As a seasoned crypto investor with several years of experience under my belt, I’ve seen the Bitcoin market go through its fair share of ups and downs. And based on the latest trend in Open Interest for Bitcoin, I believe we could be in for some exciting times ahead.

As a crypto investor, I’ve noticed that the open interest in Bitcoin derivatives has reached an unprecedented level, hitting a new all-time high (ATH). This surge could signify several possibilities for Bitcoin’s price:

Bitcoin Open Interest Has Registered A Steep Rise Recently

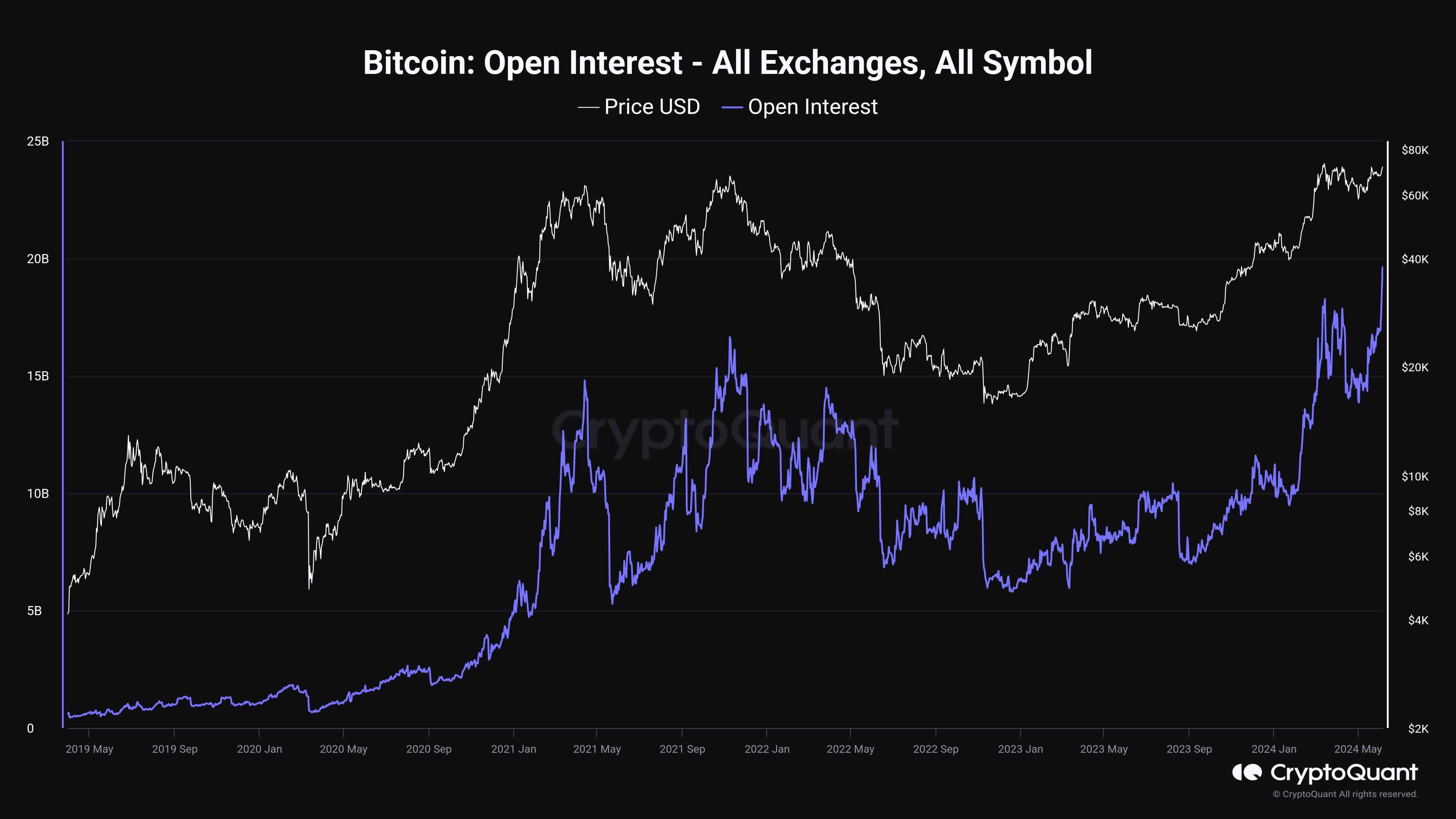

Maartunn, the community manager at CryptoQuant Netherlands, recently wrote a post where he delved into the current trend regarding Bitcoin’s Open Interest. The term “Open Interest” signifies the aggregate number of active derivatives contracts linked to Bitcoin that remain open across all trading platforms.

As a researcher studying market trends, I have observed that an increase in this metric indicates investors are actively purchasing assets at the current moment. This phenomenon often results in a heightened level of leverage within the sector. Consequently, the asset’s price may exhibit greater volatility due to this trend.

Alternatively, a reduction in the indicator may indicate that derivative users are closing their positions voluntarily or being forced out by their platforms. Regardless, this decrease could lead to increased stability for the coin.

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the past few years:

In the graph before you, it’s clear that Bitcoin Open Interest experienced a significant increase earlier in the year. This surge occurred during the cryptocurrency’s price rally as it approached a new all-time high.

During this recent price surge, I noticed that the indicator reached new heights, surpassing its previous record set during the 2021 bull market peak. However, as the crypto market prices began to consolidate following mid-March’s all-time high (ATH), I observed a noticeable cooling off in this metric as well.

Recently, Bitcoin’s latest recovery has triggered a change in direction for Open Interest. As investors swiftly establish fresh positions, Open Interest has surpassed its previous high recorded this year with a notable difference.

It seems that speculation has fiercely resurfaced in the market, leading to high Open Interest levels as we’ve seen historically. Consequently, this could trigger significant price swings for cryptocurrencies – the movement could be upward or downward.

Previously discussed, the surge in volatility following an uptick in Open Interest can be attributed to an amplified use of leverage. With heightened leverage comes a higher likelihood of substantial market corrections through mass liquidations. These significant market adjustments have the potential to instigate market turbulence.

Previously in a post on X, Maartunn mentioned that the total Open Interest in the crypto market as a whole was nearing an all-time high. This implies that it’s not just Bitcoin experiencing heightened interest for speculative purposes lately.

BTC Price

At the time of writing, Bitcoin is floating around $71,000, up more than 4% over the past week.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-06-06 22:11