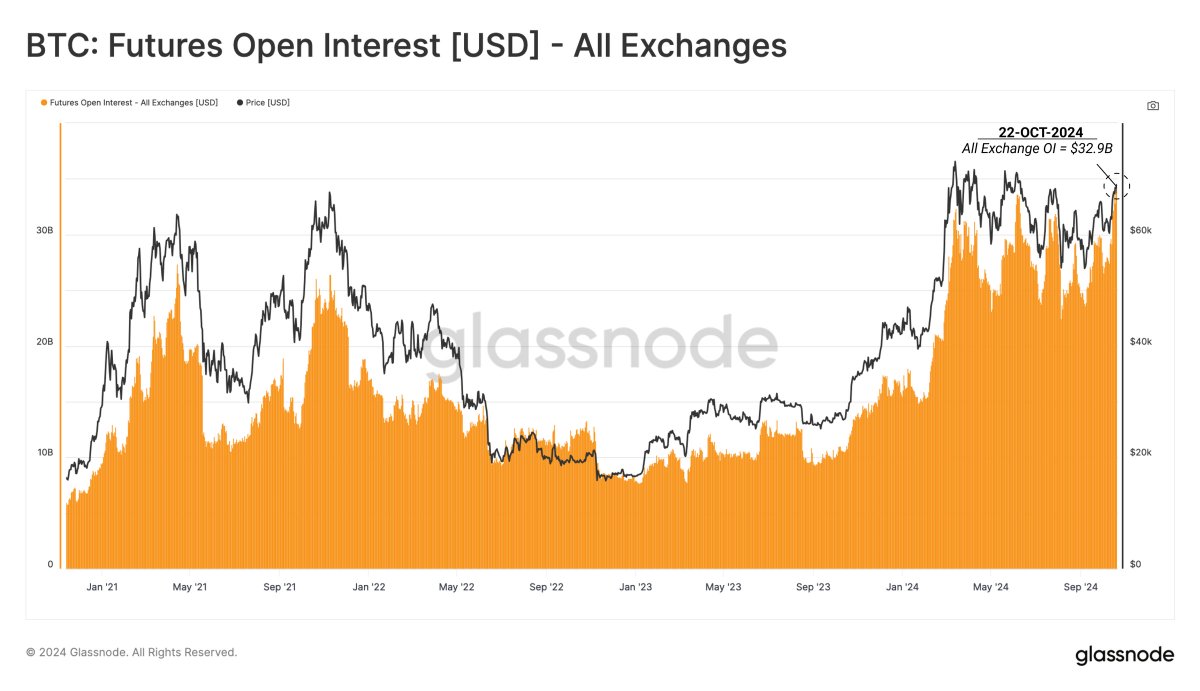

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous market cycles and trends that have shaped my understanding of risk, volatility, and investor behavior. The recent surge in Bitcoin open interest to an all-time high of $32.9 billion is indeed a significant development, indicating fresh capital inflows into the cryptocurrency market.

The Bitcoin open interest has been a subject of debate over the past week, with various on-chain platforms revealing its recent record-breaking surge. However, investment analytics firm Alphractal disputed that the open interest in BTC had reached a new all-time high.

Notably, a well-known cryptocurrency analytics service recently shared fresh insights about Bitcoin’s open interest, revealing that it reached an all-time peak in the previous week. Let’s explore what this could mean for Bitcoin’s price.

Are Bitcoin Traders Taking More Risk?

On the X platform, Glassnode announced that Bitcoin’s total outstanding contracts (open interest) across all trading platforms have hit an unprecedented record high.

Glassnode wrote on X:

This week, the total Open Interest for both permanent and time-limited future contracts reached a new all-time high of $32.9 billion, indicating a significant surge in combined borrowing power being introduced into the market.

For context, open interest is an indicator that measures the total amount of futures or derivatives contracts of a particular cryptocurrency (BTC, in this scenario) in the market at a given time. It typically offers insight into the amount of funds being invested into Bitcoin futures at the moment. Rising open interest also suggests a shift in investor sentiment and an increase in market speculations, with many traders gearing up for market movement.

In the last seven days, Bitcoin’s open interest has reached an unprecedented peak of $32.9 billion, demonstrating a significant influx of capital into the most important sector within the cryptocurrency market. While this figure doesn’t reveal whether these new futures contracts are bearish or bullish, it does suggest that the market could experience increased volatility in the near future.

According to Glassnode’s analysis on X, we’re seeing a notable rise in overall borrowing among Bitcoin derivative traders. Historically, such increases in risky trading activity have often preceded substantial and sudden price fluctuations in the market.

Over the coming weeks, the forecast suggests some intriguing developments regarding Bitcoin’s price. Unlike its performance in October, Bitcoin had shown promising strength earlier, but it hasn’t managed to build on that momentum lately.

BTC Price At A Glance

Currently, the price of Bitcoin hovers slightly below $67,000, representing a 2.1% decrease over the last day. On a weekly basis, it has also dropped approximately 2.1%, based on statistics provided by CoinGecko.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- Luma Island: All Mountain Offering Crystal Locations

- DCU: Who is Jason Momoa’s Lobo?

- INR RUB PREDICTION

- EUR ARS PREDICTION

2024-10-27 02:41