As a seasoned researcher with over a decade of experience in analyzing financial markets, I’ve seen my fair share of rollercoasters – but nothing quite compares to the Bitcoin ride. This week is shaping up to be one for the books, with the US election and Federal Reserve decision looming large on the horizon.

Bitcoin is poised to conclude a tumultuous week, characterized by an effort to surpass its record peak (highest price ever), which unfortunately resulted in a dip due to reduced buyer interest. However, the overall mood among investors continues to be mostly optimistic.

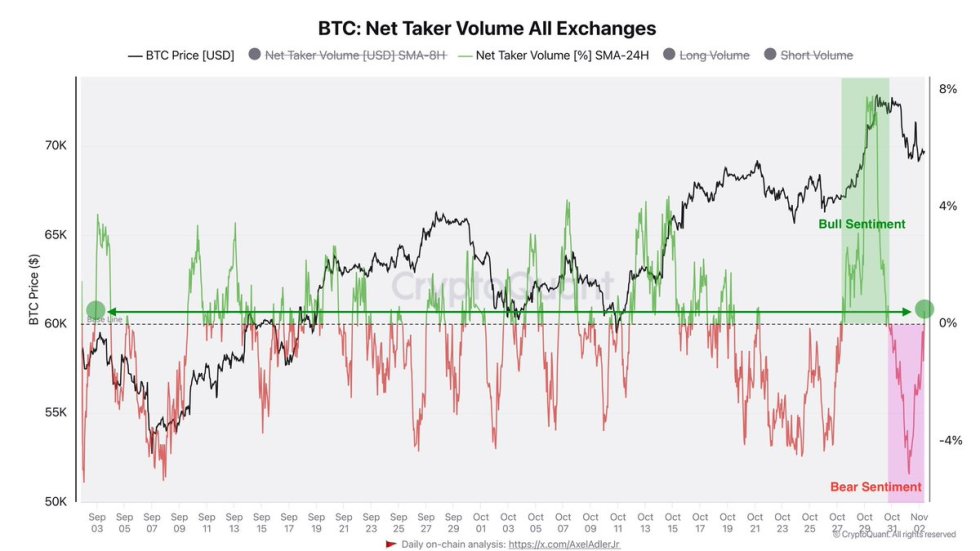

Information from CryptoQuant suggests that the Net Taker Volume (24-hour Simple Moving Average) across all platforms indicates a positive trend, as buying activity exceeds selling activity in this measure. This pattern demonstrates increasing investor confidence, mirroring the broader optimistic sentiment observed following the U.S. election results, which have boosted spirits within the crypto market.

Experts predict a surge in Bitcoin’s price, fueled by robust purchasing activity from both individual and large-scale investors. Although Bitcoin currently encounters temporary obstacles near its all-time high, the underlying desire to buy indicates that another price increase could soon occur.

As the election’s aftermath continues to unfold and Bitcoin’s value holding steady above important buying points, the upcoming days are pivotal in determining its next significant shift. Whether Bitcoin can regain its upward thrust and break into new price territory will hinge on consistent demand and the persistence of this bullish trend across various trading platforms.

Bitcoin Prepares For A Volatile Week

Bitcoin is preparing for a crucial week that could significantly impact its future, as several significant events are approaching which may influence market opinions throughout the rest of the year. The United States election next Tuesday and the Federal Reserve’s interest rate announcement on Thursday will set the stage for a high-pressure scenario for Bitcoin and the entire cryptocurrency industry.

In simple terms, these two occurrences might increase market turbulence and introduce doubt about price fluctuations, which makes the current period particularly crucial for Bitcoin’s value.

Axel Adler, a well-known analyst and investor, has presented information about Bitcoin that points towards an optimistic future. His analysis focuses on the Net Taker Volume (SMA-24H) across all trading platforms, which demonstrates the ratio of buy and sell orders. This metric shows more buying interest than selling pressure, suggesting a bullish attitude among traders. In other words, traders are gearing up for a potential price increase, adding further support to the positive outlook for Bitcoin as we approach a crucial period in its development.

Adler cautions that reaching a new all-time high for Bitcoin is not guaranteed. Although the Net Taker Volume suggests potential growth, this week’s large-scale occurrences might cause greater volatility. In the past, similar events have sparked significant market responses, making Bitcoin vulnerable to swift price fluctuations in either direction.

If the Federal Reserve suggests reducing interest rates or if election outcomes lean towards pro-cryptocurrency policies, Bitcoin may experience a significant surge. On the other hand, signals pointing towards stricter monetary conditions or increased regulatory threats might weaken investor optimism, potentially triggering a decline in its value.

In the coming days, Bitcoin stands at a critical juncture, with both promising gains and potential setbacks. The moves by the U.S. administration and central bank will play a decisive role in shaping whether Bitcoin can leverage its current positive trend and potentially reach unprecedented new peak values.

BTC Holding Crucial Level

At present, Bitcoin is being exchanged at approximately $68,500, having experienced a 7% decline from its peak of $73,600. Even with this dip, Bitcoin continues to show strength above the significant support level of $67,000. This crucial threshold has remained robust in the face of market fluctuations, and its preservation is essential for maintaining an optimistic perspective. A fall below this level might hint at additional adjustments and could potentially slow down the upward trend temporarily.

If Bitcoin (BTC) manages to maintain its position above $67,000 and start moving towards $70,000, it could establish a robust base for another attempt at reaching its record highs. This situation would likely spark renewed optimism among bullish investors, preparing BTC to contest its previous peak of $73,794 and possibly venture into new price territory.

Investors are keenly observing these significant thresholds, with $67,000 serving as a crucial demarcation line for Bitcoin (BTC). If BTC manages to stay above this level, it maintains the bullish sentiment’s validity. Overstepping the $70,000 boundary might stimulate additional investment and steer BTC towards challenging its previous peak levels and potentially exceeding them, thereby reinforcing its dominance as the market frontrunner.

Read More

- Marvel Rivals Announces Balancing Changes in Season 1

- “Fully Playable” Shenmue PS2 Port Was Developed By SEGA

- Marvel Rivals Can Earn a Free Skin for Invisible Woman

- EUR CAD PREDICTION

- Valve Announces SteamOS Is Available For Third-Party Devices

- DMTR PREDICTION. DMTR cryptocurrency

- What Borderlands 4 Being ‘Borderlands 4’ Suggests About the Game

- Elden Ring Player Discovers Hidden Scadutree Detail on Second Playthrough

- Christmas Is Over: Bitcoin (BTC) Loses $2 Trillion Market Cap

- Kinnikuman Perfect Origin Arc Season 2 New Trailer and Release Date

2024-11-03 16:11