As a seasoned crypto investor with a knack for deciphering market trends and a healthy dose of patience, I find myself cautiously optimistic about the recent developments in Bitcoin’s long-term holder behavior. While it is concerning to see such a significant selloff from this group, it is essential to remember that these “diamond hands” are not known for their frequent selling sprees.

Recent on-chain activity indicates that long-term Bitcoin investors have been actively selling off their holdings, which could potentially have a negative impact on Bitcoin’s current market price.

Bitcoin Long-Term Holders Have Been Distributing Recently

According to on-chain expert Checkmate’s recent analysis on platform X, the long-term Bitcoin holders have recently displayed the most significant profit-realization activity during this current market cycle.

In simpler terms, “long-term holders” (LTHs) are individuals who have owned Bitcoin (BTC) for over 155 days. This group is contrasted with another segment in the market, referred to as the “short-term holders” (STHs), who typically own BTC for a shorter period. The distinction between these two groups is often made based on the duration of their ownership.

Over time, investors who hold onto their investments for a longer period tend to be less inclined to sell them. Consequently, Long-Term Holders (LTHs) could be seen as the ‘diamond hand’ group in the market, contrasting with Short-Term Holders (STHs), representing more of the ‘weak hand’ investors.

Even though Long-Term Holders (LTHs) seldom sell, they seem to have seized the recent price surge as an attractive chance to cash in on their profits.

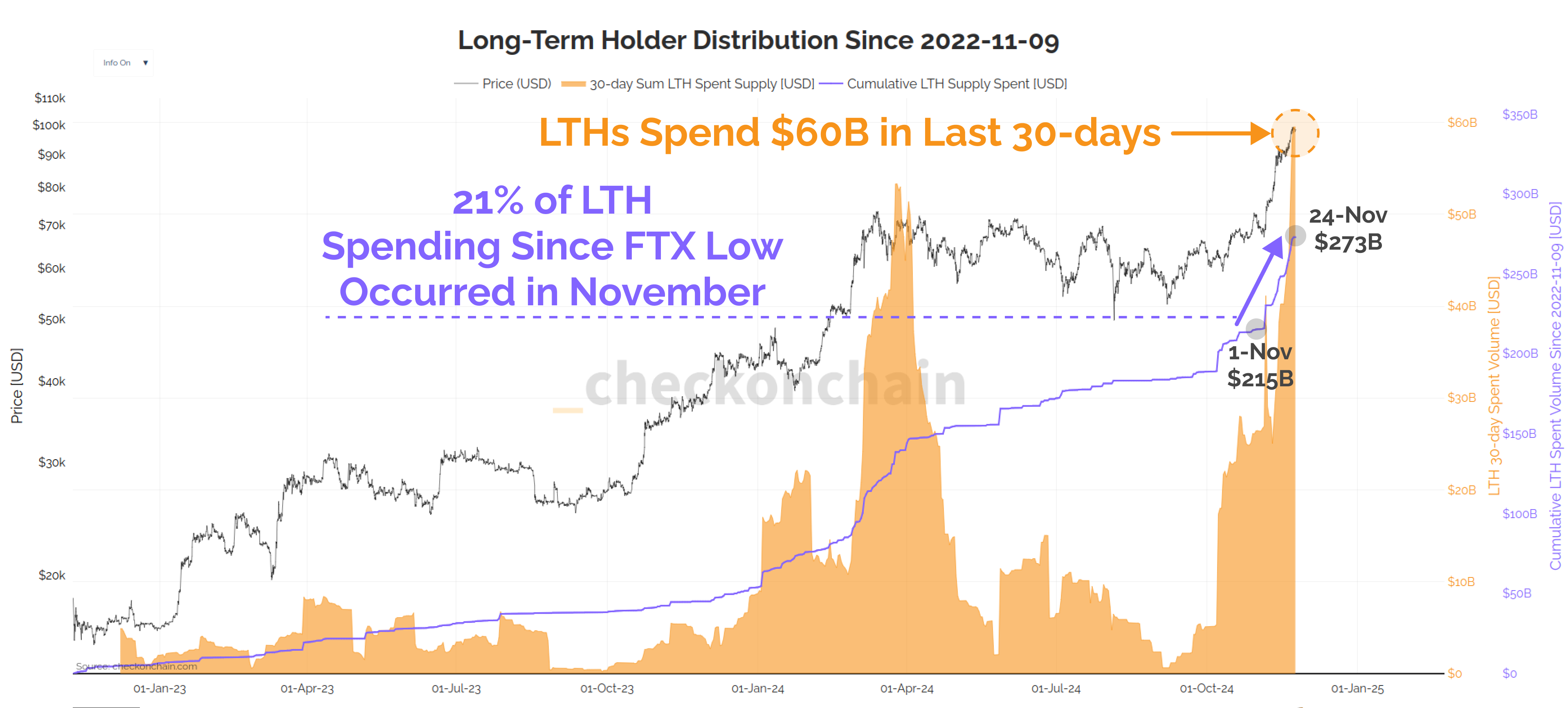

One method to follow the activities of this group involves looking at how much they are investing in supplies, and here’s a chart presented by the analyst that demonstrates the evolution of this Bitcoin-related spending measure over time, starting from November 2022, showing both the daily and cumulative values.

It’s clear from the chart that Large Bitcoin Holders (LTHs) have significantly increased their spending over the past 30 days, moving approximately $60 billion in Bitcoin tokens.

Typically, when these investors become active again, it’s usually because they intend to sell, which suggests that this activity might be indicative of a mass sell-off by the group.

Without a doubt, as the 30-day spending supply increases, so does the total value of the spent supply. In terms of the present graph, this latter figure represents the accumulated worth of the distribution that Large Token Holders (LTHs) have been executing since November 2022.

Checkmate chose this specific month as the dividing line because Bitcoin’s previous bear market ended and a new bullish phase began around that time, which was after the FTX collapse. Essentially, this month marks the beginning of the current cycle for this digital asset.

Currently, the indicator stands at a staggering $273 billion. This implies that approximately one fifth, or 21%, of the total supply expended throughout the entire cycle originates from last month’s Long-Term Holder (LTH) distribution.

It’s clear from the graph that these “diamond hands” were involved in a significant selling spree during the initial quarter of the year. This selling pressure might have contributed to Bitcoin entering a period of stabilization or consolidation.

Based on this pattern we’re observing, it would be intriguing to find out if the current drop in price will produce effects comparable to those seen with Bitcoin (BTC), or if the demand at present is robust enough to surmount this challenge.

BTC Price

At the time of writing, Bitcoin is trading around $95,500, up more than 8% over the last week.

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEI PREDICTION. SEI cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- ZIG PREDICTION. ZIG cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- USD MXN PREDICTION

- ARB PREDICTION. ARB cryptocurrency

- NTRN PREDICTION. NTRN cryptocurrency

2024-11-26 17:34