Bitcoin mining became a little easier on Thursday. The difficulty dropped by 3.28%, reaching a level not seen since September 2025. This is good news for miners, who have faced increasing challenges in recent months. The change comes at a time when miner revenue has decreased by over 5%, so it’s a necessary adjustment to reflect current conditions rather than a handout.

Bitcoin’s Self-Correction Kicks In as Mining Difficulty Falls Again in 2026

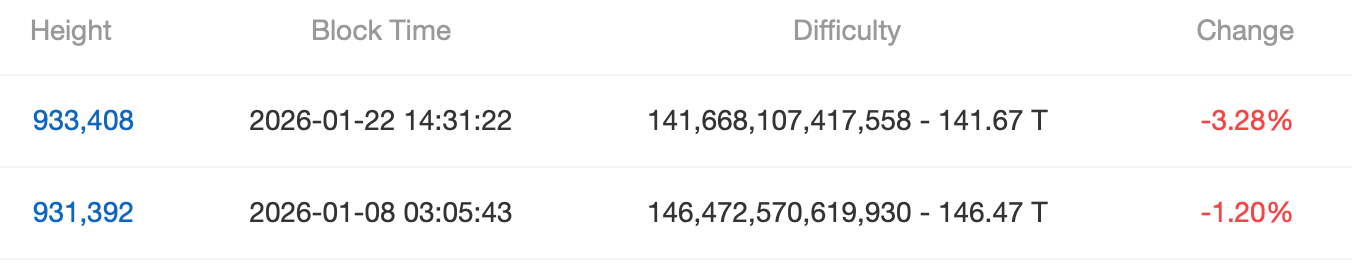

At block height 933408, Bitcoin’s mining difficulty setting slipped by 3.28%, and for the next two weeks—or precisely 2,016 blocks—it will sit at 141.67 trillion, a quieter dial setting that gives miners a brief moment to catch their breath.

Basically, Bitcoin’s mining difficulty is a native network setting that recalibrates about every two weeks, keeping new blocks arriving at roughly ten-minute intervals, no matter how much computing muscle is vying for the prize.

As miners and hashpower flood in, block intervals speed up and the difficulty tightens; when that power recedes, the difficulty parameter loosens when block times are slower, preserving Bitcoin’s issuance schedule as steady, predictable, and stubbornly resistant to gamesmanship.

As of today, the difficulty has been adjusted twice in 2026, and both times it has decreased. The most recent change lowered the difficulty by 1.20%, following a small 0.04% increase on December 24th of last year.

The last time the difficulty was in this same range was 18,144 blocks prior to block height 933408, when the difficulty change led to 142.34 trillion for two weeks on Sept. 18, 2025. The latest difficulty dip offers bitcoin miners a modest reprieve, arriving as revenue has been sliding steadily over the past eight days.

According to data from hashrateindex.com, the price of mining power—specifically, one petahash per second (PH/s)—dropped from $42.20 on January 14th to $39.90 by January 22nd. This represents a 5.45% decrease in just one week, highlighting how quickly the economics of cryptocurrency mining can change.

As a crypto miner, things are tough right now, but there’s a small window of opportunity to get back on stable ground, even though the whole system around securing the network is changing. My margins are squeezed, but I’m hoping to weather this storm and find a sustainable path forward.

FAQ ❓

- What caused Bitcoin’s latest mining difficulty change?

Bitcoin’s difficulty adjusted lower after a decline in network hashpower, triggering an automatic recalibration at block 933,408. - How much did Bitcoin’s mining difficulty drop?

The difficulty fell by 3.28%, setting the new level at 141.67 trillion for the next 2,016 blocks. - Why does Bitcoin adjust mining difficulty every two weeks?

The network recalibrates difficulty roughly every two weeks to keep block times near 10 minutes regardless of hashpower changes. - Does the difficulty drop help bitcoin miners right now?

Yes, the reduction offers short-term relief as miner revenue per petahash has declined over the past week.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- INR RUB PREDICTION

- Best Ship Quest Order in Dragon Quest 2 Remake

2026-01-23 18:32