As an analyst with a background in macroeconomics and experience following the trends in the financial markets, I find Jurrien Timmer’s analysis on Bitcoin versus gold as stores of value to be both thought-provoking and insightful. His perspective on the correlation between the increase in monetary aggregates and inflation is well-established in economic theory.

In the continuing dispute between Bitcoin and gold as top choices for storing value, Jurrien Timmer, Fidelity’s Director of Global Macro, offers fresh insights on this contentious issue.

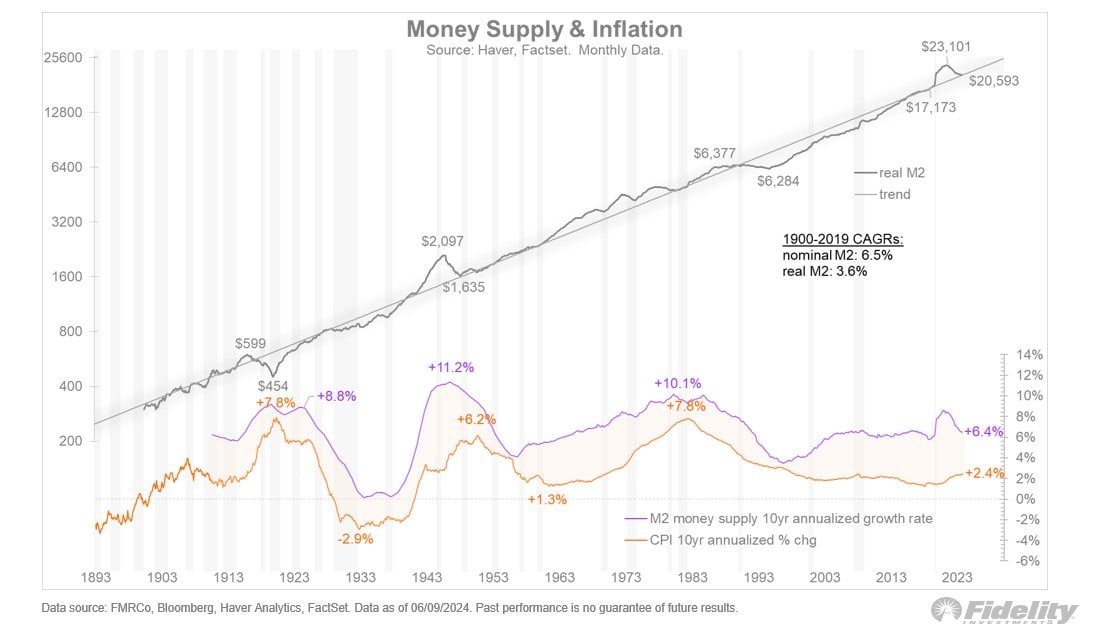

Based on Timmer’s perspective, these two assets are generally considered protective measures against fiscal dominance. Fiscal dominance refers to a situation where the government weakens the value of currency by expanding the money supply excessively. According to Timmer, this argument holds merit because prolonged growth in the money supply tends to result in inflation. This relationship is clearly demonstrated when examining the 10-year percentage increase of the M2 money supply and the consumer price index.

As an analyst, I would interpret Timmer’s perspective as follows: I believe Bitcoin and gold can firmly establish themselves as valuable assets by experiencing persistent growth in monetary aggregates. However, this condition has not been achieved thus far. The substantial expansion of real money mass during the pandemic was short-lived due to the Federal Reserve’s tightening measures. Consequently, the prerequisites for Bitcoin to effectively challenge gold as a competitive store of value have yet to materialize.

Exponential gold: money with the network technology on top of it.

— Jurrien Timmer (@TimmerFidelity) June 11, 2024

He likewise refers to cryptocurrency as an alternative form of gold, but prefers the term “exponential gold” because of its unique blend of monetary attributes and sophisticated network technology.

Bitcoin v. gold

The debate about Bitcoin potentially surpassing gold in market value has been a topic of interest within the community ever since Bitcoin was first brought to public attention.

As an analyst, I wouldn’t shy away from acknowledging that the first encrypted transaction making headlines in The Times was indeed related to the global financial crisis. With the recent arrival of spot Bitcoin ETFs, this topic has gained even more traction, making it easier for hundreds of millions of people to invest in cryptocurrency through conventional channels.

At present, gold’s total market value exceeds $15.6 trillion, whereas Bitcoin’s is around $1.33 trillion. In order for Bitcoin to equal gold’s market value, it would require a growth of about 11.72 times its current value, resulting in an approximate price of $790,000 per Bitcoin.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- SUI PREDICTION. SUI cryptocurrency

2024-06-12 12:31