As a seasoned crypto investor with several years of experience under my belt, I’ve seen the market go through its fair share of ups and downs. The latest on-chain observation regarding the Bitcoin traders’ realized losses reaching a critical level once again has piqued my interest. Historically, when the Profit/Loss Margin has fallen beneath the -12 mark, it has been followed by periods of significant bullish price action.

Based on my analysis of the most recent on-chain data, I’ve noticed that Bitcoin traders have racked up substantial realized losses. Historically, such a situation has been a significant factor influencing Bitcoin’s price movements. This observation raises an intriguing question: could this be an indication that the Bitcoin price is about to stabilize or even start recovering?

Traders’ Realized Losses Below -12 Again — What Happened Last Time?

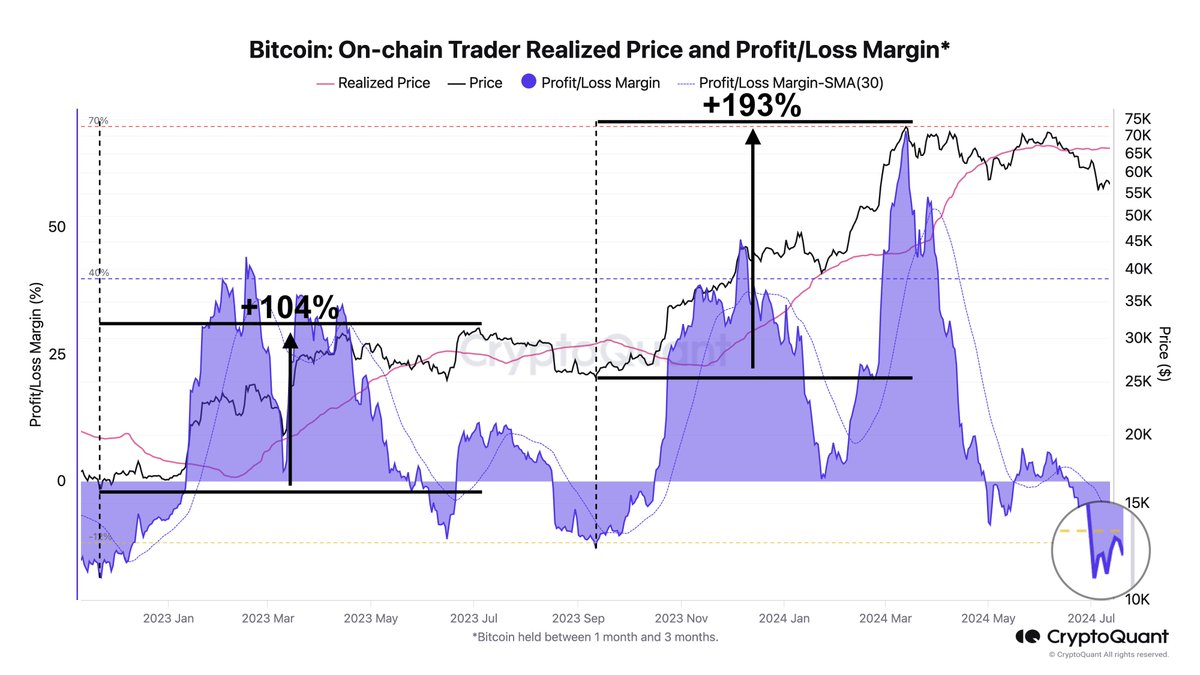

In a recent article on the X platform, well-known cryptocurrency analyst Ali Martinez highlighted that the number of Bitcoin traders incurring losses has been rising notably over the past few weeks. This insight stems from the Profit/Loss Margin metric provided by CryptoQuant, which collects and summarizes profits and losses from all Bitcoin transactions.

The Profit/Loss Margin serves as a measure of the overall profitability for investors in a specific cryptocurrency, such as Bitcoin. A positive value signifies that more Bitcoins are being disposed of at a gain, while a negative Profit/Loss Margin suggests that investors are selling Bitcoins incurring losses.

As a researcher analyzing data from CryptoQuant, I’ve noticed that the Profit/Loss Margin currently stands at a figure beneath the -12 mark. This signifies that traders have incurred more losses than gains in the market at present. Historically speaking, this level holds greater significance given that it has dipped below the -12 mark during previous market cycles.

It’s intriguing to note that when the Profit/Loss Margin has dropped below -12 in recent history, it has been preceded by robust bullish price movements. As demonstrated in the chart and pointed out by Martinez, the past two occurrences of this metric falling beneath this threshold resulted in price surges of 104% and 193%, respectively.

Based on historical trends, it’s plausible that Bitcoin’s price will see significant gains in the coming days. Additionally, substantial market declines may indicate the end of a bearish trend and the beginning of a more optimistic period.

Bitcoin Price To Surge? Here Are Important Levels To Watch

As a researcher studying the historical patterns of Bitcoin prices, I’ve identified key resistance levels that have previously halted price rallies. According to my analysis, these levels are located around $61,340 and $64,620. If the Bitcoin price continues its upward trend, it’s important for investors to keep an eye on these zones as potential obstacles in the path to further gains.

The size of the dots on the following chart signifies the quantity of Bitcoin bought at different price levels, with larger dots indicating stronger resistance and support. This analysis is derived from the cost basis of Bitcoin investors and the distribution of Bitcoin supply across various price ranges.

Two significant resistance points to keep an eye on for Bitcoin are $61,340 and $64,620. Meanwhile, the pivotal support level to focus on is $57,670.

— Ali (@ali_charts) July 13, 2024

At present, Bitcoin’s price hovers around $59,467, marking a 2.7% gain over the past day based on available information. According to CoinGecko’s latest data, Bitcoin has experienced a 2% price rise in the last week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- SHI PREDICTION. SHI cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

2024-07-14 16:41