As a seasoned analyst with over two decades of experience in financial markets, I find myself intrigued by this recent trend among Bitcoin long-term holders. The data suggests that these ‘diamond hands’ are gradually distributing their tokens, which historically could be interpreted as a potential bearish signal.

According to blockchain data, Bitcoin long-term investors are currently transferring their coins, indicating a period of distribution might be underway. Let’s explore how this could impact the Bitcoin market price.

Bitcoin Long-Term Holders Have Just Sold Over 177,000 Tokens

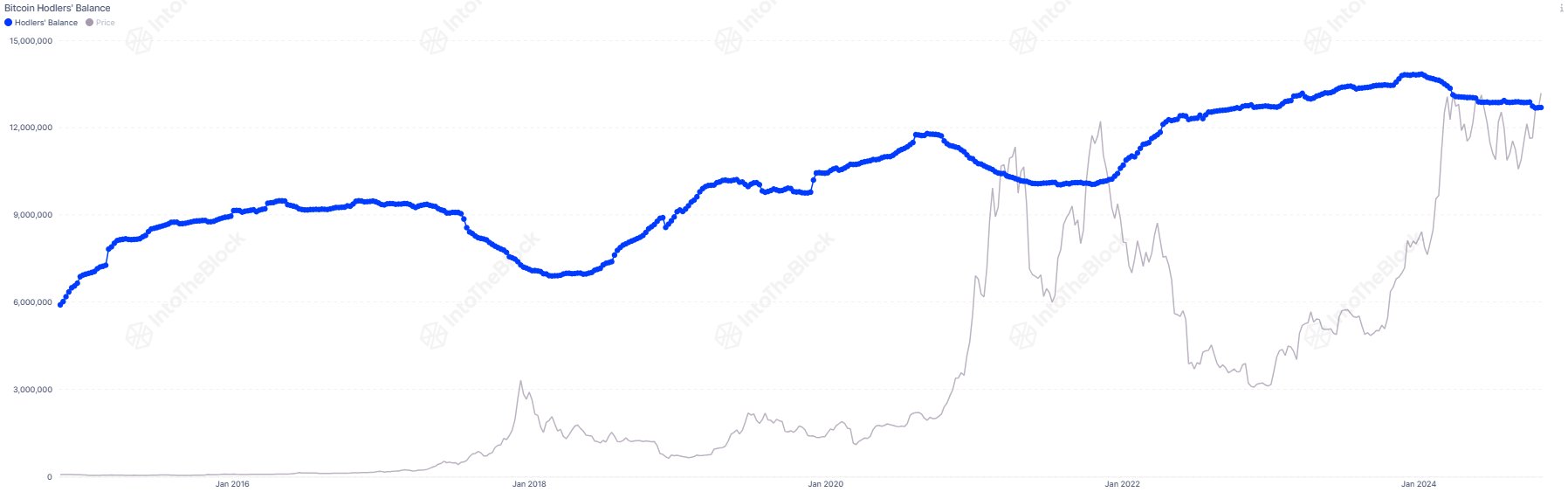

According to an analysis shared by Maartunn in a recent post on X, there’s been a decrease in the net balance for older Bitcoin holders as of late. Here is a chart from market intelligence platform IntoTheBlock, which illustrates the changes in balances among various holder groups within the Bitcoin network:

The groups here have been divided based on holding time: investors who bought their coins within the past month fall inside the <1 Month cohort (colored in yellow), while those who bought between one and twelve months ago are put into the 1-12 Months group (pink).

As for the subject at hand, we’re not considering either of the first two groups; instead, our attention lies with the third group (the blue one). This particular group consists of investors who have maintained their positions for over a year.

Investors who keep their assets for a year or more are generally less inclined to offload them. This means that those who have held onto their investments for over 12 months are likely the most committed users within the network.

As a researcher, I’ve observed an intriguing pattern: Holders have consistently been amassing assets throughout the 2022 bear market and the subsequent 2023 recovery rally. However, there appears to be a significant change in this trend that has emerged in 2024.

At the start of the year, the Bitcoin group’s account balance shifted noticeably into negative territory. This suggests that long-term holders may have been realizing the profits they had accumulated through their patience.

Initially holding onto diamonds, these investors eventually found less and less reason to sell as the cryptocurrency’s price stabilization after reaching a new all-time high continued for some time. Eventually, their account balances became perfectly stable, showing no net changes in buying or selling activity.

Lately, with Bitcoin showing a positive trend again, it seems that those who HODL (hold onto their coins) have resumed selling, as indicated by the shift of the balance change back to negative.

Considering the implications for cryptocurrency, historical trends might provide some insight. According to Maartunn, the behavior of long-term holders can serve as a contrarian signal. These investors typically buy more (increase their holdings) when prices decrease and sell less (reduce their holdings) during price increases.

From the graph, it’s clear that Large Time Holders (LTHs) often time their sales with bull markets. However, the peak of the cryptocurrency market doesn’t usually happen immediately after their selling spree; instead, it occurs after a prolonged period of distribution. This suggests there might be more room for Bitcoin to rise during this current rally before reaching its ceiling.

Something that may invalidate the pattern, though, is the fact that the scale of selling from the LTHs has been less intense this cycle, as IntoTheBlock has pointed out in an X post.

According to the analysis from the firm, even though some long-term investors are selling, this selling activity is less intense compared to previous market highs. This suggests that the current Bitcoin market may be developing a unique pattern or behavior.

BTC Price

At the time of writing, Bitcoin is trading around $68,800, down more than 3% over the past week.

Read More

- FIS PREDICTION. FIS cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- Luma Island: All Mountain Offering Crystal Locations

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- Space Marine 2 Teases 2025 Plans

- Fidelity’s Timmer: Bitcoin ‘Stole the Show’ in 2024

- Here’s How Bitcoin Price Could React To Potential US DOJ Sell-Off, Blockchain Firm Explains

- Some Atlus Fans Want Snowboard Kids to Make a Comeback

- 13 EA Games Are Confirmed to Be Shutting Down in 2025 So Far

2024-11-06 03:11