Well, folks, it looks like Bitcoin’s got the fever again-sneaking past $97,000 faster than a cat after the cream, all thanks to court delays, fat wallets, and a downright tornado of money swirling around. Even ol’ Uncle Sam’s legal fancy footwork couldn’t hold it back-just like trying to stop a runaway train with a rubber band. 🚂💸

Bitcoin Nears $100K as Supreme Court Tariff Delay Ignites Rally

Bitcoin shot past $97,000 on January the 14th, with all the subtlety of a bull in a china shop – thanks to a wild stew of legal limbo, record-breaking investments, and a whole lot of folks betting the farm that this digital gold ain’t done climbing yet. Don’t that beat all? The Supreme Court, in a move slicker than a Mississippi eel, kicked the tariff decision down the road-twice!-letting the crypto crowd get their hopes up higher than a kite on a windy day. After busting through $95,000, it went on to roar up nearly 5%, hitting a peak of $97,797, making it look like it’s got a date with destiny-and maybe a cheeseburger or two. 🍔

This lightning ride boosted the cryptocurrency’s week-long gains to nearly 7%, making its market value swell to a staggering $1.95 trillion-more zeros than a Texas-sized bank vault. All this hustle turned other cryptocurrencies green with envy, gaining 3-6%, while the whole crypto economy jumped 4% to about $3.4 trillion-a number that might make the IRS scratch their heads. Numbers, sir-more confusing than a goat on astroturf. 📈

The price jump set off a panic in the derivatives market, with over $372 million in short positions getting liquidated faster than a barber’s chair at a barber college, while long bets didn’t fare much better-around $28 million wiped out. Overall, about $850 million in leverage was blown out like a candle in a windstorm, mostly taking out the shorts-those gents betting on prices falling. 💥

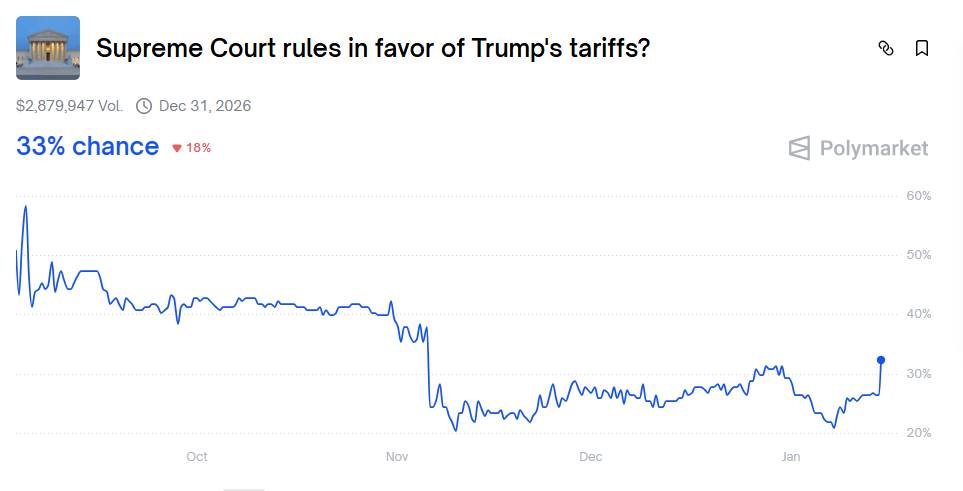

While the Court was busy handing down opinions like a preacher at Sunday service, their decision on tariffs was about as clear as mud-fueling speculation among traders that the whole show might lean against Trump’s trade policies. The prediction markets, like Polymarket, upped the odds of a Trump-friendly ruling by 12 points since January 7, including a 6-point jump after today’s delay. Looks like the courts are playing their cards close to the vest, or maybe just bluffing. 🎭

Big institutional players, those fat cats of finance, are throwing their weight around too. Reports say ETF inflows hit a massive $753.8 million on January 13-the biggest single-day haul since the dawn of time-or at least since ETF began. Fidelity and BlackRock led the charge, raking in hundreds of millions, proving once again that money talks and bears walk. The old fogies are finally waking up to the fact that crypto might just be the future, or at least a good way to make a quick dollar. 💰

Meanwhile, President Trump’s recent mud-slinging at the Federal Reserve’s Jerome Powell about GDP growth and conspiracy theories about the Fed’s independence added more fire to the economic furnace. Rumors swirl that the Justice Department is poking around the Fed’s laundry, which has everyone from gold bugs to bankers feeling a mite jittery. With tariffs, lawsuits, and a Fed in the crosshairs, it’s a perfect storm-more chaotic than a tornado in a trailer park. ⛈️

All these wild winds-tariff delays, ironclad ETF inflows, and a president right out of a soap opera-have cooked up a “perfect storm” for crypto. With bullish momentum speeding faster than a Texan at a barbecue, Bitcoin’s gunning for its first double-digit weekly gain of 2026 and a ticket to the $100,000 promised land. Hold onto your hats; it’s going to be a bumpy, glorious ride. 🚀

FAQ ❓

- Why did bitcoin surge past $97K? Courts delaying, and investors making it rain with record ETF inflows-nothing like a good old-fashioned panic to push prices up.

- How much has bitcoin gained this week? Nearly 7%, pushing its market cap to a cool $1.95 trillion-you’d think it was Monopoly money! 🎲

- What happened in the derivatives market? Over $850 million in bets got wiped out, mostly those pesky shorts betting on a fall-serves them right. 🔥

- Is bitcoin getting close to that hundred thousand mark? You betcha-if she keeps climbing like a hillbilly on a sugar high, it’ll be knocking on that door real soon. 🔑

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- How to Unlock all Substories in Yakuza Kiwami 3

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2026-01-14 22:53