As a seasoned crypto investor with a decade of experience under my belt, I find myself intrigued by the recent trend of Bitcoin moving from global platforms to US-based ones. Having weathered multiple bull and bear markets, I can’t help but draw parallels between this pattern and the events leading up to the 2017 and 2021 bull runs.

The data indicates an increase in the influence of American cryptocurrency exchanges over Bitcoin transactions. Let’s take a look at what transpired the previous two times this pattern emerged.

Bitcoin Is Moving From Global Platforms To US-Based Ones

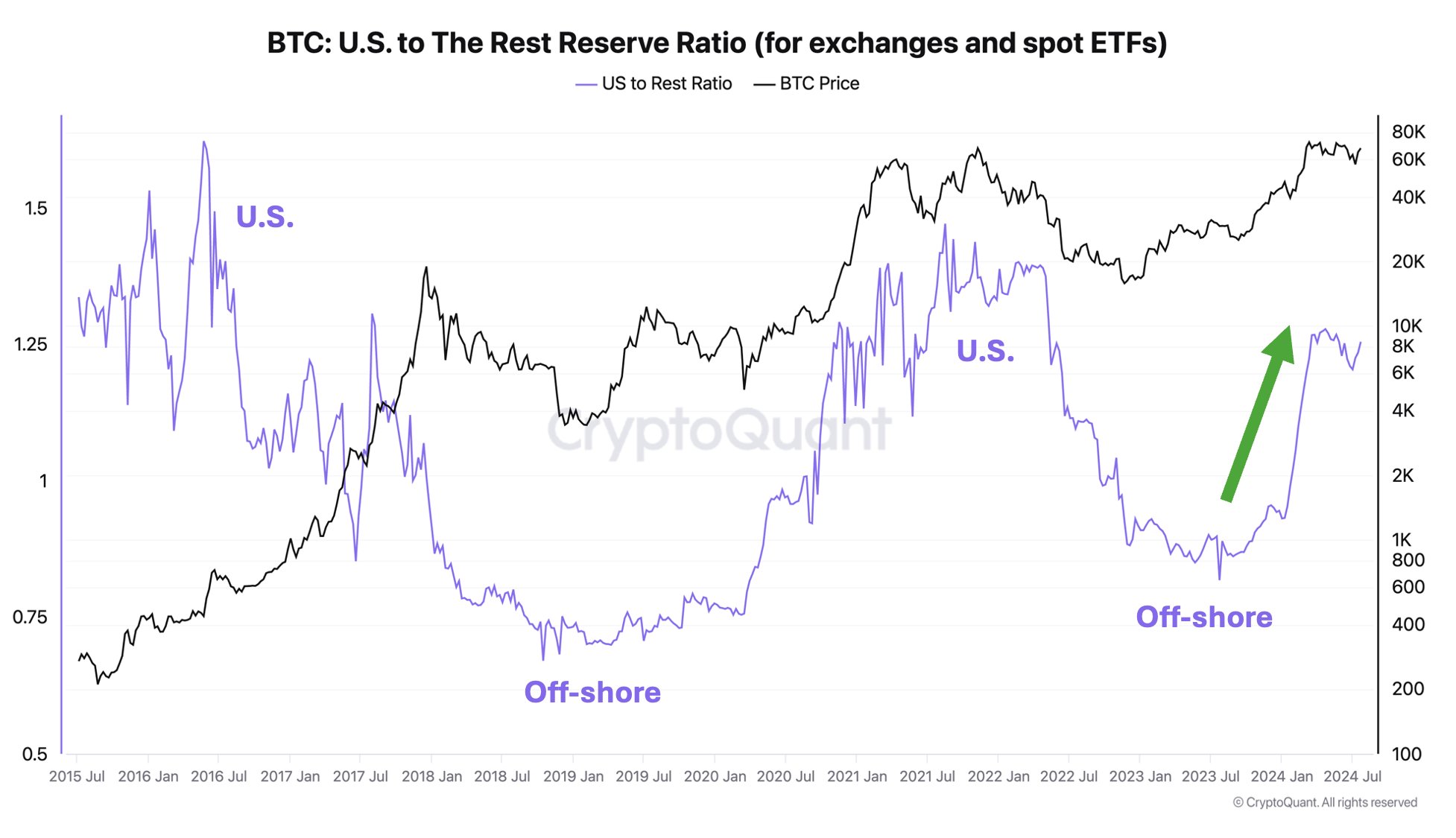

On his latest update for platform X, CryptoQuant’s founder and CEO, Ki Young Ju, has highlighted an intriguing pattern connected to a Bitcoin marker. Specifically, he’s referring to the proportion of Bitcoin reserves held by American-based services compared to those operating overseas.

In this context, “Platforms” refers not just to trading exchanges, but also to ETFs that trade on a spot basis and have recently been authorized to function within the United States, starting from January of the current year.

When the comparison between this ratio’s increase and the reserves held by US-based platforms exceeds that of off-shore platforms, it may imply a growing preference for the former over the latter platforms. This pattern might be indicative of a shift in interest towards the domestic platforms.

Alternatively, the decrease in this measurement could suggest that the cryptocurrency is moving away from U.S. exchanges and spot ETFs and toward international trading platforms instead.

Now, here is a chart that shows the trend in this Bitcoin indicator over the past decade:

According to the graph, this ratio dropped significantly during both the 2022 bear market and the 2023 recovery period. However, in contrast to previous years, we’ve seen a significant surge in the indicator’s value so far this year.

It seems that off-shore platforms are experiencing a significant decrease in their influence, possibly due to the growing popularity of U.S. spot Exchange-Traded Funds (ETFs) ever since they were introduced.

According to the graph, we can see that a comparable trend was noticed prior to the 2021 bull rush as well. During the bear market and subsequent recovery period, global exchanges held the majority of activity. However, there was a transition towards American trading platforms which set the stage for the price surge.

During the 2017 bull market, there was a significant increase in the influence of U.S.-based cryptocurrency exchanges. This suggests that Bitcoin tends to experience bullish phases when there’s greater interest in American trading platforms compared to those elsewhere globally.

Given the recurring pattern in the ratio lately, there’s a chance that the cryptocurrency might be gearing up for another significant surge in value. Whether this trend will continue or not, though, is yet to be determined.

As someone who has been closely following the cryptocurrency market for several years now, I can’t help but feel a sense of deja vu when I hear about yet another round of liquidations in the derivatives sector. It seems like just yesterday that we were witnessing similar events unfold with Bitcoin and other coins going through drawdowns. My personal experience has taught me to always stay vigilant and cautious when it comes to investing in this volatile market, as prices can swing wildly in a matter of hours or even minutes. While I’m still bullish on the long-term potential of cryptocurrencies, I believe it’s important for investors to approach this space with a healthy dose of skepticism and a well-diversified portfolio.

It’s clear from the information above that roughly $173 million worth of contracts tied to cryptocurrencies have been terminated within this period, with more than $148 million being long positions.

BTC Price

As a researcher studying the cryptocurrency market, I observed that momentarily, Bitcoin dipped below the $66,000 mark during its recent fall. However, it has demonstrated some resilience, recovering slightly and currently trading at approximately $66,600.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- AAVE PREDICTION. AAVE cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

2024-07-31 01:42