The Bitcoin Mining Hashrate has reached a new all-time high, despite the market’s chaotic price fluctuations.

Bitcoin Mining Hashrate Reaches New Heights

The Bitcoin Mining Hashrate is a metric that measures the total amount of computing power connected to the Bitcoin network. When the value of this metric rises, it means new miners are joining the network or existing ones are expanding their facilities. This trend suggests that these chain validators find the blockchain an attractive opportunity.

On the other hand, a decrease in the metric implies that some miners have disconnected their machines from the chain, potentially because they are no longer making a profit on BTC mining.

Here is a chart from Blockchain.com that shows the trend in the 7-day average Bitcoin Mining Hashrate over the past year:

As displayed in the above graph, the 7-day average Bitcoin Mining Hashrate rose to an all-time high (ATH) of around 817,700 TH/s during the starting days of the year, but the metric couldn’t sustain at these levels as its value soon registered a plunge. The indicator showed consolidation about its lows for the rest of January, but it would appear February has finally brought fresh winds as its value has seen a steep uptrend and has smashed past its previous peak to set a new record of about 832,600 TH/s.

This renewed expansion from the miners has interestingly come while the cryptocurrency has been going through an uncertain period with its price displaying high volatility in both directions. The Mining Hashrate serves as a look into the sentiment among the miners, so this latest increase would imply these chain validators believe the asset would ultimately come out of this volatile period in the bullish direction.

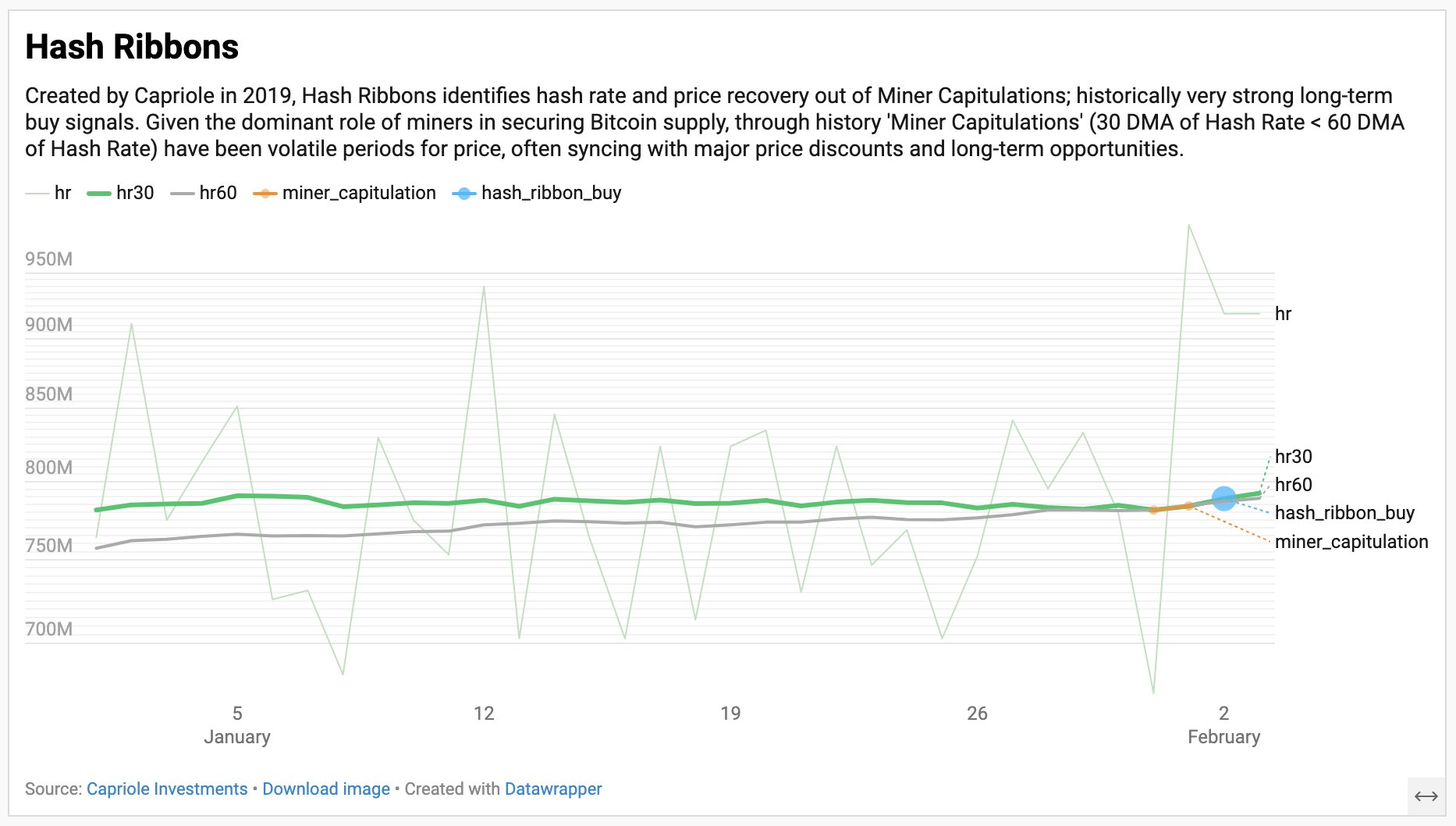

An indicator that makes it easy to use the Hashrate for tracking the situation of the miners is the Hash Ribbons. This metric is made up of two moving average (MAs) of the Hashrate: 30-day and 60-day. As Capriole Investments founder Charles Edwards has explained in an X post, the Hash Ribbons flashed a very brief capitulation signal at the beginning of the month.

Miner ‘capitulation’ occurs when the 30-day MA falls under the 60-day one. This crossover couldn’t last for long this time as the Hashrate observed a sharp increase, leading to a reverse crossover taking place. Historically, this has served as a buying signal for Bitcoin.

BTC Price

At the time of writing, Bitcoin is trading around $100,000, down 3% in the last week.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- How to Reach 80,000M in Dead Rails

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Unlock the Mines in Cookie Run: Kingdom

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- REPO: How To Fix Client Timeout

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

2025-02-05 12:14