Ah, what a fine spectacle, dear reader. In the midst of Bitcoin‘s relentless decline, when the price dips as though it has discovered a bottomless pit, a strange and amusing scene unfolds. The big players in the market-those towering giants of finance, who seem impervious to such minor inconveniences as market sentiment-remain resolutely unmoved. They continue to buy, buy, buy, as if the world were not crumbling around them, and as though the very concept of loss were a distant memory. One must admire their stubbornness, if not their foresight.

Big Investors Keep Buying Bitcoin Amid Bearish Conditions

Indeed, the buying pressure surrounding Bitcoin-the so-called “king” of cryptocurrencies-has been mounting, and it is mounting with such force that even the most stoic observer might find it hard to ignore. On-chain data, a form of divine revelation in the crypto world, shows that the mighty Bitcoin whale holders have reached a crucial accumulation benchmark, despite the market’s erratic mood swings. A rising tide of interest, even in a sea of gloom-how utterly thrilling!

This trend of accumulation, steadfast as an old oak tree in a storm, tells a tale of unwavering conviction among these investors. They are not swayed by the temporary drops, no. Instead, they tighten their grip on Bitcoin, believing, perhaps foolishly, that its value will one day rise to stratospheric heights. Long-term holders, the so-called institutional whales, are continuing to buy in droves. As they do so, the supply of Bitcoin grows ever tighter, a fact which no doubt bolsters its fundamental strength. Or does it?

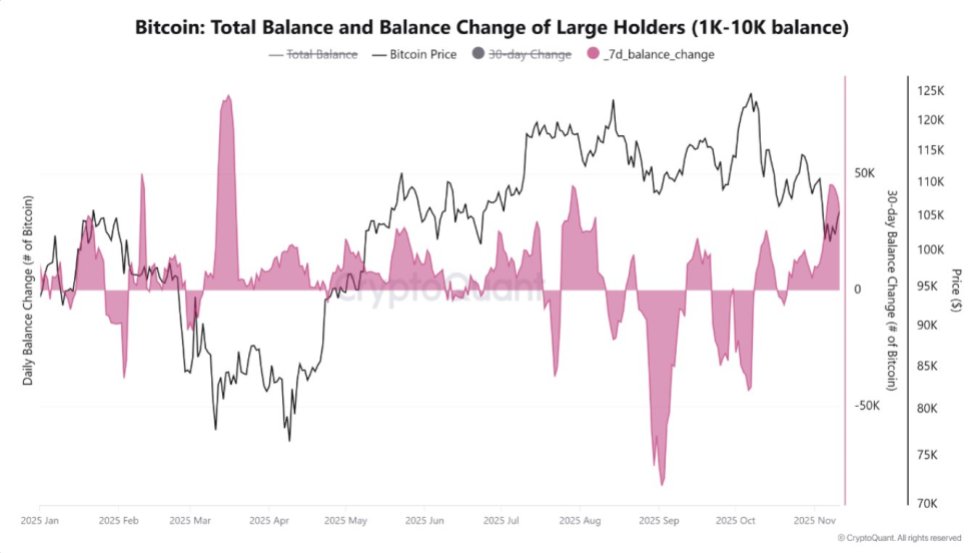

In an insightful post on the CryptoQuant platform, Caueconomy, a market expert (whose name I dare say sounds like something plucked from the world of economics and eccentricity), noted that Bitcoin is currently undergoing one of its largest whale accumulations in 2025. “Aha!” one might say. “So, trust in Bitcoin’s long-term prospects is growing?” Perhaps. But one must ask, will this trust withstand the weight of the inevitable market fluctuations? Time will tell.

Caueconomy pointed to a rather curious phenomenon in March 2025, when, despite Bitcoin’s steady descent and the general sense of dread that seemed to permeate the market, the whales, those great creatures of the deep, began buying in earnest. The largest weekly accumulation in large-scale wallet addresses, so the numbers say. And now, just when it seemed the small holders were abandoning ship, the whales, ever opportunistic, are once again snapping up the coins, as if they were rare treasures cast aside by the panicked masses.

BTC In A Structural Maturity Phase

Now, while Bitcoin’s price may be sinking lower than a drowned rat, Axel Adler Jr.-a researcher at CryptoQuant and no doubt a man of great intellect-has declared that the asset is not in a state of weakness, but rather in a “structural maturity phase.” A phase, he claims, that indicates Bitcoin is evolving, not failing. The evidence? Why, the ADX (Power of Trend) metric, of course, which has dropped, but not to alarming levels. Ah, the delicate dance of numbers!

Adler explained that the ADX, once a robust 32%, has now fallen to a humble 78%. This, he argues, signals a shift from a market dominated by speculative impulses to one that is, in his words, “institutionally balanced.” Fascinating, no? It’s as if Bitcoin is growing up and shedding its adolescent impulsivity. Out with the wild mood swings, in with the regulated, calm demeanor of an institution.

But alas, there is more. Adler notes that Bitcoin’s cycle seems to be diverging from its traditional four-year pattern. The ETF era, he claims, is dampening the dominance of these cycles. As seen in this latest period, the consolidation phases are growing longer, the volatile spikes less dramatic, and the price movements increasingly stable. Why, it’s almost as if Bitcoin is maturing into a responsible asset, settling down for a quiet life in the middle of the market’s chaotic tendencies. Quite the spectacle.

A glance at the chart reveals Bitcoin’s current situation: languishing between $100,000 and $110,000, with an ADX score of 32%. Could this mean an impending internal catalyst? Is a grand change on the horizon? Who can say, my dear friend, but one can certainly sense the building tension in the air. If only there were a way to predict the next big move. Perhaps the next great surge in volatility awaits us.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- EUR USD PREDICTION

- Sony Shuts Down PlayStation Stars Loyalty Program

- God Of War: Sons Of Sparta – Interactive Map

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

2025-11-14 01:15