As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I have learned to navigate the turbulent seas of Bitcoin price swings with a blend of cautious optimism and calculated risk-taking. The current sell-off, while disheartening, is not entirely surprising given the historical patterns we’ve seen.

Bitcoin appears to be experiencing a drop as we speak, nearing the significant support level of $60,000. The daily chart suggests that this could mark a tentative beginning for what is traditionally a strong quarter – Q4 2021, which has often shown bullish trends in the past.

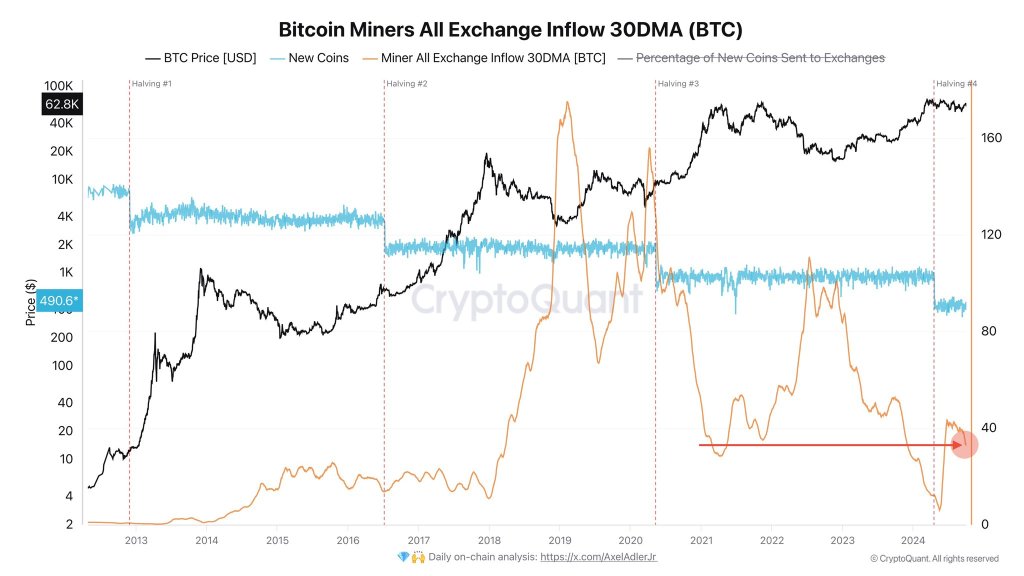

Bitcoin Miners Reducing Their Dumping

Despite Bitcoin experiencing a 10% drop from its September peaks, it’s becoming apparent that Bitcoin miners are lessening their sell-off pace. In a recent post on platform X, an analyst notes that in the last few weeks, leading Bitcoin miners have been progressively decreasing Bitcoin transfers to major centralized exchanges such as Binance and Coinbase.

Following the April 20 Halving, there has been a significant increase in prices, which is typically observed due to miners selling their reserves on exchanges as they adapt to the altered inflation system. (Historically, this pattern has been seen before and after the Halving event.)

Following a halving event, the system will lower the block reward payout by half. This 50% decrease implies that miners must adjust to a corresponding reduction in their earnings. This impact is particularly noticeable when transaction fees per block do not increase substantially.

After reaching nearly $74,000 in March, investors anticipated that Bitcoin would continue its upward trajectory following the Halving event. However, due to a large number of Bitcoins being sold by struggling miners post-Halving, the prices actually dropped, even though some US-based spot Bitcoin ETF providers were reportedly bringing more Bitcoin into circulation in certain instances.

Will BTC Bounce Higher In Q4 2024?

Slowing down Bitcoin sales by miners could probably boost prices, as their actions suggest they anticipate a price increase in the upcoming months. To maintain an upward trend, investors are closely monitoring key fundamental aspects.

In simpler terms, it’s been historically advantageous for optimistic investors (bulls) during the last quarter of 2024, with particular emphasis on October and November. However, the recent losses over the past three days have made October 2024 the weakest start in at least a decade for Bitcoin, which could potentially challenge this historical trend.

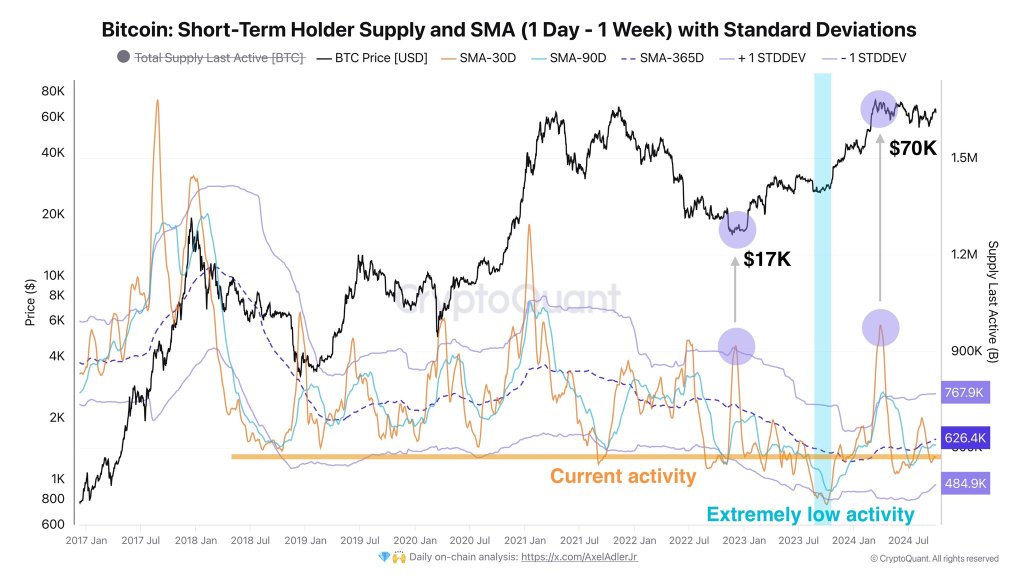

For a brief period, the market analyst predicts that the current sell-off might be limited if short-term investors (those who purchased the coin within the past 155 days) decide to withhold selling about 80,000 Bitcoin from the market.

These individuals are frequently viewed as speculators and could potentially disrupt the Bitcoin upward trend because they’re inclined to sell when prices drop dramatically, which they find difficult to endure. If their supply decreases, Bitcoin might find stability at around $60,000. However, if bears continue to push, the coin may fall below $57,000 – a level that has served as support in the daily chart.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD CLP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- KATA PREDICTION. KATA cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- BLACK PREDICTION. BLACK cryptocurrency

- Best JRPGs That Focus On Monster Hunting

2024-10-04 16:41