Markets

What to understand:

- Bitcoin hovered around $88,800-probably feeling a little homesick-while the world’s markets decided to roll the risk dice, coinciding with gold’s shiny new record and Asian stocks throwing a party.

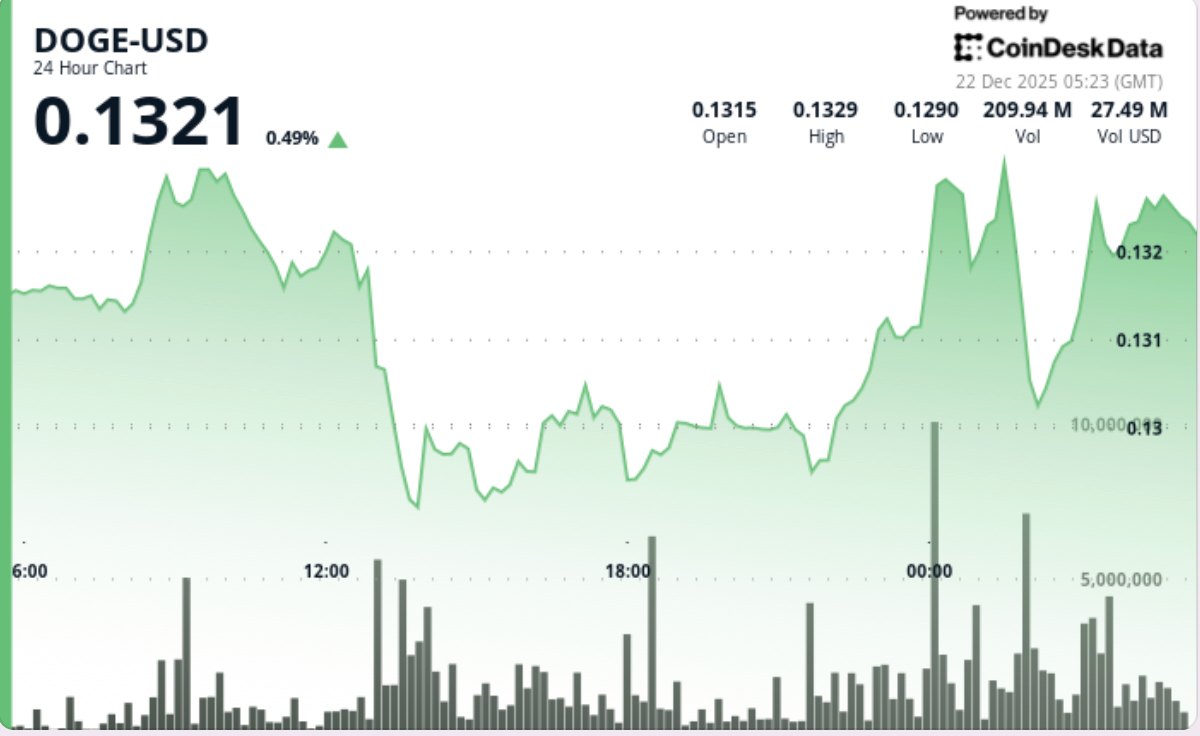

- Ether and its cryptocurrency friends XRP, Solana, and Dogecoin jumped back into the fray after a turbulent period of swinging like a drunk pendulum, despite over half a billion bucks in crypto positions being liquidated (bye-bye, liquidity).

- Gold, that old reliable, hit a brand spanking new high above $4,380 per ounce, all amid geopolitical chaos and the Federal Reserve’s secret plan to cut rates in 2026-because why not?

Bitcoin was teasing $88,800, perhaps trying on different price tags-global markets, meanwhile, decided to embrace risk like a cat embraces an empty box, all thanks to gold’s shimmering record and Asian stocks cheering the comeback. 🐱💼

Ether bounced back above $3,000, clinging onto the number like a toddler to a teddy bear, while XRP, Solana, and Dogecoin-all part of the crypto merry-go-round-rebounded after a rollercoaster that would make even the bravest investor lose their lunch.

Meanwhile, gold summoned its inner dragon and soared past $4,380 an ounce. The bullion was apparently driven by a secret conspiracy involving geopolitical tensions and whispers that the Fed might, just might, actually cut interest rates in 2026-sure, why not? Gold’s on pace for its strongest year since 1979, supported by central banks hoarding shiny things and ETF investors being drawn like moths to a flame.

Asian stocks joined in the fun, with the MSCI Asia Pacific Index climbing over 1%, led by tech shares, as the US markets finished their late-week recovery, possibly trying to find their lost keys. The futures? Slightly more optimistic. Japan, still savoring its last-rate-hike-inspired-yield-bonanza, saw the yen strengthen-and no, it’s not just a fluke. The Bank of Japan’s hawkish stance has officially kicked the ultra-loose policy to the curb.

Crypto, being the unpredictable creature it is, danced to the tune of risk appetite but remained as fragile as a glass sculpture in an earthquake. Traders pointed out that liquidity was slim pickings, and leverage was lurking like a caffeinated squirrel-ready to cause chaos.

Data from K33 Research reveals that long-term Bitcoin holders are almost done selling for now-and institutional buyers are gobbling up coins faster than miners can produce them. Even after prices dropped over 30% since the October highs, corporate treasuries and ETFs kept buying, showing that maybe, just maybe, crypto is playing the long game-or at least pretending to.

Crypto’s mood swings are still dictated by macro factors-borrowing strength from rate-cut hopes and gold’s safe haven cheers, yet still haunted by the ghost of last quarter’s bloodbath. Could be worse-could be a mining rig stuck in a flux capacitor.

Dogecoin slips below $0.129 as support takes a vacation 🐶💸

17 minutes ago

XRP falls flat after giving it a go at $1.95-guess it’s not ready for prime time

28 minutes ago

Galaxy Digital’s wise owl explains why Bitcoin’s future is as clear as mud in 2026

8 hours ago

Fed’s Hammack goes full hawk, asks if we’ve seen a CPI that isn’t distorted yet

14 hours ago

‘DeFi is dead,’ declares Maple Finance’s CEO-soon to be onboarded into a #ZombieMarket

15 hours ago

Tom Lee finally responds to the ongoing mystery of why his bitcoin outlook looks like a weather forecast

Dec 20, 2025

Tom Lee finally addresses the bitcoin outlook controversy-possibly with a magic eight ball

Dec 20, 2025

‘DeFi is dead,’ says the CEO-onchain markets poised to gobble Wall Street like a hungry Pac-Man

15 hours ago

Bitcoin’s quantum future: markets start nervously eyeing the sci-fi revolution

Dec 20, 2025

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-12-22 09:08