As a seasoned researcher with years of experience delving into the complex world of cryptocurrencies, I find myself consistently intrigued by the dynamics at play within the Bitcoin market. The recent data showing significant net accumulation among investors is nothing short of fascinating.

Recent activity suggests that Bitcoin investors are purchasing Bitcoin at a pace five times greater than the current mining output, according to on-chain data.

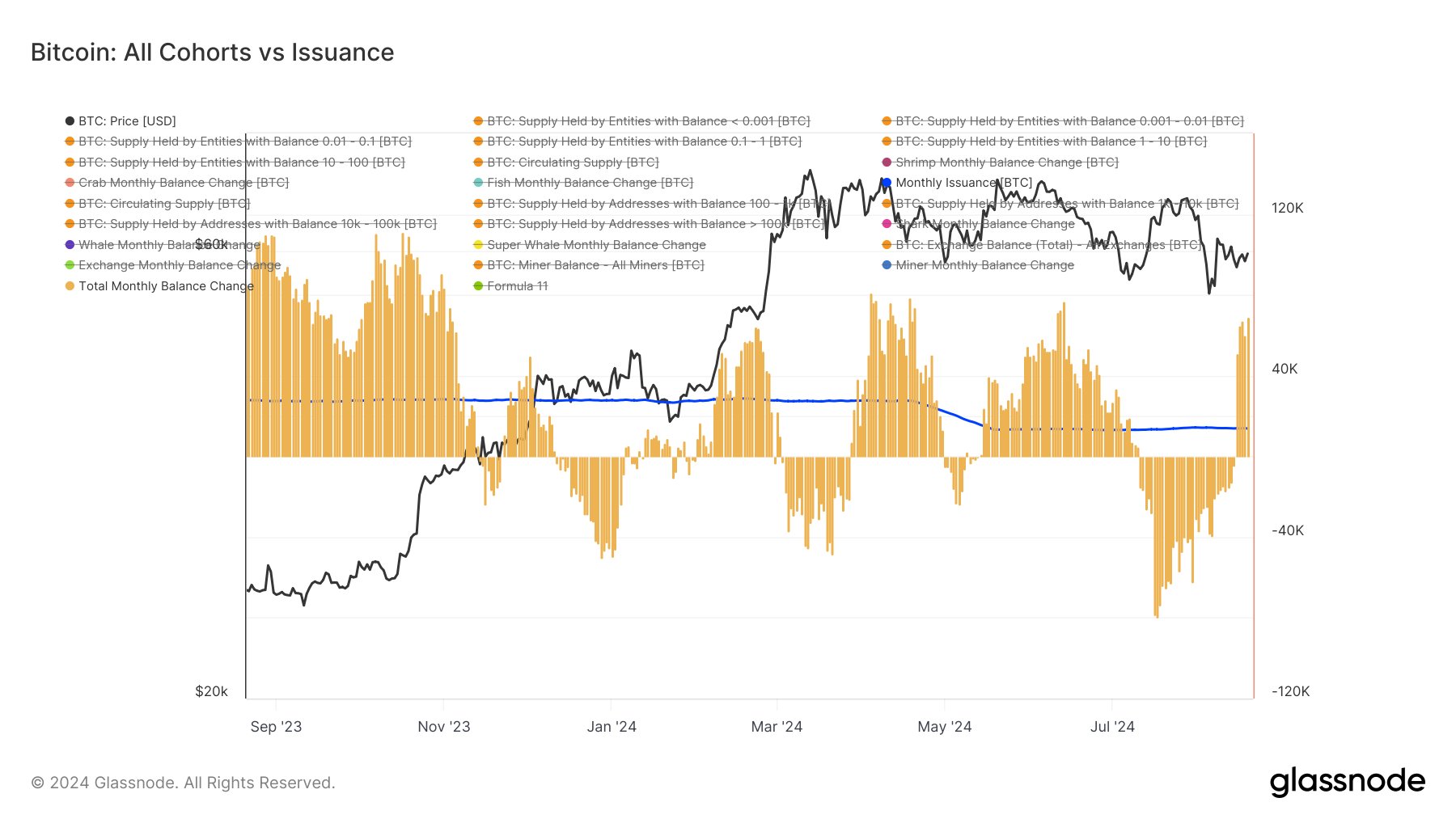

Bitcoin Investors Have Been Doing Significant Net Accumulation Recently

In his latest update, analyst James Van Straten discussed the current demand from Bitcoin investors relative to the monthly supply released within the network.

In this context, “monthly issuance” is the total number of Bitcoins that miners have generated within the network over the past 30 days. These Bitcoins are produced whenever miners successfully mine a new block and are rewarded with block rewards as payment for their work.

As a seasoned cryptocurrency enthusiast with years of investment experience under my belt, I have closely observed and analyzed the dynamics of Bitcoin’s monthly issuance compared to the changes in the balances of various investor cohorts over the past year. The visual representation below offers valuable insights into this intricate relationship, providing a clearer picture of how these factors interact and influence each other.

In this data set, you’ll find various categories of investors, from small-time savers to large-scale investors. Last month, the overall market balance experienced a significant drop, but since then, it has been steadily climbing in value and is now showing a positive trend with a notable surge.

Investors showed reluctance to purchase Bitcoin when its price was high in July, opting instead to offload their holdings. However, the change in trend indicates that the current prices have become significantly more appealing.

Over the last month, the accumulation by investors has clearly surpassed the production of new Bitcoins (mining). Specifically, the mining process produces around 14,000 BTC each month, whereas investors have added approximately 70,000 BTC to their holdings. This means that investors have purchased five times more Bitcoin than what miners have generated during this period.

In simpler terms, the reason investors can amass more than miners is due to the fact that some groups (cohorts) in this context do not include digital wallets used for exchanges.

Centralized exchange reserves serve as an indicator of the existing market sell-off, meaning that when investors transfer their coins to these platforms, the overall balance shift among all groups results in a net decrease in value.

As an analyst, I’ve noticed a significant buildup in Bitcoin holdings among investors recently, which is undeniably a promising indication. This accumulation implies that these investors are collectively withdrawing more Bitcoins from the storage facilities of these central entities, suggesting a shift in supply dynamics.

Yet, it’s uncertain for how long the market will persist in its accumulation phase, given that this condition was just recently established a few days ago.

BTC Price

Earlier today, Bitcoin managed to surpass the $61,000 threshold, but it appears that the digital asset encountered resistance and is currently retreating back towards $60,600. Here’s a visual representation of its recent price movement within the realm of cryptocurrencies.

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- EUR CLP PREDICTION

- USD COP PREDICTION

2024-08-23 18:12