Recent data from the Bitcoin blockchain reveals a significant increase in the proportion of miner revenue derived from transaction fees. Let’s explore the reasons behind this surge.

Bitcoin Runes Have Caused A Sudden Shake-Up In Miner Revenues

Approximately two days ago, an significant milestone transpired on the Bitcoin network: the long-awaited fourth Halving. During this event, which happens approximately every four years, the rewards miners receive for solving blocks are reduced by half permanently. This marked a major turning point for cryptocurrency. Concurrently, another noteworthy development unfurled on the network: the unveiling of Runes, an innovative protocol enabling the creation of interchangeable tokens on the network.

Casey Rodarmor, who is known for inventing the Ordinals protocol launched in early 2023, created the Runes protocol. The Ordinals protocol enabled users to write data on a single bitcoin unit, often referred to as a satoshi.

Due to this groundbreaking protocol, an array of applications came into being on the network, such as Non-Fungible Tokens (NFTs). These innovative applications have swiftly captured the interest of users and have established themselves as essential components of the network. The introduction of Runes signifies a continuation and enhancement of this renowned protocol.

In simpler terms, Runes and the inscriptions generated by Ordinals protocol serve distinct functions. While each inscription is one-of-a-kind, Runes consist of identical units that can be exchanged or used interchangeably. So, unlike NFTs (Non-Fungible Tokens) where each token is unique, Runes represent Fungible Tokens with equal value.

Fungible token functionality isn’t exactly new for Bitcoin, however, as the popular BRC-20 token standard already exists. So, why the hype behind the Runes? The reason behind that is the fact that the latter is much more simple and efficient than other standards.

BRC-20 tokens adopt a circuitous method for creating fungible tokens, relying on the Ordinals protocol and functioning under an account-based structure akin to Ethereum. This intricacy necessitates three separate transactions in order to finalize a single transfer.

The Runes operate differently than BRC-20 tokens. They use an On-Chain Unspent Transaction Output (UTXO) system, which is similar to Bitcoin’s mechanism. As a result, Runes are entirely accessible through block explorers. In contrast, dealing with BRC-20 tokens necessitates multiple transactions.

From the time they were first introduced, Ordinals-linked apps have created a ripple effect on the network and noticeably influenced the economic indicator of cryptocurrency transaction fees during periods of high excitement, resulting in significant, if temporary, increases.

The use of these apps significantly impacts blockchain traffic, and when there’s high demand for them, the traffic can exceed that of other cryptocurrency activities.

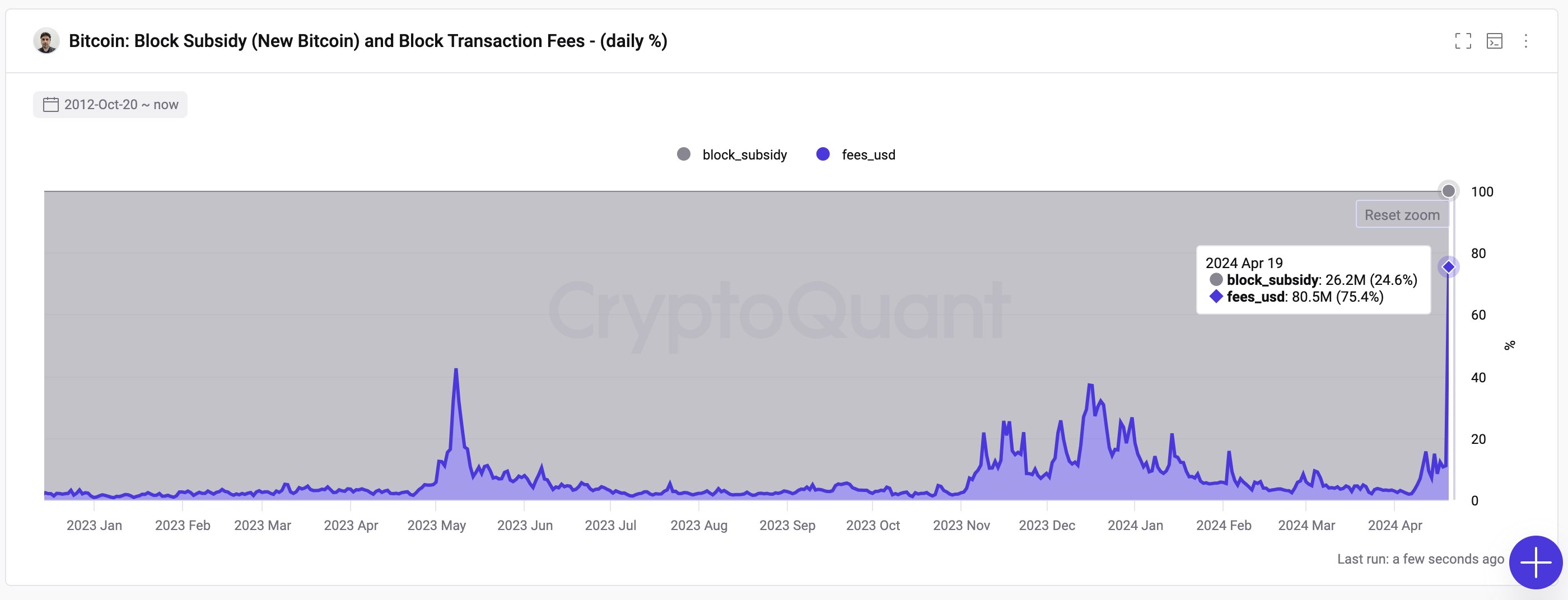

The introduction of Runes seems to have prompted a similar response from the network, as transaction fees have significantly increased. According to CryptoQuant’s Head of Research Julio Moreno, who made this observation in a recent post, miner revenue from transfer fees has risen to 75% following the launch of Runes.

According to the graph, the miners earned an astounding $107 million in total revenues that day, with an impressive $80.5 million derived solely from transaction fees.

In the past, mining fees have made up a small portion of miners’ earnings compared to block rewards. However, new uses of the network have led to fee increases that have temporarily reached significant amounts.

The recent Halving event has resulted in a substantial reduction in block rewards once again. This implies that the main income source for miners is now under greater constraint.

Over time, as rewards from halving keep getting smaller, miners would need to depend more on transaction fees to stay profitable.

With ordinals and runes potentially leading the way, the Bitcoin network could see a shift towards their widespread use, significantly increasing transaction fees and becoming a primary revenue stream for miners in the future.

BTC Price

Before the Bitcoin Halving, the price dipped below $60,000. However, following that dip, the price has regained momentum and is now approaching $65,900 once again.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- PNG PREDICTION. PNG cryptocurrency

2024-04-22 19:11