As an experienced analyst, I’ve closely monitored the Bitcoin market for years, and the recent data on the sharpest drop in Bitcoin mining hashrate in three years is a concerning development. The 7-day average Bitcoin mining hashrate, which represents the total amount of computing power connected to the network, had witnessed its largest plunge since the China ban in 2021.

The average Bitcoin mining hash rate over the past week has experienced a significant decrease, marking the most pronounced drop since the mining restrictions in China were imposed in 2021.

Bitcoin Mining Hashrate Has Just Observed The Sharpest Drop In 3 Years

As a researcher studying the Bitcoin network, I would describe the “mining hashrate” as the collective processing power contributed by all the miners currently participating in the Bitcoin mining process. By monitoring this metric, we can gain insights into the current state of Bitcoin mining operations.

As the value of this metric rises, existing miners broaden their operations, and fresh ones are drawn in. This pattern suggests that the chain is becoming increasingly appealing to validators.

Alternatively, a decrease in the indicator implies that certain miners may have withdrawn from the network, possibly due to Bitcoin mining no longer being profitable for them.

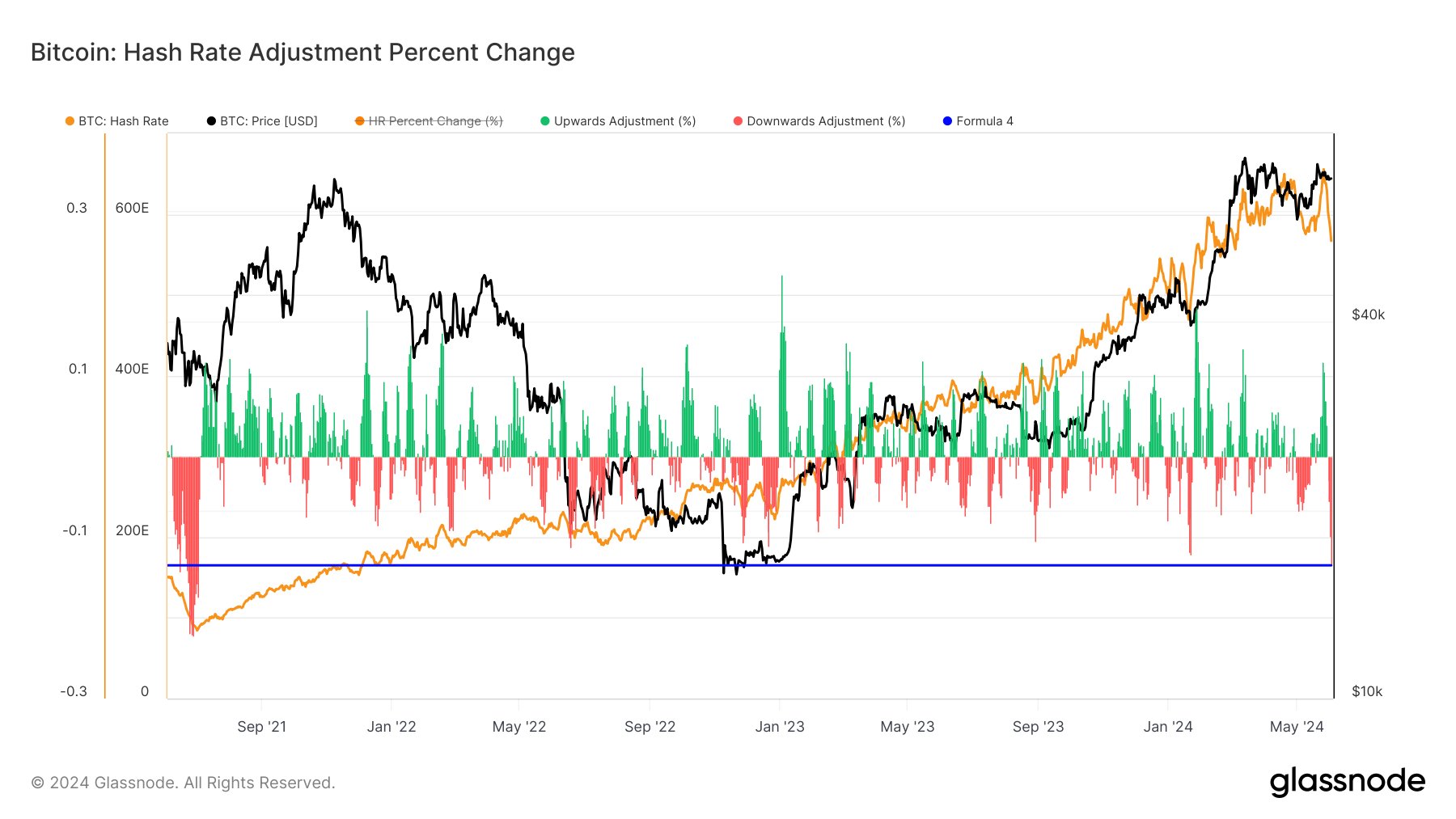

Here’s a chart displaying the yearly development of the 7-day average Bitcoin mining hash rate:

The 7-day average Bitcoin mining hash rate reached a new record high on May 27th, as indicated in the graph above. However, this figure has experienced a significant drop since then.

As a researcher studying hash rate trends at the Advanced Technology Hub (ATH), I’ve observed that the indicator’s value previously stood approximately at 657.2 terahashes per second (TH/s). However, I now find it has dropped significantly to around 566.8 TH/s – representing a nearly 14% decrease in hash rate.

As a cryptocurrency analyst, I’d like to share some insights about a significant event that took place on the Bitcoin network back in April. This was the fourth occurrence of what we call “Halvings” – these are periodic phenomena happening roughly every four years. During Halvings, the rewards for mining new blocks get reduced by half.

As a crypto investor, I can tell you that the block rewards, which miners earn by adding the next block to the blockchain network, make up a significant portion of their income. Consequently, when the number of coins awarded for mining a block gets reduced through a Halving event, it can have a detrimental effect on their financial situation.

It’s normal for the Hashrate to decrease after the most recent Halving, given that miners who were already struggling financially were pushed into deeper financial hardship. However, this downturn didn’t persist for long. Instead, by mid-May, the metric experienced a remarkable turnaround and began to rise strongly.

It was believed by some that the recent surge to a new all-time high (ATH) indicated an end to the miner capitulation triggered by the Halving. However, the latest price drop hints that this upward trend could have been merely a brief deviation, as the Hashrate has returned to align with its previous downward trend.

As a researcher, I’d like to provide some context for the metric in question. To help visualize the recent shifts, fellow analyst James Van Straten has kindly shared a graph displaying the percentage variations of this indicator over the past few years.

It’s clear to see that the recent drop in Bitcoin’s hashrate represents the most significant decline since the mid-2021 incident. The previous, more extensive downturn was triggered by China’s prohibition of Bitcoin mining within its borders.

In the past, China controlled a substantial portion of the Bitcoin network’s computational power. Consequently, when China imposed a ban, a considerable amount of Bitcoin mining capacity went offline. It took some time before this metric rebounded, as miners had to complete their moves to other countries to continue their operations.

As a crypto investor, I’ve witnessed some significant market crashes in the past, including one that was much more severe than the recent drawdown we’re experiencing now. However, it’s important to note that the current miner capitulation may not yet be over. The hashrate metric could continue to decline in the near future and potentially surpass the scale of the hashrate decline we experienced in 2021.

BTC Price

At the time of writing, Bitcoin is trading at around $69,800, up more than 3% over the past week.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- Every Obsidian Entertainment Game, Ranked

2024-06-05 02:12