As an experienced financial analyst, I’ve closely monitored Bitcoin’s price action and sentiment shifts over the past few months. Based on my analysis of the current market situation, I believe that bullish sentiment could indeed push Bitcoin’s price to $70,000 or even beyond.

Since reaching a record-breaking price of $73,737 around mid-March, Bitcoin‘s value has failed to maintain its previous intensity and power. Despite entering a new phase following the April halving event, the premier cryptocurrency’s recent weekly performance does not yet mirror this significant development.

In the past week, Bitcoin experienced good fortune as its price surpassed $67,000 for the first time in over a month. Despite a generally negative outlook on the crypto market and Bitcoin specifically in recent weeks, the latest bullish trend appears to be changing sentiment.

Can Bullish Sentiment Push BTC Price To $70,000?

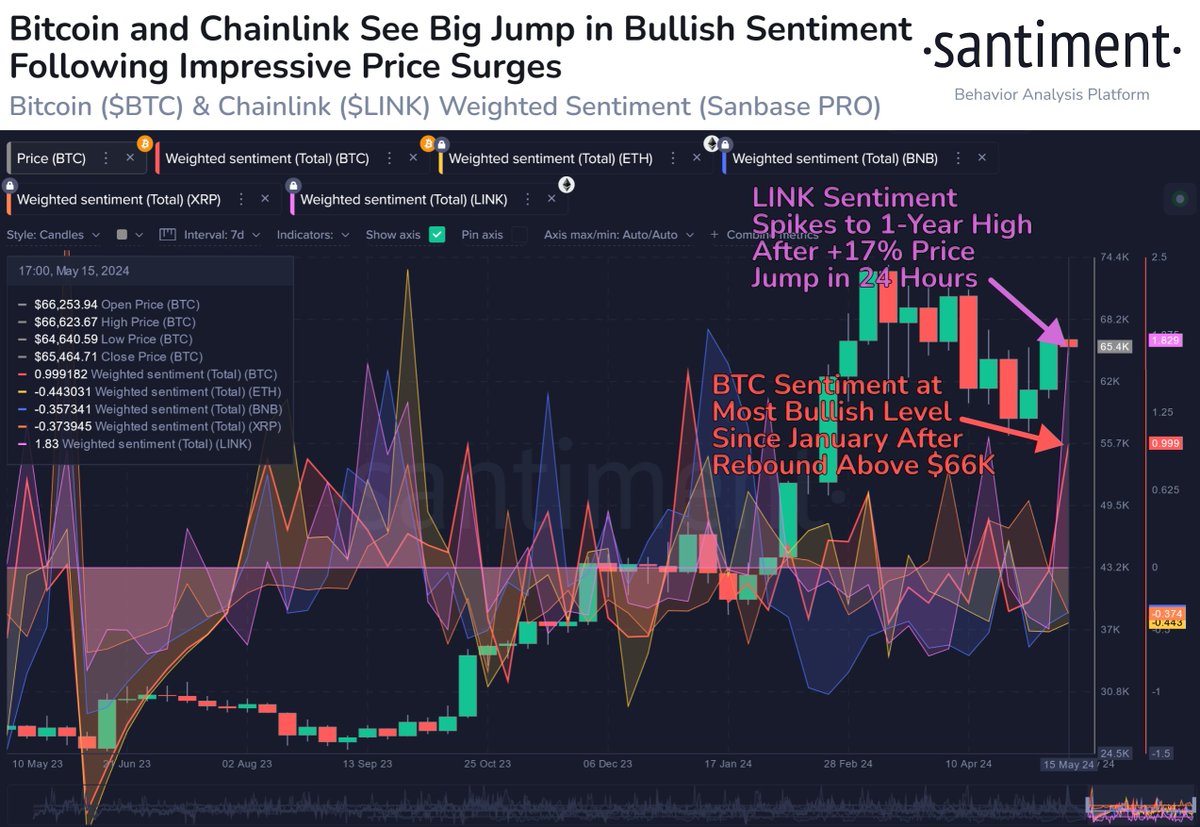

As a crypto investor, I’ve noticed an intriguing shift in the collective sentiment toward Bitcoin following its recent price surge above $67,000. According to the latest report by Santiment, an on-chain analytics firm, this trend is reflected in their Weighted Ssentiment metric. Essentially, this metric measures the overall emotional tone of crypto conversations across various social media platforms and forums. As Bitcoin’s price climbed, so did the positive sentiment surrounding it.

As an analyst, I would describe this indicator in the following way: I examine this indicator by considering two key components. The first component is sentiment score, which measures the overall attitude of the crowd towards a particular asset, whether it’s positive or negative. The second component is social volume, which represents the total chatter about an asset on various social media platforms.

The weighted sentiment arises from combining the intensity of feelings expressed, represented by the sentiment score, with the quantity of expressions, denoted as social volume. A noticeable shift occurs in this measure when the social volume is substantial and there exists a clear-cut average sentiment, be it favorable or unfavorable.

Based on Santiment’s analysis, Bitcoin’s optimistic outlook, as indicated by its weighted sentiment, has reached its most enthusiastic point since January. This surge in positive sentiment can be attributed to the latest price increase. Notably, the last instance of such bullish sentiment was observed following the Securities and Exchange Commission’s approval of Bitcoin spot ETFs in the US.

It’s intriguing to note that Bitcoin isn’t the only cryptocurrency from the top 20 experiencing a favorable outlook right now. According to sentiment data, Chainlink (LINK) is another noteworthy token that has experienced a surge of around 20% in value over the past week. This bullish trend marks the most optimistic sentiment for Chainlink in over a year.

As a crypto investor, I’ve experienced the exhilarating feeling of bullish sentiment in the market. However, this optimistic outlook can sometimes be a double-edged sword. FOMO, or the fear of missing out, can take hold and lead to impulsive buying decisions. This mass influx of investors can drive up the price, but it’s often unsustainable.

Bitcoin Price At A Glance

From my current perspective as a researcher, Bitcoin is currently priced at around $66,924 based on the latest market data. This represents a modest 2.3% gain over the past 24 hours. However, the most significant growth can be observed in the weekly timeframe, with Bitcoin showing an impressive 10% increase in value.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-05-18 17:41