As a seasoned researcher with extensive experience in analyzing Bitcoin market trends, I find it intriguing that long-term Bitcoin holders, often referred to as HODLers, have seen their supply increase recently despite the FUD (Fear, Uncertainty, and Doubt) surrounding the market. This development, according to data from IntoTheBlock, reveals that these investors, who have held onto their coins for at least a year, have not been deterred by recent negative news.

As an analyst examining on-chain data, I’ve noticed an intriguing trend: Long-term Bitcoin holders have been adding more coins to their stash lately, despite the market being riddled with uncertainty and fear (FUD).

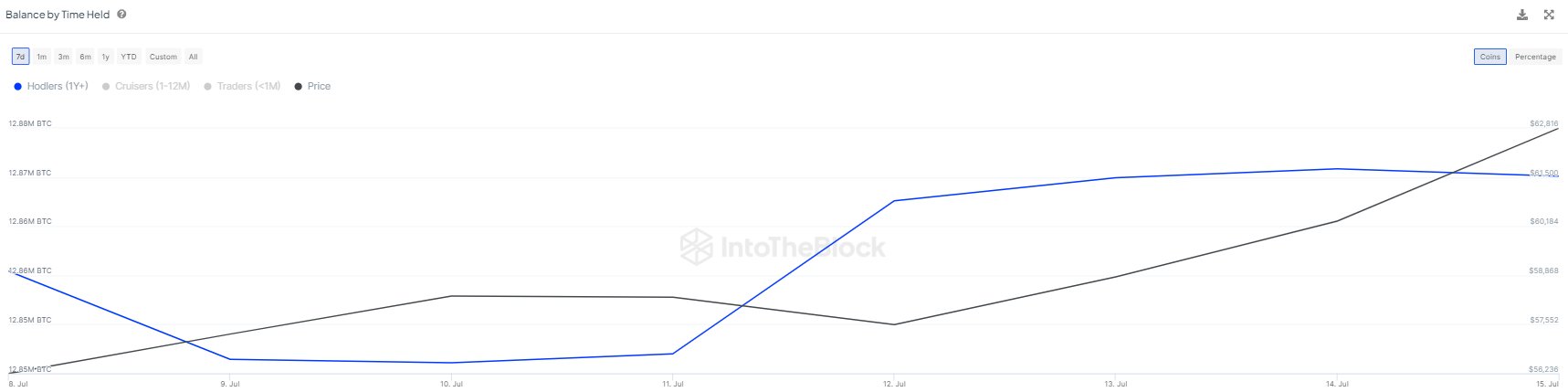

Bitcoin HODLer Balance Has Registered An Increase Recently

Based on information from market intelligence provider IntoTheBlock, the number of investors holding cryptocurrencies for over a year has grown in recent times. IntoTheBlock identifies these investors as long-term holders or HODLers.

In statistical terms, the longer a coin investor holds onto their assets without selling, the lower the probability becomes that they will offload those coins in the future. Consequently, long-term holders (LTHs), who typically maintain their investments for extended durations, symbolize the tenacious sector of the market.

As a long-term crypto investor, I understand that market volatility is a part of the game. While some investors may rush to sell their holdings during market crashes or rallies, I prefer to keep a steady hand. I believe in the potential of the projects I’ve invested in and trust that they will weather the storms and emerge stronger. Therefore, I choose to hold onto my investments through thick and thin, like diamonds in my hands.

Lately, there have been fears circulating in the Bitcoin community due to two significant events. First, the distribution of coins by the insolvent cryptocurrency exchange Mt. Gox to its original owners. Second, the sale of Bitcoins by the German government from its seized assets.

In spite of recent events, the Holders’ total balance has grown noticeably over the past week, as indicated in the following graph.

As a researcher studying Bitcoin dynamics, I’d like to clarify that an uptick in the Long-Term Holder (LTH) balance doesn’t imply current purchases. Instead, it indicates that transactions taking place over a year ago led to the accumulation of coins now considered part of the LTH cohort.

When coins are sold and transferred across the network, their age resets to zero, causing them to be excluded from the current cohort’s count.

I, as an analyst, interpret this data to mean that although the rise in this metric does not signify current buying, it does reflect the confidence of investors who purchased over a year ago. They remain unfazed by recent market fluctuations and continue to hold onto their investments.

In more recent developments, an analyst highlighted in a CryptoQuant Quicktake article that the Coinbase Bitcoin price premium has been positive. This indicator measures the variance between the Bitcoin costs displayed on Coinbase for USD and Binance for USDT.

Based on current data, Coinbase is experiencing more purchasing activity than Binance, indicating stronger demand. Given Coinbase’s popularity among American institutional investors, their increased buying could be contributing to this uptick in activity.

BTC Price

Bitcoin has rebounded and surpassed the $64,400 mark once again, experiencing a noteworthy increase of over 12% in value during the past week.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- Ethereum (ETH) Crashes Dramatically, What’s Next? Solana (SOL) Can Still Reach $200, XRP Struggling Before $0.63 Test

- Profit from the Dip: Hong Kong To Debut Asia’s First Inverse Bitcoin ETF — Here’s When

- US Govt Dumps $4M In Bitcoin Again, Another BTC Selloff Ahead?

- Bitwise Ether ETF Reveals 10% Profit Donation To Ethereum Developers

- USD PHP PREDICTION

- Breaking: Spot Ethereum ETF Trading Affirmed by US SEC

2024-07-17 13:12