading activity has significantly increased by approximately 45% within the past day. However, it’s worth noting that despite this rise, the overall market value of Bitcoin has decreased by around 1.57% over the last 24 hours.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- EUR CAD PREDICTION

- APU PREDICTION. APU cryptocurrency

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- XDC PREDICTION. XDC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- USD GEL PREDICTION

- POL PREDICTION. POL cryptocurrency

- EUR INR PREDICTION

2024-09-30 13:11