Approaching on April 19, the long-awaited Bitcoin halving event has sparked an intriguing development among miners. Contrary to the pre-halving selling frenzies observed in 2016 and 2020, miners are now hoarding Bitcoins instead of following past tendencies.

Miners Accumulating Bitcoin

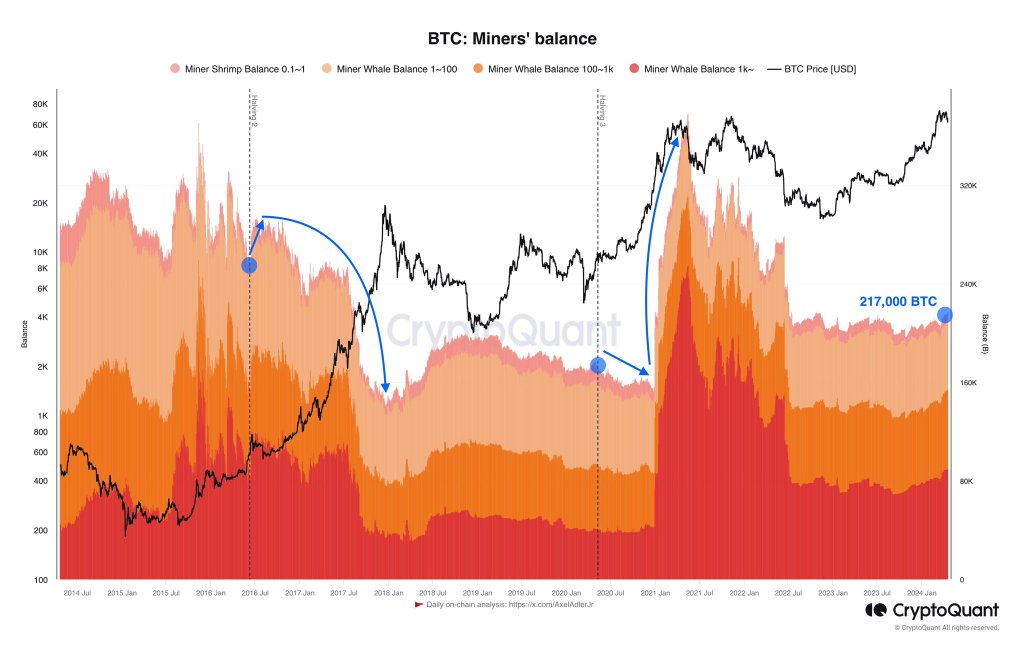

One analyst wrote in a recent post on X using CryptoQuant as a source, that the amount of Bitcoin (BTC) held by miners has significantly increased by approximately 12,100 BTC since the start of 2024. As a result, the current total BTC balance owned by miners now stands at around 217,000 BTC.

In contrast to the past when miners reduced their holdings in preparation for potential revenue drops following the Halving in 2016 and 2020, this current behavior stands out. At that time, data showed most miners decreasing their assets in expectation.

At the core of the protocol, a cut in half is implemented for miner rewards. This means that miners previously earning 6.25 Bitcoins per block are now only rewarded with 3.125 Bitcoins. Consequently, miners must invest more resources to maintain their previous income level.

In response, some smaller miners may choose to sell and leave the market due to increasing competition. On the other hand, larger miners equipped with ample resources could seize this moment to sell coins and acquire more advanced mining equipment to maintain their competitive edge.

According to the graph, miners sold off their Bitcoins following the halving event in 2016. Despite increasing supply from sellers, Bitcoin prices experienced a significant surge in 2017, reaching an all-time high of $20,000. However, prices took a downturn in 2018.

After the widespread use of Bitcoin and cryptocurrencies following the initial coin offerings (ICOs) boom in 2017, the market grew more active, leading to an increase in the number of miners joining the network. This is evident from the rising hash rate observed post-halving.

In contrast to what transpired in 2016, the 2020 Bitcoin halving signified a shift in momentum. With prices of Bitcoin soaring towards unprecedented heights, mining operations adopted a hoarding approach, amassing coins at an accelerated rate as depicted in the graph. This ongoing accumulation pattern implies that miners could be forecasting another price explosion.

Is BTC Ready For A Bull Run To $100,000?

The change in mining practices might lead to an increase in prices. Miners, who are anticipated to adapt and enhance their productivity following April 19, remain optimistic despite the present market downturn.

In simpler terms, after the Bitcoin Halving, there has been less new Bitcoin released each day. At the same time, miners are keeping more Bitcoin for themselves and institutional investors are buying Bitcoin through ETFs on spot markets. All of this could lead to a significant increase in Bitcoin’s price.

It’s unclear how quickly prices will increase. Currently, Bitcoin is showing bearish signs and continuing to face significant selling pressure due to losses on April 13. However, if Bitcoin manages to break out bullishly above the current price range of $74,000, it could potentially pave the way for further growth towards $100,000.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- REF PREDICTION. REF cryptocurrency

- ASTO PREDICTION. ASTO cryptocurrency

- SGB PREDICTION. SGB cryptocurrency

- EUR RUB PREDICTION

- Best JRPGs That Focus On Monster Hunting

2024-04-19 10:22