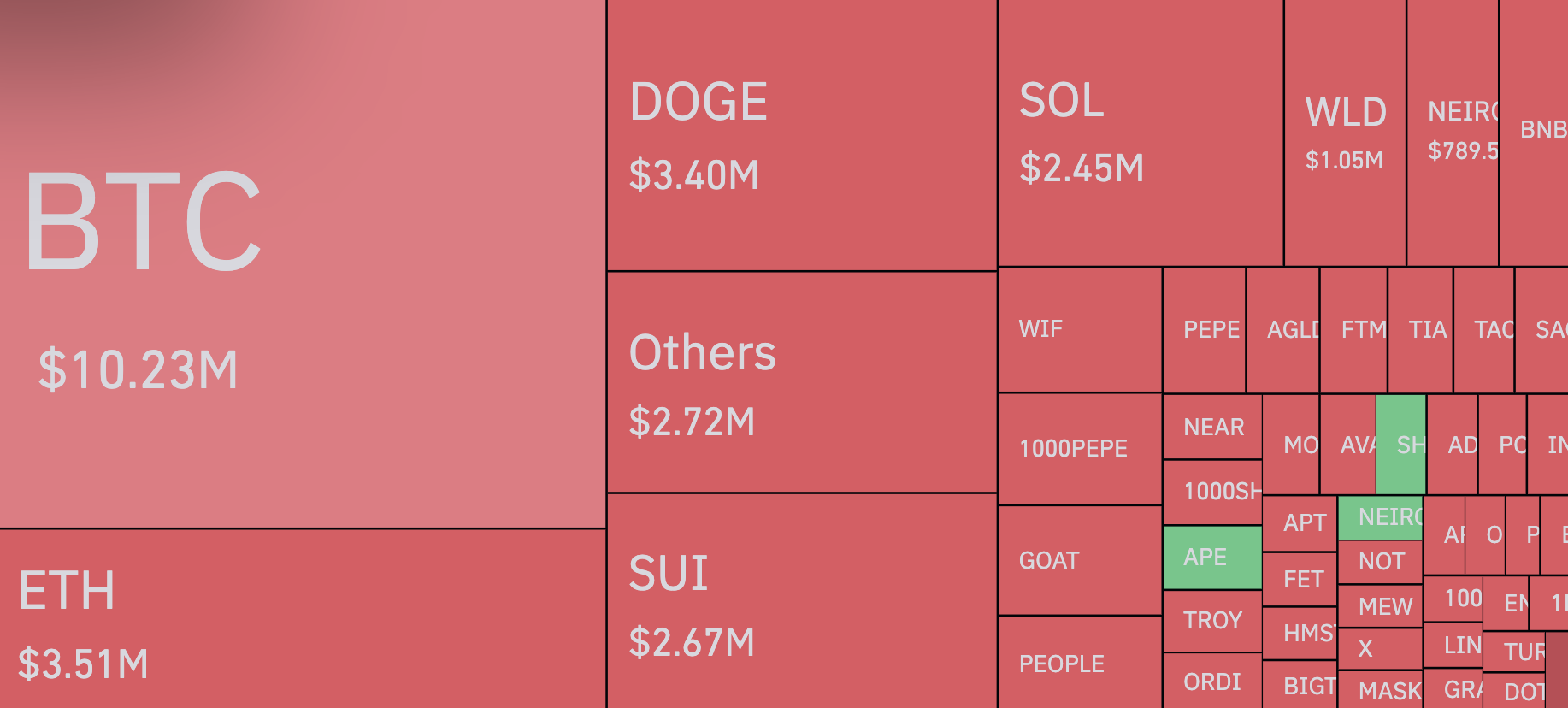

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market anomalies, but the recent Bitcoin (BTC) liquidation event was certainly one for the books. The 860% imbalance in liquidations, with bearish sellers getting cleaned out to the tune of $9.46 million while bullish buyers only added $1.1 million, is a sight rarely seen in this market.

In recent moments, Bitcoin (BTC) experienced an unusual event as per CoinGlass data, with aggressive buyers swiftly closing out short positions worth approximately $9.46 million within a short period of time, indicating a significant shift in market sentiment.

It’s intriguing to note that despite the same timeframe, the number of significant sell-offs, or bullish buyers, was surprisingly low at $1.1 million. This situation results in a striking imbalance in liquidations, with Bitcoin trading creating an imbalance of 860% that does not favor the bears.

The reasons for such a discrepancy, of course, should be sought on the price chart of the main cryptocurrency.

Bitcoin (BTC): Price outlook

In just thirty minutes, the value of Bitcoin surged by a substantial 2.1%, an impressive leap given its current market worth exceeding one trillion dollars. However, what truly stands out is that BTC’s price has now gone over $70,000 per coin, which represents a significant psychological threshold in the local market.

Indeed, given the significant and impactful nature of this technological and foundational shift, it became impossible for bearish positions to remain intact, triggering a series of liquidations. Interestingly enough, this event might have contributed significantly to the swift increase in the value of Bitcoin over a short span.

Currently, the price of Bitcoin has dropped to figures under $70,000 per coin, as indicated by open interest statistics, it seems that traders are not keen on initiating fresh positions at this time.

Read More

- VANRY PREDICTION. VANRY cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR MYR PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- USD MXN PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- RSR PREDICTION. RSR cryptocurrency

- DF PREDICTION. DF cryptocurrency

- USD BRL PREDICTION

2024-11-05 19:20