As a researcher with a background in cryptocurrency and market analysis, I find the recent trend of negative Bitcoin Net Taker Volume quite concerning. The indicator’s persistent negativity suggests that taker sell volume has been dominating the market in the past month, which could be a sign of bearish sentiment.

The data indicates that the Bitcoin Net Taker Volume has primarily been in the red zone lately. This observation could imply potential bearish price trends for Bitcoin.

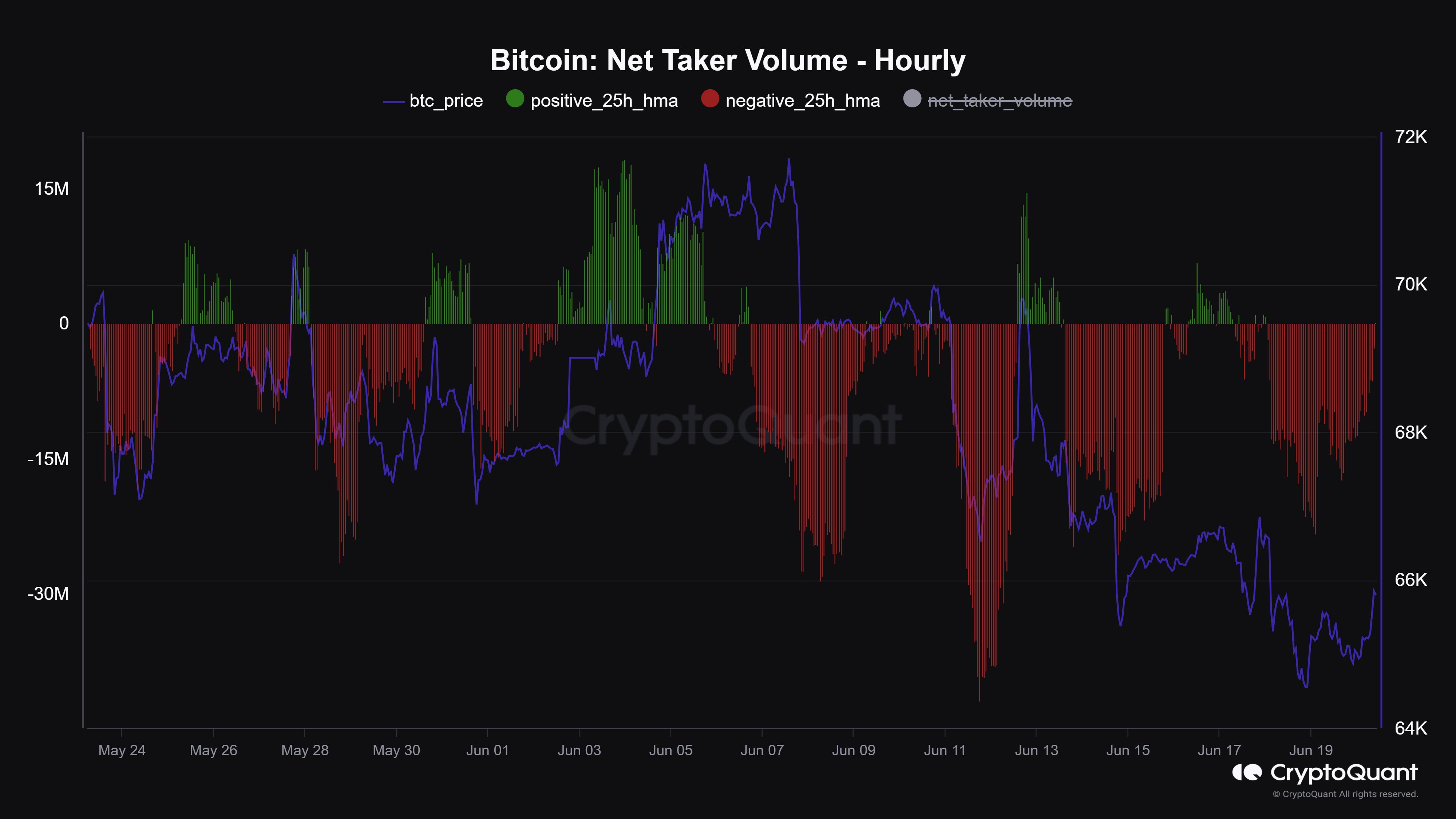

Bitcoin Net Taker Volume Has Been Mostly Negative In The Past Month

According to Maartunn, the community manager at CryptoQuant, the recent data from the Net Taker Volume indicates a noticeable decrease in significant taker buy activity over the past month.

The “Net Taker Volume” is a metric that records the gap between the number of buy and sell orders executed by takers in Bitcoin’s perpetual swap market. In simpler terms, it signifies the difference in the volume of buy and sell orders being filled through active trading by takers in this financial instrument.

When the metric’s value is positive, it signifies that more buyers than sellers are present in the market at this moment. This situation suggests a prevailing bullish attitude among market participants.

Meanwhile, the level below zero on the indicator implies a prevalent pessimistic attitude within the sector, with shorter positions exceeding longer ones.

Now, here is a chart that shows the trend in the Bitcoin Net Taker Volume over the past month:

In the graph above, the Bitcoin Net Taker Volume has only experienced a handful of upward surges within this timeframe, and the magnitude of these surges has been relatively small.

As a crypto investor, I’ve noticed that the indicator has spent most of its time in the red zone lately, displaying notably negative readings. This observation suggests that selling volume from takers has been more prevalent than buying volume in the market during the past month.

During this timeframe, the graph indicates that a significant increase in positive values occurred, which was accompanied by a surge in the cryptocurrency’s price. Consequently, if Bitcoin is to bounce back, we may see the metric turn green once more.

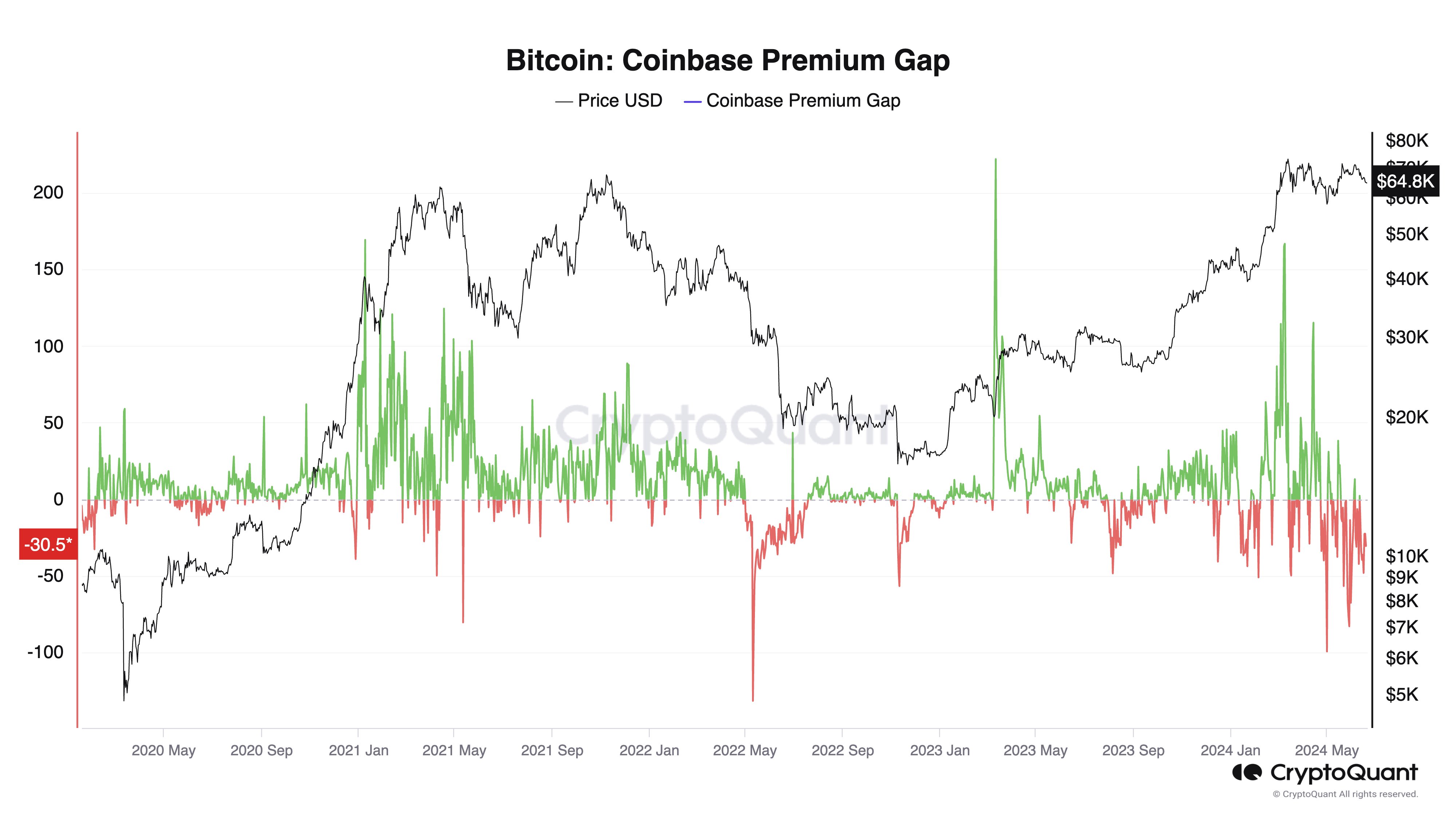

As a crypto investor, I’ve noticed that the net taker volume isn’t the only sign of bearishness for Bitcoin lately. In fact, the Coinbase Premium Gap has also been negative, as mentioned by Ki Young Ju, the founder and CEO of CryptoQuant, in a recent post. This means that the price of Bitcoin on Coinbase has been lower than its market value, indicating that sellers are more active than buyers in the market. This is an additional bearish indicator for Bitcoin that I’m keeping an eye on.

The Coinbase Bitcoin Price Difference Monitor records the variance between the bitcoin prices displayed on cryptocurrency platforms Coinbase (for USD) and Binance (for USDT). This metric signifies the disparity in investor behavior between these two exchanges.

According to the graph, the Bitcoin Coinbase Premium Gap has remained negative in recent times, implying that Coinbase has experienced greater demand for sellers compared to Binance. This selling pressure may be a contributing factor to the asset’s current price range.

BTC Price

Bitcoin currently hovers around the $64,800 mark, remaining within the price range it has been traversing horizontally for some time.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- SHI PREDICTION. SHI cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

2024-06-21 07:12