As a seasoned crypto investor with a decade-long experience in the market, I find the recent trend of ancient Bitcoin investors awakening to be an intriguing development. The 10+ Year-old Coins Expending Ratio, as highlighted by CryptoQuant’s Head of Research Julio Moreno, has shown that more old coins have been moving on the network than ever before. This is a significant observation, as such movements are not common events.

As a seasoned Bitcoin investor, I’ve noticed an intriguing trend based on on-chain data: Ancient investors – those who have held their Bitcoins for extended periods – have been reactivating their wallets more frequently than ever before during this current market cycle. This could be a sign of growing confidence and increased participation from long-term holders.

Bitcoin 10+ Year Old Tokens Have Been Seeing Large Movements Recently

I’ve been closely following the insights from CryptoQuant’s Head of Research, Julio Moreno, who posted on platform X. According to him, this current Bitcoin cycle has witnessed an unprecedented surge in the awakening of original crypto investors.

As an analyst, I focus on the “10-Year Old Coin Activity Ratio” indicator on the blockchain. This metric indicates the proportion of coins that have been inactive for ten years or longer and were activated within the previous thirty days.

As a researcher studying blockchain data, I’ve noticed an intriguing pattern: When the value of a specific metric surges, it often signifies that long-term investors on the network have been actively transacting after a prolonged period of inactivity. Such coin movements among the older cohort are not typical occurrences and merit close attention when detected.

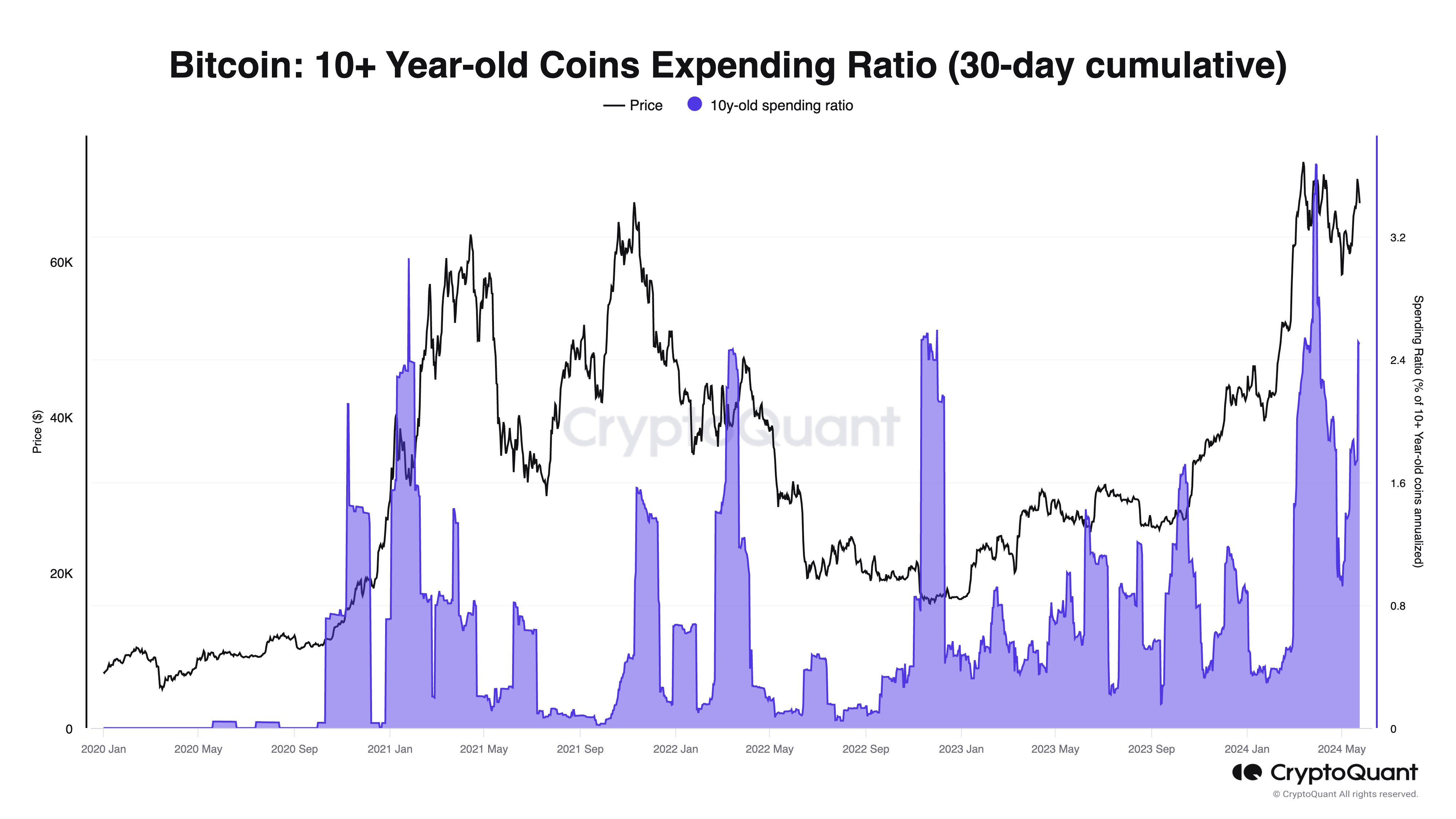

Here is a chart illustrating the development of Bitcoin’s 10+ Year-Old Coin Ratio Trend over the recent years.

In the graph before you, the indicator experienced a significant surge, reaching a peak of 3.7% in March – its highest value on record for this particular asset.

When the cryptocurrency reached a fresh record high price, dormant coins suddenly stirred with a sudden, sharp movement, unlike the usual selling instances when old coins are activated. This unexpected action suggests that profit-taking could have been the primary reason behind this spike in activity, as investors likely cashed in on their gains following the ATH break.

As an analyst, I’ve noticed a significant drop in the ratio’s value following a peak in Bitcoin’s price. The price of Bitcoin faced some struggles afterwards, leading to this decline. However, with the recent upturn in the cryptocurrency’s fortunes, the indicator has rebounded as well.

Currently, the metric reads 2.5%, representing a decrease from previous records but still considered high in relation to historical data. Consequently, it seems that ancient whale populations have been reviving at an accelerated pace during the past several months.

What could be the reasons that investors with aged coins, over 10 years old, are becoming active in the market? Typically, such prolonged inactivity is linked to long-term investors or HODlers. However, it’s less likely for them to suddenly start moving these older coins due to their holding strategy. Instead, other factors might be at play, such as potential tax implications, inheritance, or even forgetting about the existence of these assets.

These coins are more likely to have survived this long because they were “lost or forgotten” in the past, meaning their owners may have misplaced their wallets or simply overlooked them.

As a crypto investor, I’ve noticed some sellers in the market lately. Some of them could be the early adopters who have held onto their cryptocurrencies for years, but it’s also plausible that many new investors have recently acquired wallets containing dormant coins and are now selling them.

BTC Price

At the time of writing, Bitcoin is trading at around $68,500, up over 2% in the last seven days.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- PYTH PREDICTION. PYTH cryptocurrency

2024-05-27 19:11