As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find the recent surge in Bitcoin’s Open Interest to Market Cap Ratio intriguing. The ratio reaching a 2-year high is a clear indication that the derivatives market is heating up, and it’s not just the “spot” BTC that’s getting all the attention.

The data indicates that as Bitcoin‘s price recently reached a new peak, so too has the Bitcoin Open Interest to Market Cap Ratio experienced a significant increase.

Bitcoin Open Interest to Market Cap Ratio Is Now At A 2-Year High

According to Satoshi Club’s recent post on X, the Bitcoin Open Interest has been significantly higher than its Market Cap in recent times. The key factor we’re focusing on here is the “Open Interest to Market Cap Ratio” provided by the market insights platform, IntoTheBlock.

This tool helps us understand the relationship between the number of active Bitcoin derivative contracts (Open Interest) and the total market value of Bitcoin (Market Cap). Essentially, the Open Interest reflects the overall count of these contracts currently being traded across various platforms.

Derivatives contracts serve as financial tools enabling investors to speculate on Bitcoin’s price fluctuations without needing to physically possess any coins. Consequently, Open Interest is often referred to as an indicator of the ‘synthetic’ or ‘virtual’ Bitcoin quantity circulating within the industry.

As a crypto investor, I understand that the Market Capitalization refers to the total worth of all the coins in circulation, calculated based on the current exchange rate. In simpler terms, it’s the total value of all the Bitcoin (or other cryptocurrency) in existence right now. The Open Interest to Market Cap Ratio, then, gives us a sense of how much ‘Paper BTC’ (derivative contracts) is being traded compared to the actual spot value of the asset itself.

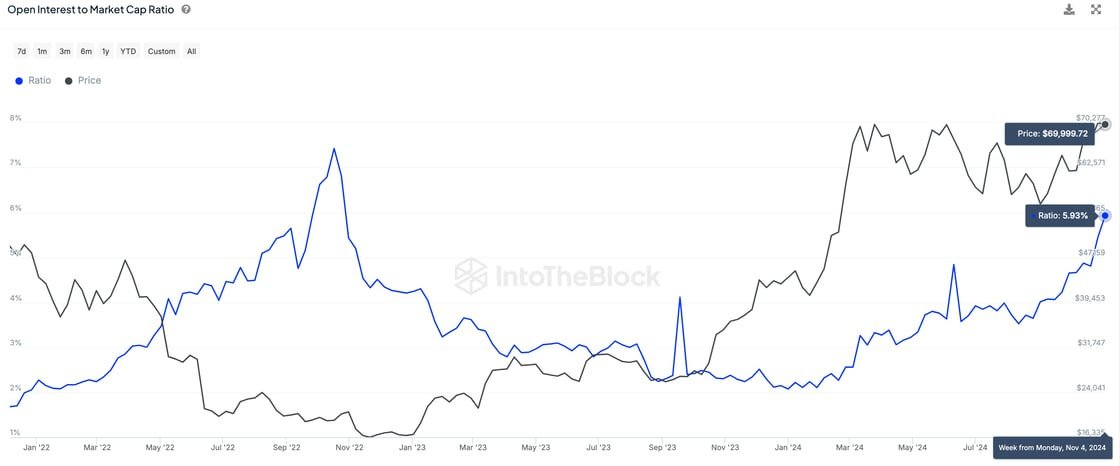

Now, here is a chart that shows the trend in this indicator for Bitcoin over the last few years:

According to the graph presented, the Bitcoin Open Interest to Market Capitalization Ratio has experienced a significant spike, coinciding with the recent price surge that pushed the asset to a fresh record high (new peak).

It’s intriguing to observe this pattern because when the Market Capitalization grows, you’d expect the ratio to decrease since it’s calculated using the Market Cap as the denominator. However, the fact that the ratio is still rising suggests that new Bitcoin (BTC) on paper have been created faster than the Market Capitalization has increased.

Currently, the number of open derivative positions has increased to a point where they account for about 6% of the entire value of the cryptocurrency. This is the highest level this metric has reached since the FTX exchange failure in November 2022.

Historically, when the ratio of Open Interest to Market Capitalization for Bitcoin (BTC) is high, it’s not typically a good sign. This is because a high ratio often suggests that there’s excessive leverage, or borrowed money being used excessively, within the cryptocurrency sector.

In November 2022, there was a peak that subsequently caused a plunge for the asset, taking it to its bottom during the bear market. A similar downturn happened earlier in the current year as well.

It is uncertain if the Market Capitalization will continue to expand amidst the heated circumstances on the derivatives market, or if a second massive deleveraging event will occur for Bitcoin.

BTC Price

Bitcoin is on the cusp of another record high as its price is floating around $76,300 right now.

Read More

- EUR ARS PREDICTION

- EUR CAD PREDICTION

- CHR PREDICTION. CHR cryptocurrency

- EUR MYR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- SAFE PREDICTION. SAFE cryptocurrency

- POL PREDICTION. POL cryptocurrency

- USD BRL PREDICTION

- KSM PREDICTION. KSM cryptocurrency

2024-11-09 20:11