As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the current state of the Bitcoin market, particularly the MVRV Ratio trend. The historical data presented by IntoTheBlock is compelling and aligns with my own observations from past cycles.

As a crypto investor, I’m keeping an eye on the Bitcoin Market Value to Realized Value (MVRV) Ratio, as it seems to suggest that the peak of this market cycle might still be ahead.

Bitcoin MVRV Ratio Hasn’t Yet Hit The Peaks Of Previous Cycles

On their latest update for X, market analysis platform IntoTheBlock delves into the past patterns observed in the Bitcoin Market Value to Realized Value (MVRV) ratio, a widely used on-chain metric that measures the relationship between Bitcoin’s market capitalization and realized capitalization.

The market cap here is just the simple total valuation of the cryptocurrency’s supply at the current price. At the same time, the latter is an on-chain capitalization model that puts the last transaction price of each coin in circulation as its ‘true’ value.

If we consider that the latest transaction was when a coin was last exchanged, then the price during that exchange serves as the cost basis. Consequently, the estimated total value, or realized capital, is simply calculated by adding up the cost bases of all Bitcoin (BTC) tokens.

To put it simply, this measurement indicates the overall amount of money investors have invested in the cryptocurrency at present. On the other hand, market capitalization refers to the current value that investors hold at this moment.

In essence, the MVRV Ratio shows whether Bitcoin investors are currently making a profit or suffering losses by comparing two key measures. When this ratio is over 1, it indicates that most investors are seeing profits, whereas if it’s below 1, losses appear to be more prevalent among them.

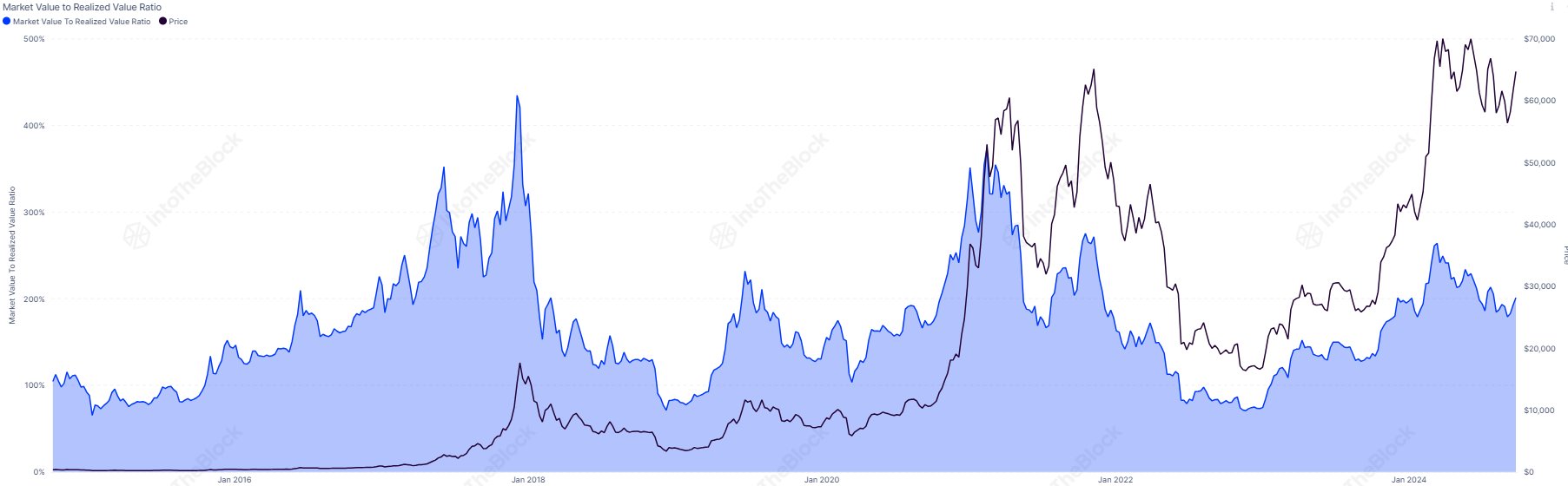

Now, here is a chart that shows the trend in the Bitcoin MVRV Ratio over the past decade or so:

In the graph shown earlier, we can see that the Bitcoin MVRV Ratio significantly increased during the first quarter of this year when Bitcoin reached its highest price ever. This is because the gains made by investors on their Bitcoin investments have swelled or grown significantly.

Historically, Bitcoin has tended to experience price peaks more often, and as investor profit levels increase, there’s a tendency for them to want to cash out at higher profit margins.

Consequently, when the MVRM Ratio reaches elevated levels, it might suggest that the cryptocurrency is overvalued and could potentially experience a correction. Back in the year’s peak, this indicator reached a maximum value of 2.64, indicating that the market capitalization exceeded the realized capitalization by more than double.

As reported by IntoTheBlock, the highest value for this indicator was 4.35 during the bull run of 2017 and 3.7 during the 2021 bull run. At present, the indicator’s value hasn’t reached either of these highs yet. The analytics firm has pointed out that the current value appears relatively low compared to what’s typically seen at market tops.

BTC Price

At the time of writing, Bitcoin is trading at around $60,600, down around 7% over the past week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- RIDE PREDICTION. RIDE cryptocurrency

2024-10-04 09:11