The cost of transacting on the Bitcoin network has been relatively low lately, with fees for processing blocks at nearly the lowest levels seen in recent cycles.

Bitcoin Miners Have Been Receiving Low Fees Recently

According to analyst James Van Straten in his latest post on X, the cost for bitcoin users to send transactions on the blockchain has been reaching its lowest point in recent cycles. This “transaction fee” is the amount that users pay as an incentive for miners to process their transfers.

The value of this metric often reflects the amount of traffic on the network. During periods of heavy usage, transactions may take a long time to be processed due to the network’s limited ability to handle high volumes of activity.

For users short on time, it’s an option to pay higher-than-normal fees when networks are busy. This increases the likelihood of miners processing their transactions first. In highly congested situations, average fees can surge significantly due to numerous senders trying to get their transfers confirmed before others.

During times of light traffic on the blockchain, users are not strongly motivated to pay high fees since there’s not much congestion. Consequently, the typical fee amount across the network remains relatively low under these circumstances.

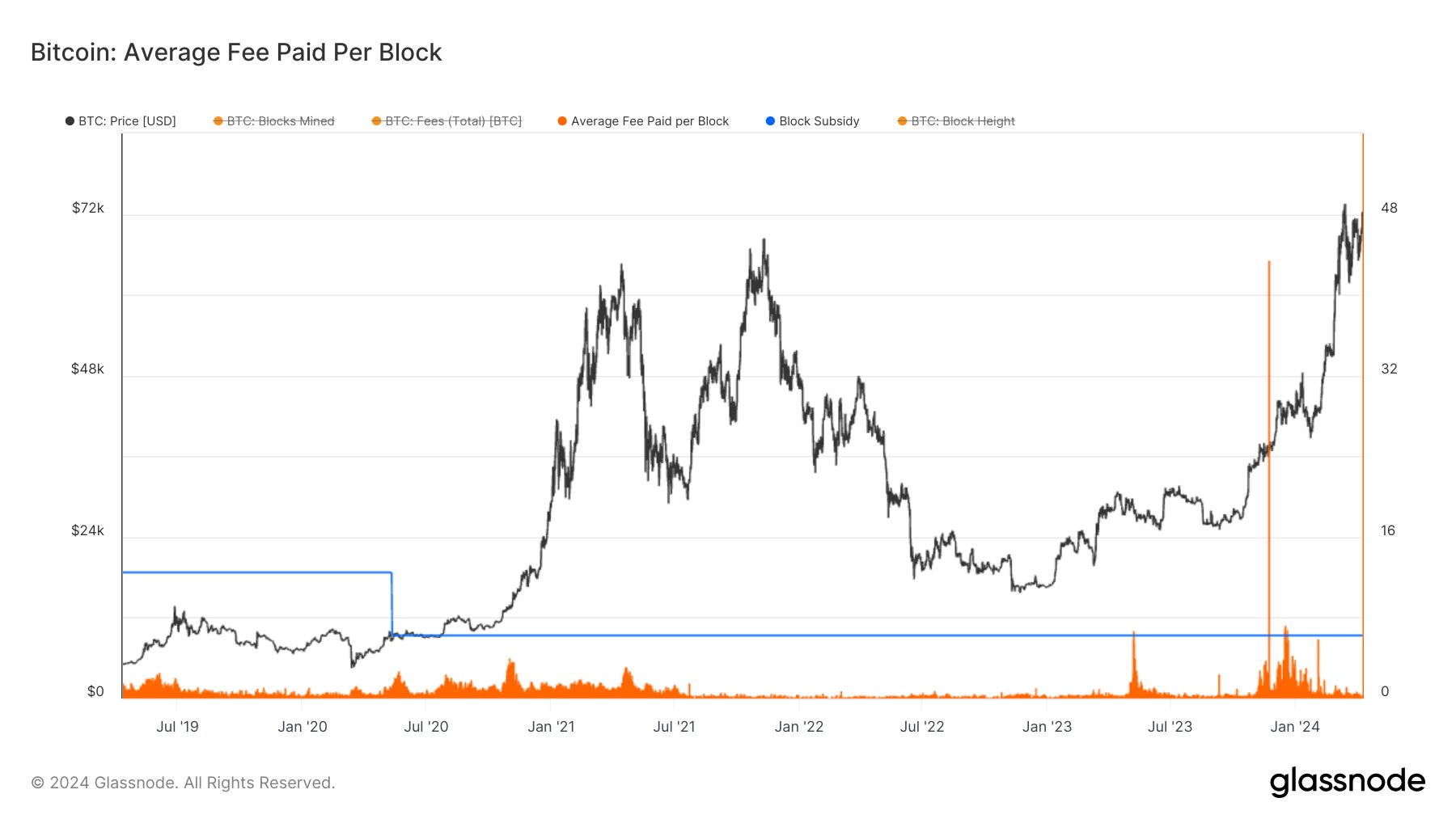

One way to gauge the trend in the transaction fee over a long period is to measure the average fee paid to the miners per block. The chart below shows how this metric’s value has changed for the Bitcoin network over the past few years.

Based on the graph’s representation, the average fee for a Bitcoin transaction per block has remained relatively low in recent times. This implies that miners have not been generating substantial income from transaction fees.

On the same graph, both the block subsidy, which represents the overall remuneration miners receive per block, and the transaction fees are depicted. Historically, it’s been uncommon for transaction fees to equal these rewards, with current fees being just a small portion of them.

Miners are primarily funded through a combination of block rewards and transaction fees in the Bitcoin network. However, because the amounts of these two sources can be uneven, block rewards have historically provided the majority of miner income.

For now, this method has been effective for those validating Bitcoin chains. However, this won’t last indefinitely since the Bitcoin supply is finite. In time, miners will exhaust the block rewards they receive.

Before the anticipated event, there’s an immediate danger brought about by the halvings. These are recurring occurrences where block rewards undergo a permanent reduction by 50%. The halving process takes place approximately every four years, with the next instance happening in roughly nine days.

Currently, Bitcoin miners receive 6.25 BTC as reward for each block they mine. However, an upcoming halving event will cut this reward in half to 3.125 BTC. After each subsequent halving, the miner’s reward will continue to decrease, leading to a gradual reduction in their primary income source.

Instead of relying solely on block rewards for their long-term income, miners could find continued success through transaction fees. Last year, these fees frequently equaled the reward, largely due to the craze surrounding Inscription creation. It’s possible that applications similar to Inscriptions will be responsible for generating fees in the future as well.

Straten has noticed an intriguing pattern in the way fees have been increasing. Fees started climbing prior to the last halving and kept going up afterwards. According to the analyst, a comparable trend may occur again.

BTC Price

At the time of writing, Bitcoin is trading at around $69,400, up more than 3% over the past week.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- EUR NZD PREDICTION

- USD ILS PREDICTION

2024-04-11 06:12