As a seasoned researcher who has navigated through countless market cycles and observed the ebb and flow of Bitcoin’s price action, I find it intriguing to see the dichotomy between the diamond hands (LTHs) and the weak hands (STHs). The recent downturn in the market has indeed brought about a major capitulation event among the short-term holders, as evidenced by their consistent selling at a loss.

The data from the blockchain indicates that Bitcoin holders who choose to sell can do so with a gain, as the less experienced investors (often referred to as ‘weak hands’) appear to be experiencing a significant selling spree or liquidation event.

Bitcoin Diamond Hands Still Comfortably Selling At A Profit

According to Julio Moreno, Head of Research at CryptoQuant, in his recent post on X, it appears that short-term Bitcoin (BTC) investors have succumbed to this current market dip.

Among Bitcoin users, there are two primary categories divided by holding duration: “short-term investors” (STIs) and “long-term investors” (LTIs). The former refers to those who typically hold their Bitcoins for a shorter period, while the latter group consists of individuals who tend to hold their Bitcoins for an extended time.

As a crypto investor, I find myself categorized based on my holding period, with anyone like me who has been invested for fewer than 155 days considered a Short-Term Holder (STH), while those who have held for longer periods qualify as Long-Term Holders (LTHs).

Over time, it’s statistically more rare for investors who hold onto their investments for a longer period to consider selling or moving them. Therefore, those who keep their assets for shorter durations are often seen as less steadfast compared to those who hold on for the long haul, who are referred to as Long-Term Holders (LTHs). The Short-Term Holders (STHs) represent a more impulsive segment of the market.

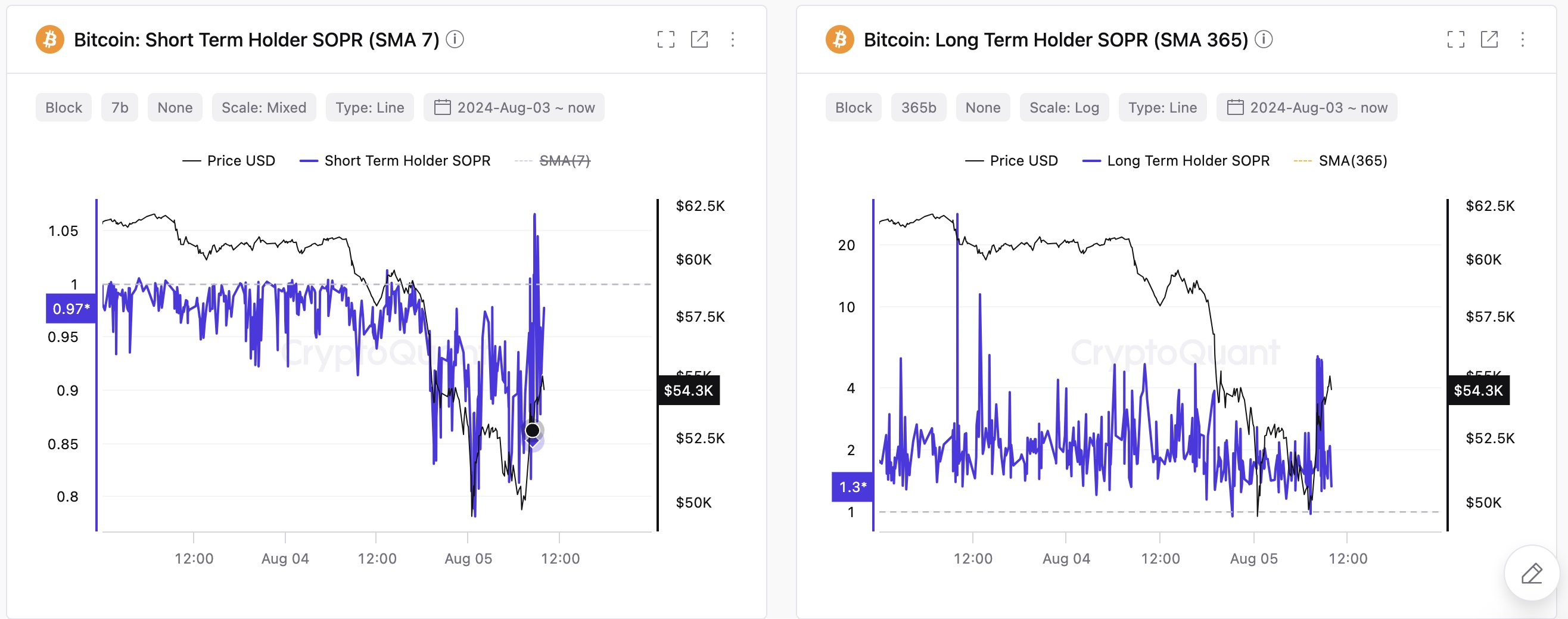

In the most recent accident, it’s been noticed that both groups have responded, yet their responses have been significantly distinct from each other. To highlight this disparity, Moreno has opted to employ the “Spent Output Profit Ratio” (SOPR) marker.

In simpler terms, the SOPR (Spend Output Profit Ratio) gives us insight into whether a specific Bitcoin user group is currently making a profit or incurring a loss when they sell their Bitcoins. When the SOPR value is greater than 1, it indicates that the majority of these users are selling their Bitcoins for a profit. Conversely, if the SOPR is less than 1, it suggests that the dominant trend among this group is to sell at a loss.

Now, here is a chart that shows the recent trend in the Bitcoin SOPR for the STH and LTH cohorts:

According to the graph, the Bitcoin STH SOPR (Spend Output Profit Ratio) has predominantly stayed below 1 throughout the recent drop in its price, suggesting that those holding Bitcoins are generally selling it at a loss.

In the most challenging period, the indicator dropped below 0.8, implying that the group experienced losses exceeding 20%. Undeniably, such a market plunge caused considerable worry and anxiety among these impulsive investors.

As Short-Term Holders (STHs) continue to sell and lose ground, Long-Term Holders (LTHs) persist in earning profits, with their Spent Output Profit Ratio (SOPR) remaining robust above 1. The SOPR reached a notable peak during Bitcoin’s recent rebound from its lows, implying that these patient investors cashed out for substantial profits.

Certain entities also capitalized on this recovery’s upswing, yet their performance barely surpassed the 1-mark threshold and only did so for a fleeting instant. This suggests that their gains were minimal and short-lived.

BTC Price

Currently, Bitcoin’s value is approximately $55,000 per unit, representing a decrease of over 17% from its price during the last seven days.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- Every Obsidian Entertainment Game, Ranked

2024-08-07 13:11