What you absolutely need to pretend to understand:

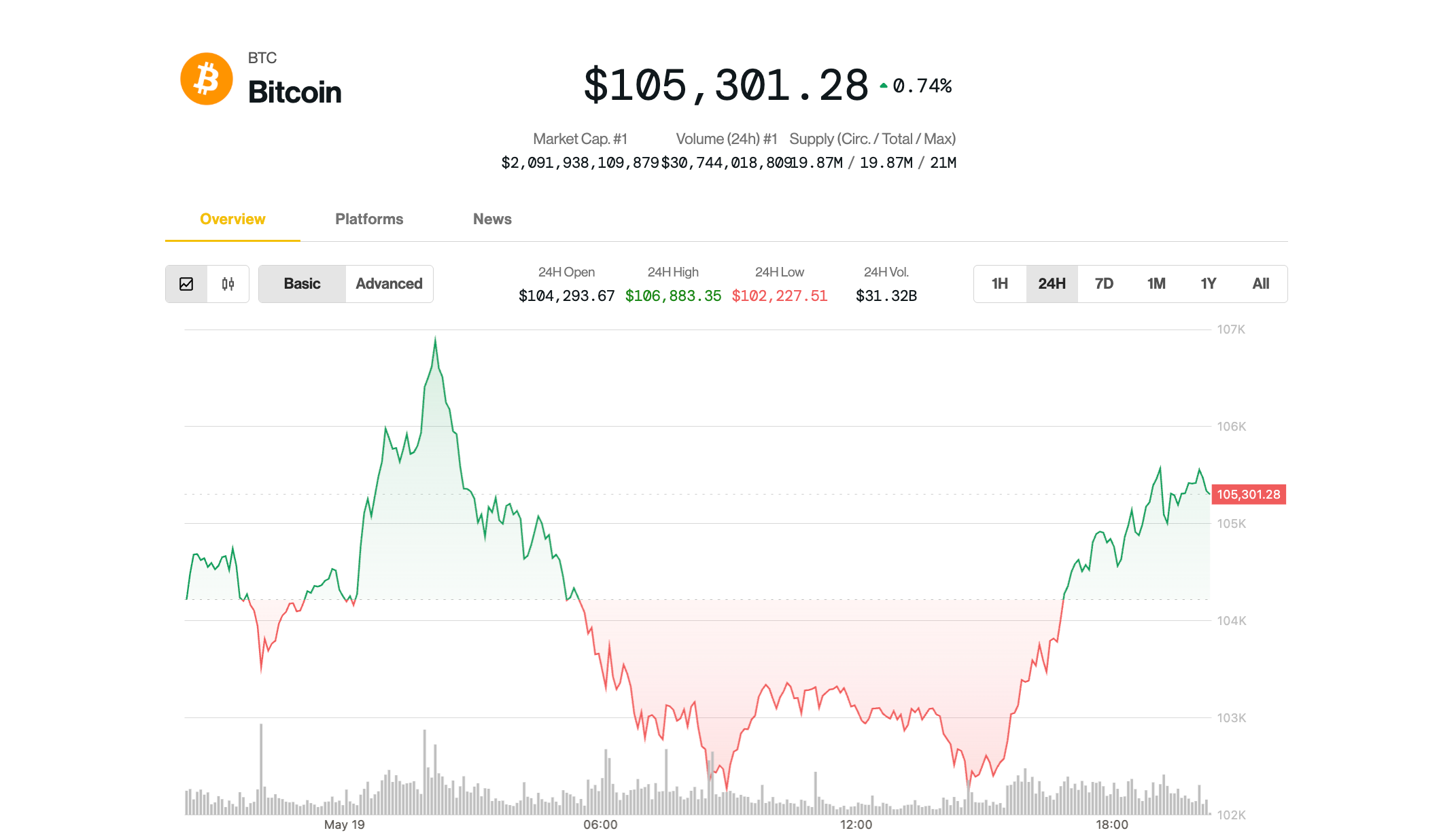

- Cryptos decided to be brave and bounced back on Monday, with Bitcoin (the big cheese) clawing its way back above $105,000—after starting the week looking like it had seen a ghost.

- Moody’s downgraded US bonds—because what’s more fun than a scolding from the financial fairy godmother?—but Lumida Wealth CEO confidently declared it’s basically just a minor inconvenience, like a paper cut for the economy.

- According to 21Shares, BTC might hit a fancy $138,500 this year. Apparently, this isn’t a ‘retail frenzy,’ but wealthy folks with more money than a dragon has treasure chests pouring into the market.

Cryptocurrencies decided Monday was a good day for a comeback—probably because they secretly enjoy the thrill of a rollercoaster ride, especially after Moody’s decided to give US bonds a good talking-to, which sent markets into a brief tizzy. Meanwhile, Bitcoin, the “let’s see who can drop the lowest” champion, fell as low as $102,000 in the early US hours, but by magic (or just market volatility), it climbed back to a sprightly $105,000, up a tiny 0.4%. Ether, the slightly more relaxed cryptocurrency, gained 1.2% and mockingly reclaimed its $2,500 throne.

DeFi lending platform Aave was the cool kid that outperformed, while the rest of the broad-market crowd mostly stayed in their pajamas, stuck in the red, with Solana, Avalanche, and Polkadot sulking down 2-3%.

The stock market was feeling the drama too—by midday, the S&P 500 and Nasdaq realized they didn’t need to pout anymore and wiped away their morning frowns.

All this chaos happened right after Moody’s dashed into the room and downgraded the USA from the “AAA” club—because what’s life without a little uncertainty? That pushed bond yields higher than a kite at the end of summer—30-year Treasury yields topped 5%, making investors clutch their pearls. But some wise folks, like Ram Ahluwalia, shrugged and said, “Eh, it’s just a blip.”

Even Callie Cox was like, “No biggie—markets are used to this sort of drama by now.”

Bitcoin: The Year of the $138K Fiesta?

While Bitcoin teeters just shy of its fiery January record, the smart folks at 21Shares believe it’s got plenty of juice left. “Bitcoin is on the verge of a breakout,” announced research wizard Matt Mena, who wisely points out that it’s not retail folks freaking out this time but rather the big money—think institutions with more zeros than you can count—are pouring in like a flood after they realized supply is tighter than a miser’s purse.

Major institutions and even new countries are eyeing Bitcoin as their sovereign snack. All these antics could push BTC sky-high—possibly up to a shiny $138,500, which is roughly 35% more than last week’s rollercoaster.

So, hold onto your digital hats—looks like this crypto rollercoaster isn’t ending anytime soon. 🎢💰🚀

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- USD ILS PREDICTION

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Invincible’s Strongest Female Characters

2025-05-19 22:19