If you’ve spent any time online lately, you probably noticed two things: spam emails about “rare coins” and everyone’s least favorite word, “bull market,” being thrown around like free mints at a chain diner. Apparently, Bitcoin has leapt past $100,000—yes, that’s three commas, and yet my barista still wants a tip for half-frothing almond milk.

Selling Your Bitcoin: Why Not Just Ask Your Uber Driver? 🚕

A guy on X with the perfectly normal name “Ardizor” (sure, why not?) claims he’ll sell everything the moment Bitcoin’s “Profitability Index” soars above 300%. I admit, I had to resist the urge to ask if that index also counted the emotional profits of telling people at parties you bought in early.

His sell alarm triggers if:

- Crypto jumps to #1 on the App Store and Coinbase replaces TikTok as the new teenage obsession. (Can you even dance to a candlestick chart?)

- Your taxi driver’s giving hardcore Ethereum price targets between stop lights. 🚖

- The “BTC Coin Days Destroyed” metric jumps to over 300 million, which presumably is Very High, and not something you Google after two glasses of Malbec.

- Dave, who once lost his password to Farmville, messages out of nowhere to ask if he’s “too late to get in.”

Until the apocalypse disguised as a block reward halving, Ardizor assures us he’ll be “stacking coins daily.” He’s also promised to tell the community when to sell. (Just not before he does, obviously. 🤞)

As for portfolio wisdom, here’s the hot take:

- 40% Bitcoin—so you too can ride the rollercoaster and Tweet about “diamond hands.”

- 20% Ethereum—because you want to pretend you understand smart contracts.

- 10% “quality alts”—translation: maybe not the ones named after food.

- 5% meme coins—when you believe in Doge more than your marriage.

- 15% working capital—in case you need to pay rent or bribe your accountant.

- 20% USDT for “buying the dip,” aka buying when everyone else is posting memes of burning $100 bills.

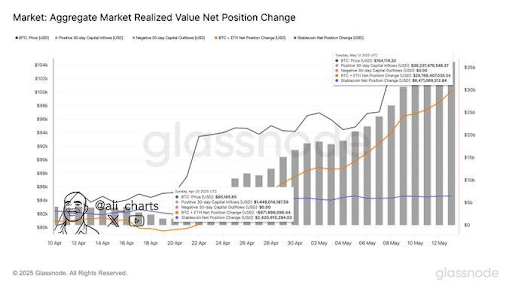

The crowd, ever optimistic and caffeine-fueled, is “accumulating coins” like it’s the last Black Friday before the apocalypse. Analyst Ali Martinez whipped out a chart showing $35 billion flooding into crypto in three weeks. You know, just in case you were feeling good about your savings account.

How High Can Bitcoin Go Before Your Aunt Asks You for Tech Support? 📈

Gurus and bedtime-story traders are betting on a market top anywhere from $125,000 to $200,000. One guy, Peter Brandt, has $150,000 circled on his calendar between dentist appointments, promising a biblical 50% crash afterward. And then there’s Jim Cramer, who, by the logic of inverse finance, may mean $200,000 is actually possible. Standard Chartered agrees—probably because they want you to take out a loan.

For the curious: Bitcoin’s price is currently around $103,600. That’s up for the day, which is more than I can say for my patience as I explain NFTs to my cousin’s boyfriend, again.

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- How to Get 100% Chameleon in Oblivion Remastered

- USD ILS PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Invincible’s Strongest Female Characters

- Gold Rate Forecast

2025-05-15 00:42