As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed numerous bull runs and bear markets. The current trend of Bitcoin HODLers reducing their holdings is not an unfamiliar sight, although the degree of decline seems to be less this cycle compared to previous ones.

During this bull market, the total Bitcoin held by investors (HODLers) has decreased by approximately 9.8%. Let’s take a look at how this balance has changed in past cycles.

Bitcoin HODLers Have Seen Their Holdings Go Down Recently

Based on information from the market research platform IntoTheBlock, Bitcoin owners who plan to keep it for a long time have been slowly reducing their collective ownership amount in recent times.

In this context, “long-term holders” (LTHs) are individuals who have kept their Bitcoin (BTC) for a minimum of one year, meaning they haven’t made any transactions to transfer or sell their coins during that period.

From an analytical standpoint, I’ve noticed a trend: The longer I, or any other holder, keep my coins, the less inclined we become to sell our tokens. This group of persistent holders, who maintain their positions for extended periods, can be referred to as Long-Term Holders (LTHs). Conversely, those with a shorter holding duration are known as Short-Term Holders (STHs), representing the market sector with less stable hands.

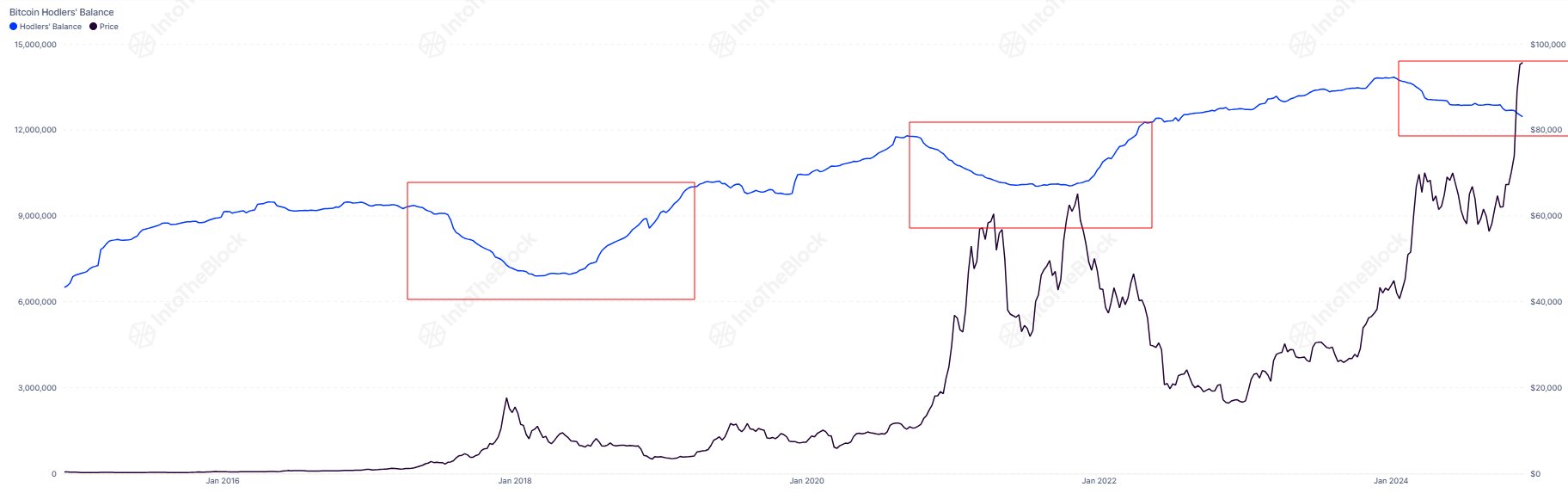

Currently, I’d like to share a graph provided by IntoTheBlock, which illustrates the evolution of the long-term Bitcoin holdings (LTHs) during the last ten years.

This year, it appears from the graph that long-term Bitcoin holders (LTHs) are reducing their ownership. To be more precise, there’s been a roughly 9.8% decrease in the total amount held by these LTHs during this recent market downturn.

The LTHs (Long-Term Holders) will emerge from their dormant state when this particular indicator shows a drop. Typically, this occurs as they wish to take part in some trading activity, usually selling.

It is important to keep in mind that unlike selling, buying doesn’t immediately show up on the indicator. In terms of Long-Term Holder (LTH) supply, there’s a one-year waiting period before coins can be included in this group, as they must first be held for at least 12 months.

Previously stated, Long-Term Holders (LTHs) typically hold onto their investments firmly, meaning they seldom sell. However, even these persistent investors may be compelled to sell when substantial profits from a significant Bitcoin rally begin accumulating.

According to the data presented by the analytics company, this recent selling phase seems to have shown a lesser degree of drop compared to past bull market cycles, as depicted in the chart.

According to IntoTheBlock, long-term investor balances have decreased by 9.8% during this cycle, which is less than the declines of 15% in 2021 and 26% in 2017. This suggests that there might be more potential for the distribution of Bitcoin holders to increase before the current rally ends.

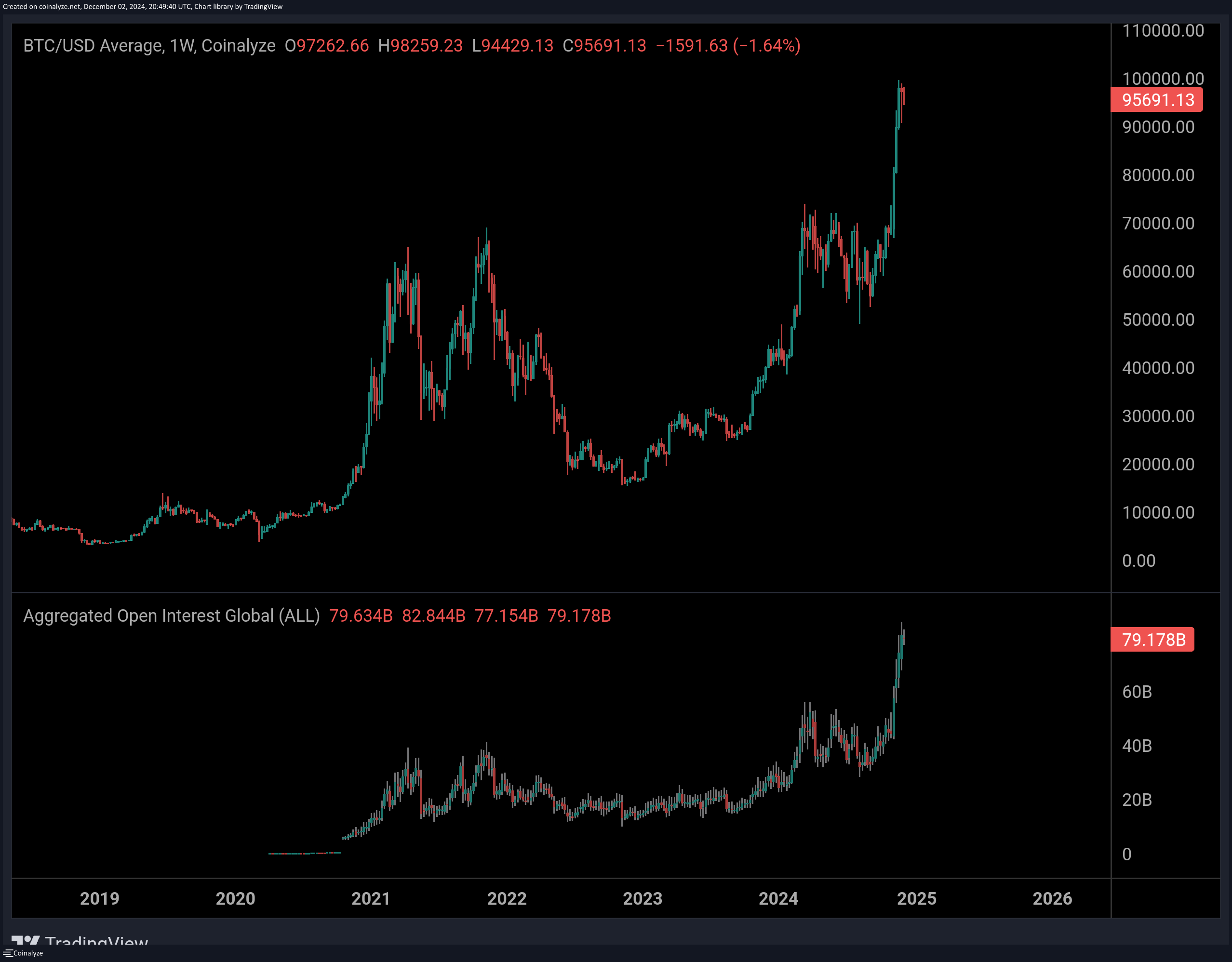

Meanwhile, it’s worth noting that, according to a recent post by Maartunn from the CryptoQuant community, the combined value representing outstanding futures contracts in the crypto market has reached an unprecedented peak of $79.2 billion.

As an analyst, I interpret “Open Interest” as a gauge that reflects the total number of derivative positions initiated by users across all centralized platforms. A notable surge in this metric typically signals increased market volatility.

BTC Price

Over the past few days, the surge in Bitcoin’s value seems to have cooled down, with its price hovering near the $95,800 level without significant movement up or down.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- USD DKK PREDICTION

- EUR AUD PREDICTION

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

2024-12-04 13:42