A financial expert has shared that a developing trend in the relationship between Bitcoin‘s Market Value and Realized Value, as indicated by the MVRV ratio, might signal an opportune moment for investment.

Bitcoin MVRV Momentum Could Reveal Buying Opportunity For BTC

According to Analyst Ali’s latest update on X, the Moving Average Value (MVRV) Momentum has signaled potential purchasing chances for cryptocurrencies during this ongoing bull market.

The MVRV ratio is a commonly used Bitcoin on-chain metric that measures the asset’s market value against its true value, which represents the total amount of money all owners have spent to acquire their coins.

An alternative perspective on the MVRM (Maximum Realized Value over Realized CapitALization) ratio involves examining the current market value of a holder’s assets against their initial investment. In simpler terms, consider the difference between the present worth of the holdings and the amount originally spent to acquire them.

If the indicator’s value surpasses 1, it means that the market capitalization currently exceeds the realized cap. This situation indicates that on average, investors are realizing profits. Conversely, when the metric is below this benchmark, it can be assumed that the overall market is experiencing losses.

In simple terms, when the MVRV ratio equals 1, it signifies that investors have neither made a profit nor incurred a loss – they have simply recovered their initial investment.

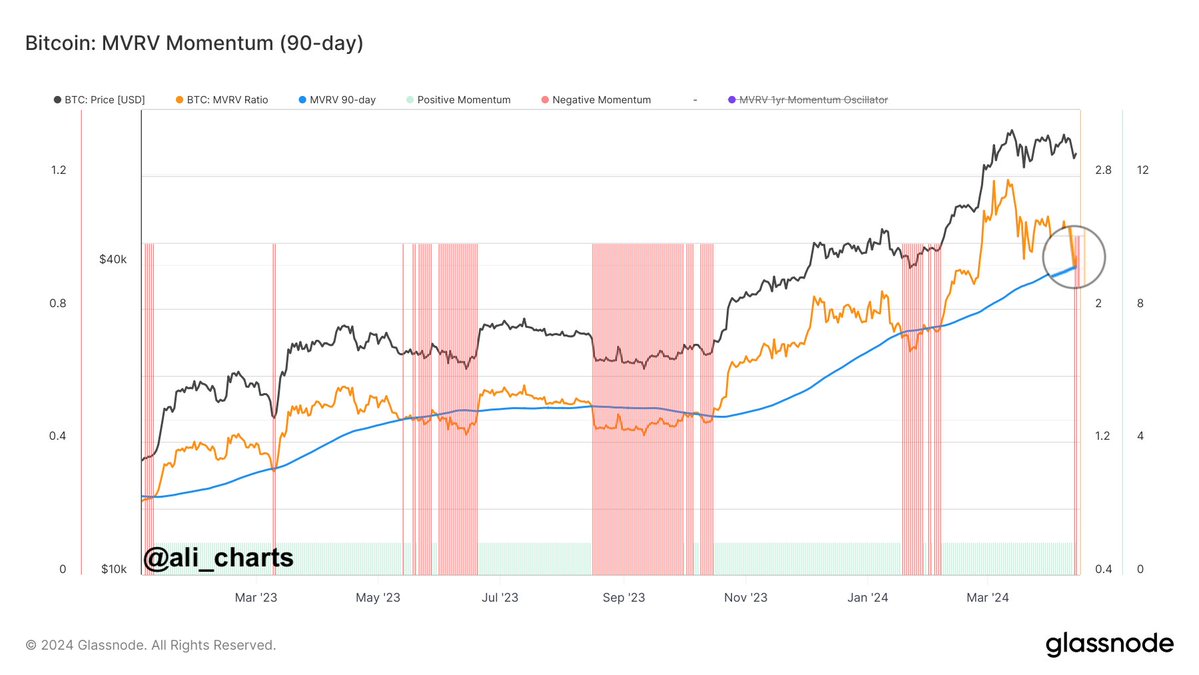

When it comes to the present discussion, it’s not just the MVRV ratio that matters, but rather how it compares to its 90-day moving average (MA). The following graph illustrates the development of the Bitcoin MVRV Momentum.

The Bitcoin MVRV ratio on the chart has dropped off lately, which can be attributed to a decrease in the digital currency’s value.

In simpler terms, after this recent decline, the metric has dropped below its moving average over the past 90 days. This indicates that the indicator is currently showing downward momentum, which has happened several times during the past year and a half of bull market.

According to the graph’s representation, the cryptocurrency’s local troughs usually align with the metric reaching specific thresholds. An analyst points out that when the MVRV falls beneath the 90-day mean, it indicates a promising moment for investment.

If this pattern holds true, the Bitcoin MVRV Momentum meeting this requirement once more might signal a prime opportunity for investing in the asset.

Although the MVRV ratio falling below its threshold doesn’t guarantee an immediate end to the price decline for Bitcoin, history shows that the bottom tends to be near when this occurs. In other words, previous drops have often continued after the MVRV ratio dipped, but the market has typically reached a turning point soon thereafter.

BTC Price

At the time of writing, Bitcoin is trading at around $62,400, down over 11% in the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

2024-04-17 01:42