As a researcher with experience in analyzing cryptocurrency market trends, I find the pattern identified by IntoTheBlock intriguing. Long-term Bitcoin holders, those who have held their coins for over a year without selling or moving them on the blockchain, are typically considered a resilient and unyielding section of the market. Their recent participation in a selloff is an unusual event that warrants attention.

As an analyst, I’d like to share some intriguing insights from the market intelligence platform IntoTheBlock. They have identified a Bitcoin pattern that implies we might be in for more developments in this cycle.

Bitcoin Long-Term Holder Pattern Could Suggest Bull Market Isn’t Over Yet

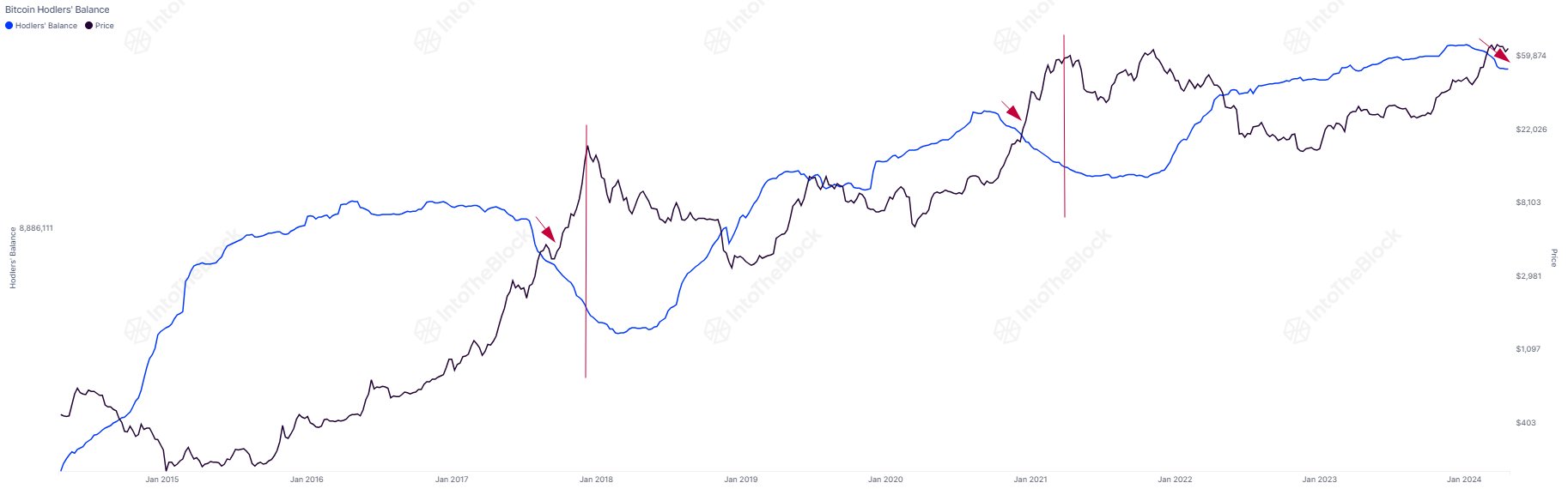

In their latest update on X, IntoTheBlock outlined a common trend observed in the accumulated Bitcoin holdings of long-term investors throughout previous bull markets.

Investors referred to as “long-term holders” (LTHs) are individuals who have kept their cryptocurrency assets for over a year, according to IntoTheBlock’s definition. Other analytics firms might use a different timeframe for this classification.

In statistical terms, as an investor keeps holding onto their assets for longer durations, the probability of them selling decreases. Consequently, those investors with extended holding periods are often referred to as the steadfast or resilient segment of the market.

LTHs (Long-Term Holders) exhibit this robustness in real life, seldom giving in to sell even during market turmoil. However, more recently, they’ve joined the selling trend.

As an observer, I’d point out that the following chart, provided by the analytics firm, displays an uncommon trend in the investing habits of this particular group over the past few years.

The graph indicates that Long-Term Bitcoin holders amassed coins during the 2022 bear market and the subsequent 2023 recovery rally. However, more recently, there has been a trend of these holders reducing their bitcoin holdings.

A important consideration to note is that purchasing from this particular group involves a waiting period of one year due to the requirement that investors must have owned their assets for at least 12 months before being classified in the corresponding cohort.

When the LTH (Long-Term Holder) coin holdings increase, this isn’t indicative of current purchases taking place, but instead reflects past buying that transpired over a year ago. These coins have since grown and qualified for the designated group.

In contrast, the coin’s age returns to zero upon being sold, resulting in the current market trend reflecting recent selling activity.

I’ve noticed from the data presented by IntoTheBlock that experienced investors began selling off their assets in January and increased the pace of those sales toward the end of March. Remarkably, this trend bears resemblance to what transpired during the previous two market upswings.

Based on my observation of Bitcoin HODlers’ past behavior, it seems they typically begin selling once a significant bull run sets in and carry on selling even after the peak has been reached. According to our analysis, there is still ample time left for this cycle compared to previous ones.

BTC Price

As a researcher observing the cryptocurrency market at this moment, I notice that Bitcoin’s value hovers around $64,400 – marking a gain of more than 1% within the last seven days.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-04-26 06:38