As a seasoned crypto investor with several bull and bear market cycles under my belt, I’ve learned to pay close attention to on-chain metrics like the Bitcoin futures-to-spot trading volume ratio. The recent 63% decrease in this indicator since the peak of the last bull market is an intriguing development.

The ratio of Bitcoin futures trading volume to spot trading volume has dropped by 63% compared to its highest point during the previous cryptocurrency bull market.

Bitcoin Futures Market Occupying Lower Volume Share This Rally

According to Ki Young Ju, the founder and CEO of CryptoQuant, the Bitcoin market seems less influenced by futures contracts compared to the previous bull market, as he discussed in his latest post on X.

As a crypto investor, I pay close attention to the “futures-to-spot trading volume ratio” of Bitcoin. This metric provides valuable insights by comparing the volume of Bitcoin futures contracts being traded against the volume of spot transactions. Essentially, it helps me gauge the market sentiment and the level of institutional involvement in the Bitcoin market.

The trading volume signifies the overall quantity of cryptocurrencies engaged in transactions across different exchanges within the crypto market.

In simpler terms, a large ratio value signifies that there’s greater trading activity in the futures market compared to the spot market. Conversely, when the ratio value is small, it suggests that more transactions occur in the spot market rather than the futures market.

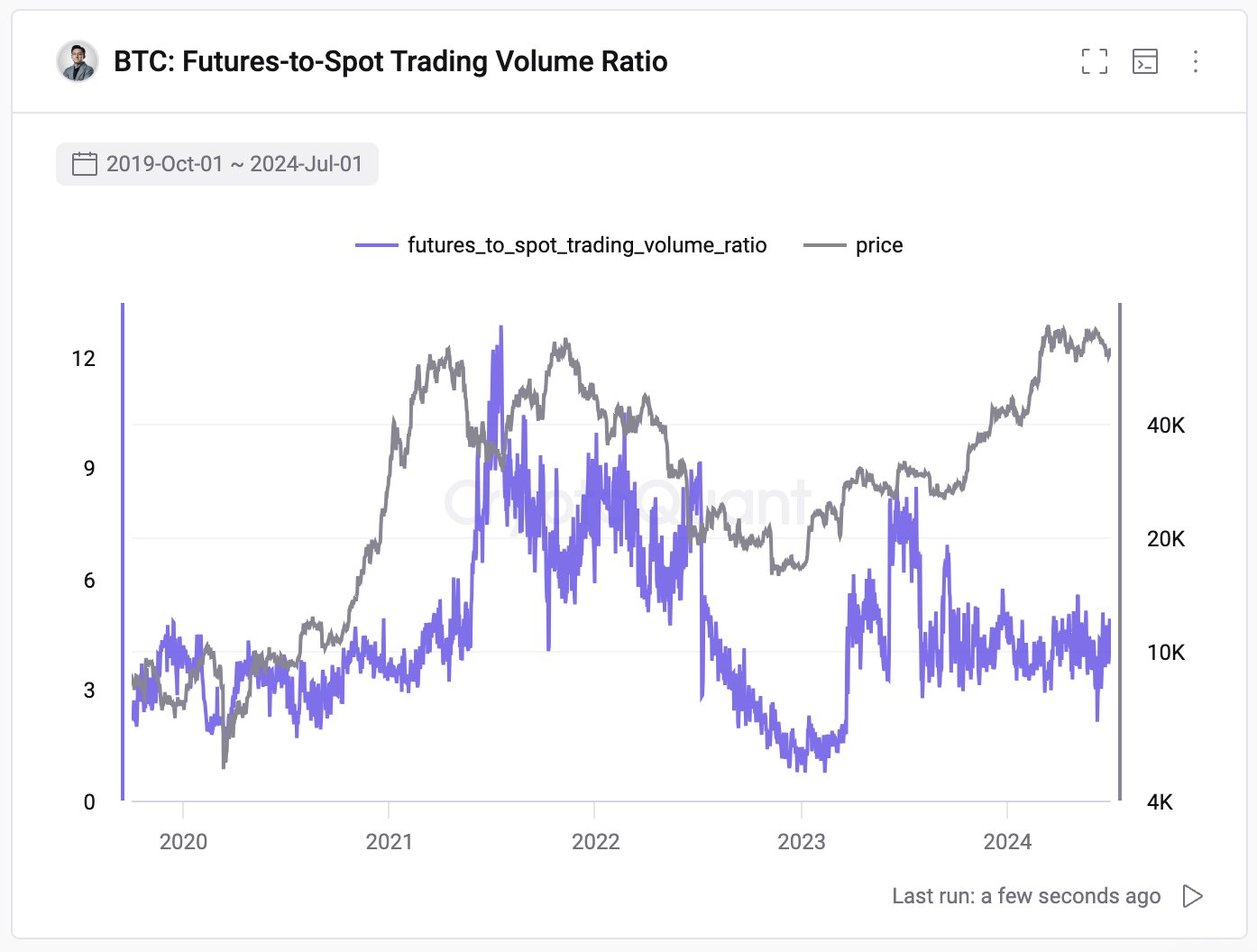

Here is a chart illustrating the development of the Bitcoin futures trading volume in relation to the spot market volume over the past few years.

During the 2021 Bitcoin bull market, the ratio of futures trading volume to spot trading volume reached remarkable heights, as depicted in the graph. In more detail, the indicator exceeded a threshold of 12 at its maximum point, signifying that the volume of futures trades outpaced spot transactions by over twelvefold.

During the second portion of the 2021 stock market surge, the corresponding metric experienced a decrease in temperature. However, it stayed elevated throughout the initial phase of 2022.

During the bear market’s depths, this metric took a nosedive due to waning enthusiasm for cryptocurrency speculation. However, with the market recovery in 2023, it bounced back and reached levels last seen in the first half of 2022 during June.

As a crypto investor, I’ve noticed that the ratio I was closely monitoring has taken a hit since then. It has retreated significantly from its highs in 2021 and currently hovers around those lower levels. Compared to where it stood at its peak last year, this indicator’s value has dropped approximately 63%.

The trading volume for futures contracts continues to lead in the cryptocurrency market, yet it holds significantly less clout compared to last year’s bull run. This reduction suggests that speculative enthusiasm has taken a backseat during the recent rally. According to CryptoQuant’s founder, an uptick in spot trading volume is beneficial for the market.

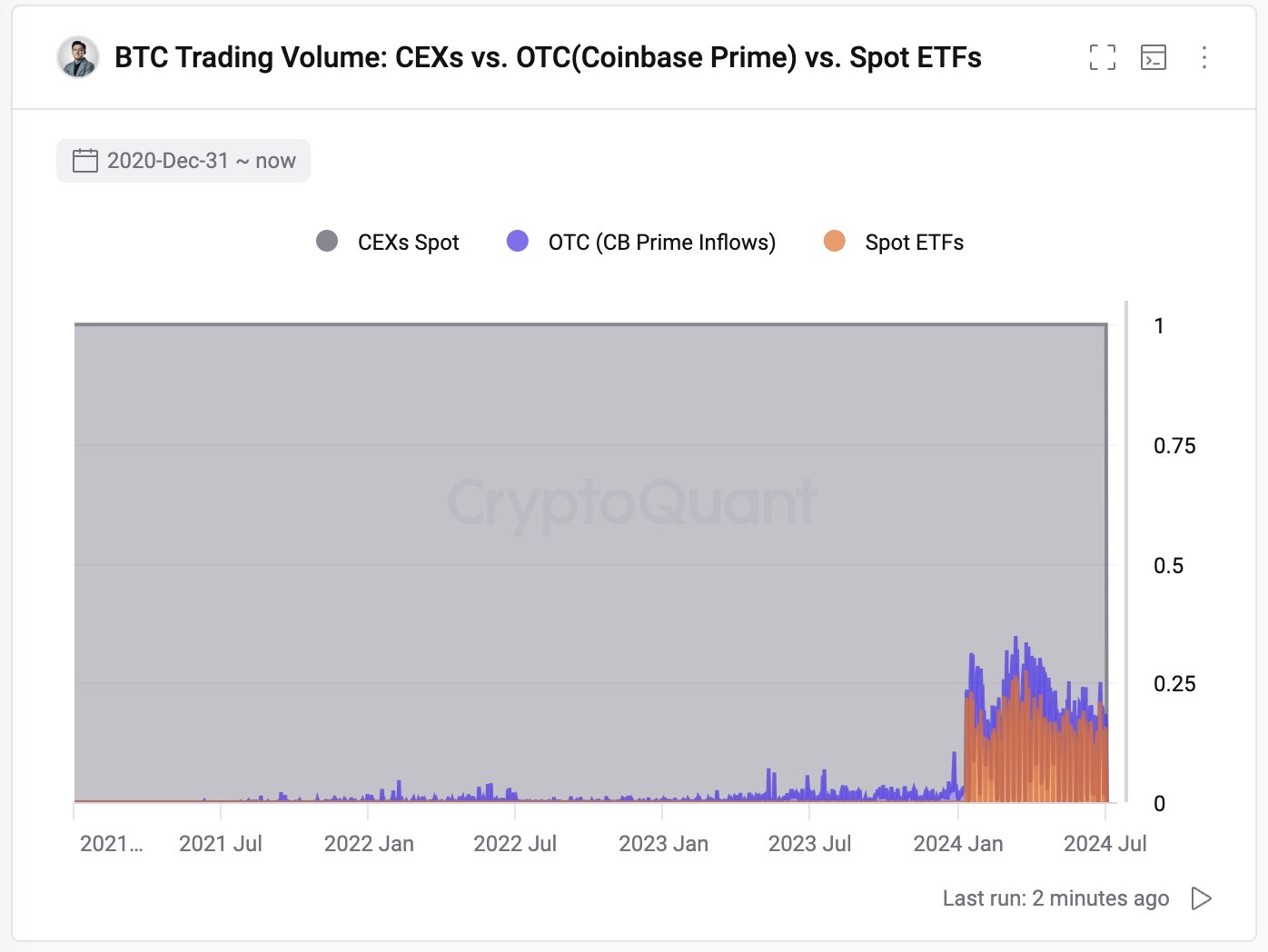

In the current market cycle, there’s a novel development: the arrival of a new method for trading Bitcoin – spot exchange-traded funds (ETFs). However, it’s worth pondering over the volume distinction between these financial vehicles and the spot market.

In a previous discussion on topic X, Ju brought up that approximately one-quarter of all spot trading volume is represented by these particular ETFs.

BTC Price

I’ve experienced a significant setback with Bitcoin in the last 24 hours, as its value has dipped by over 4%, bringing the current price down to $57,300.

Read More

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- OPUL PREDICTION. OPUL cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- 1INCH PREDICTION. 1INCH cryptocurrency

2024-07-05 08:11