As a researcher with a background in cryptocurrency and blockchain analysis, I find the recent trend in Bitcoin’s long-term holder supply particularly intriguing. The fact that this group of investors, known for their resilience and reluctance to sell, have been participating in a selloff suggests that profits had amassed significantly during the latest rally.

Recent on-chain data indicates a downward trend in the amount of Bitcoin held by long-term investors. This development could potentially signal the following implications for the cryptocurrency:

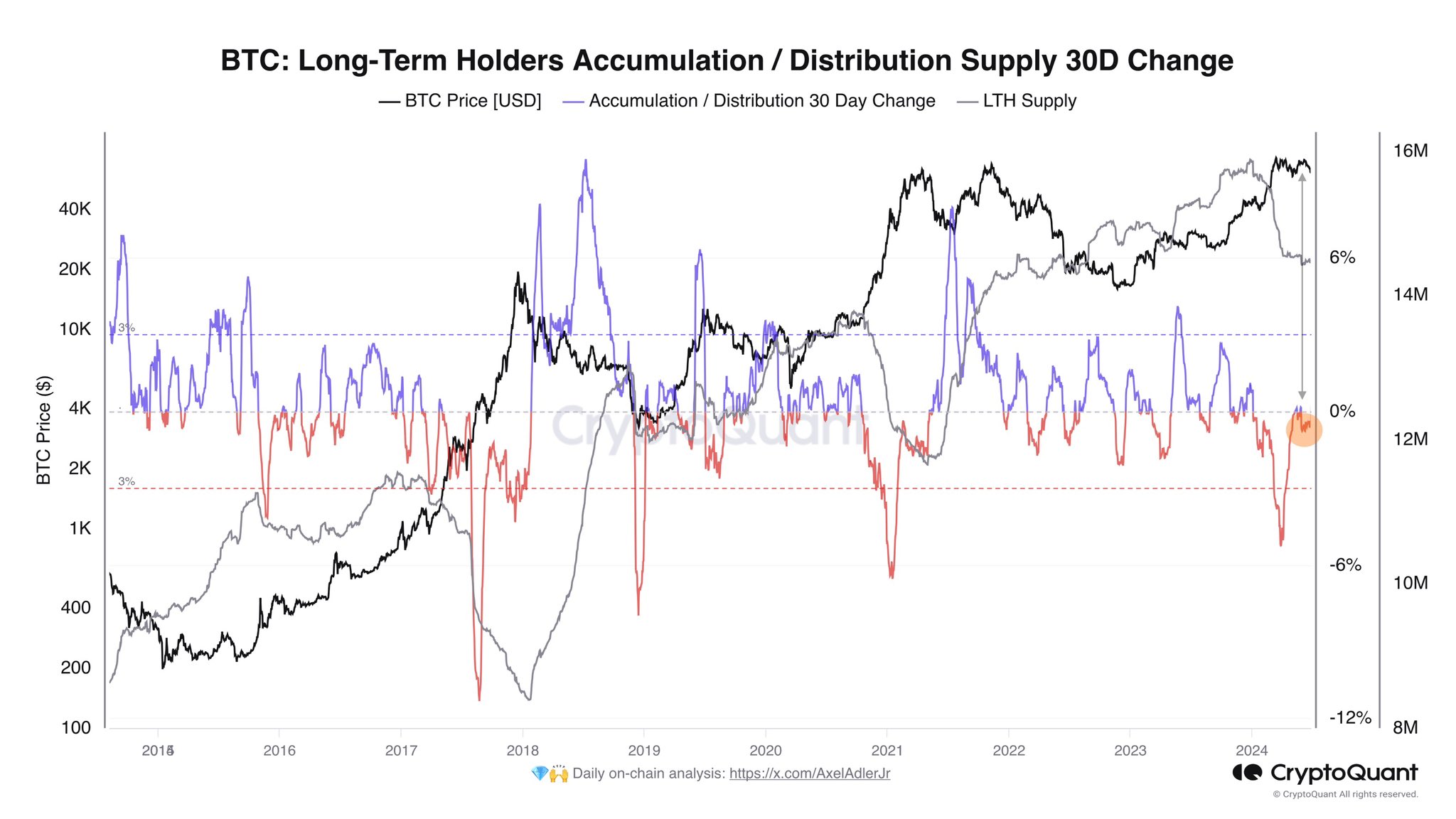

Bitcoin Long-Term Holder Supply 30-Day Change Has Been Negative Recently

According to Axel Adler Jr’s post on X, the number of Bitcoin investors holding their coins for over 155 days, referred to as long-term holders (LTHs), has not been increasing noticeably in recent times.

Long-Term Holders (LTHs) represent one of the two major groups in the Bitcoin market, with the other group referred to as “short-term holders” (STHs). The distinction between these two groups lies in the duration of their holding period.

Based on statistical analysis, investors who hold cryptocurrency for longer periods are less inclined to sell them. Therefore, Long-Term Holders (LTHs) are often perceived as resilient and steadfast within the crypto community. In contrast, Short-Term Holders (STHs) are characterized by their more unstable and changeable investment behavior.

Although Bitcoins long-term holders (LTHs) are known for their robustness, they have recently joined in selling off their assets. The enclosed chart illustrates the development of this group’s total supply and the percentage change over the last 30 days during the past decade.

As a researcher examining the Bitcoin market, I’ve noticed an intriguing trend: the long-term holder (LTH) supply has been decreasing since the SEC granted approval for spot Bitcoin exchange-traded funds (ETFs) in January.

As a crypto investor, I’ve noticed that the most dramatic drop in the metric took place during the rally leading up to the new price all-time high (ATH).

As a researcher studying investment behaviors, I’ve observed that individuals with a strong diamonds-hands approach keep their assets, including cryptocurrencies or stocks, for extended durations in pursuit of substantial returns. However, the sell-off instigated during this rally suggests that these profits had swelled to such an extent that even the most patient and steadfast investors found themselves enticed by the temptation to realize those considerable gains.

In spite of the cryptocurrency’s recent bearish trend, the indicator has persisted in descending, albeit with a reduced slope.

The ongoing reduction in value is more intriguing due to the fact that the approval date for the spot ETF launch is now over 155 days old. It appears that any purchases made by HODLers during that time are currently being offset by selling from earlier investors.

I’ve observed an intriguing pattern in the Low Time High (LTH) supply trend, which might be indicative of prevailing market pessimism based on my research. The graph reveals that this phenomenon is not a recent development in the current market cycle.

As an analyst, I’ve observed that large Bitcoin holders (LTHs) were active sellers during the mid-points of the previous two bull markets. Consequently, the recent dispossession of Bitcoin by these entities might not automatically signal bearishness for the long term.

BTC Price

At the time of writing, Bitcoin is trading at around $61,200, down more than 4% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- USD PHP PREDICTION

- SHI PREDICTION. SHI cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

- OOKI PREDICTION. OOKI cryptocurrency

2024-06-29 04:11