As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I have seen more than my fair share of market fluctuations and mining hashrate shifts. The recent retracement of Bitcoin’s mining hashrate, as shown by the chart from Blockchain.com, is a familiar sight that harks back to the ebbs and flows of this digital gold rush.

As a crypto investor, I’ve noticed that the on-chain data indicates a drop in Bitcoin‘s Hashrate lately, which seems to align with the ongoing bearish trend in its price.

Bitcoin Mining Hashrate Has Retraced Its August Recovery

In simpler terms, “Mining Hashrate” is a measure for Bitcoin that calculates the combined processing power all the miners are using at any given moment on the Bitcoin network.

As this metric increases, it suggests that more miners are entering or expanding their operations within the blockchain network. This growth pattern indicates that the blockchain is perceived as a profitable endeavor by these miners who validate the chain.

Conversely, the drop in this metric suggests that certain miners are choosing to leave the network, possibly due to Bitcoin mining no longer being financially viable for them.

Presently, I’d like to share a graph from Blockchain.com which illustrates the fluctuations in the 7-day average Bitcoin Mining Power during the past twelve months.

Over the past few days, I’ve noticed an upward trend in the 7-day average Bitcoin Mining Hasrate, which has almost reached heights reminiscent of its all-time high (ATH) attained in July.

By the end of the month, the indicator actually began dropping instead, and it’s now close to the same low levels seen during the first three weeks of August.

As an analyst, I’ve noticed that the fluctuations in these trends could be linked to Bitcoin miners’ reliance on the BTC market price for their profitability. This is primarily due to the block reward, which serves as their main source of income and is essentially a compensation for their efforts in solving blocks within the network.

The incentives are distributed based on a constant Bitcoin value and regular intervals, meaning the fluctuating U.S. dollar price of cryptocurrency is the sole factor that varies. Given the latest downturn in the market, it’s logical that miners have reduced their operations due to this price decrease.

Historically speaking, this current decrease in the 7-day average Bitcoin Mining Hasrate might not persist for much longer. Should new spikes in Bitcoin’s price occur, it would likely lead to a resurgence in the upward trend of this metric.

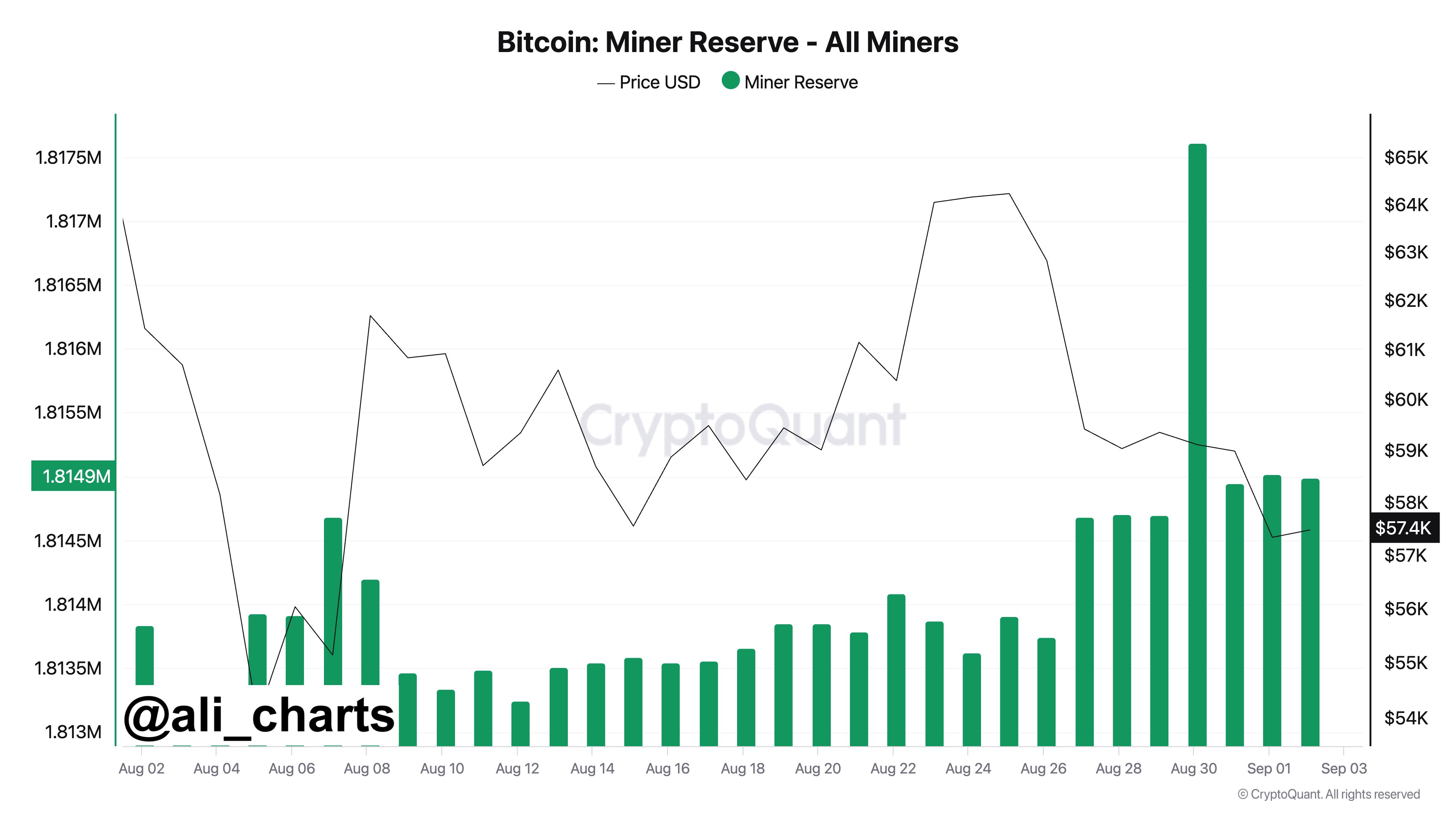

An additional metric that might reveal miner strain is the Miner Reserves, which quantifies the total Bitcoin held in the digital wallets associated with these blockchain validators. In simpler terms, it’s the amount of Bitcoin these miners are currently holding.

According to a post by analyst Ali Martinez, there was a significant level of mining activity selling over the weekend.

During that time period, Bitcoin miners transferred approximately 2,655 Bitcoins, equivalent to over $156 million based on today’s cryptocurrency exchange rates, from their digital wallets.

BTC Price

At the time of writing, Bitcoin is floating around $59,000, down over 5% in the last seven days.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- EUR RUB PREDICTION

2024-09-03 23:15