Bitcoin Plummets Below $84K, Tariffs Blamed!? 😱

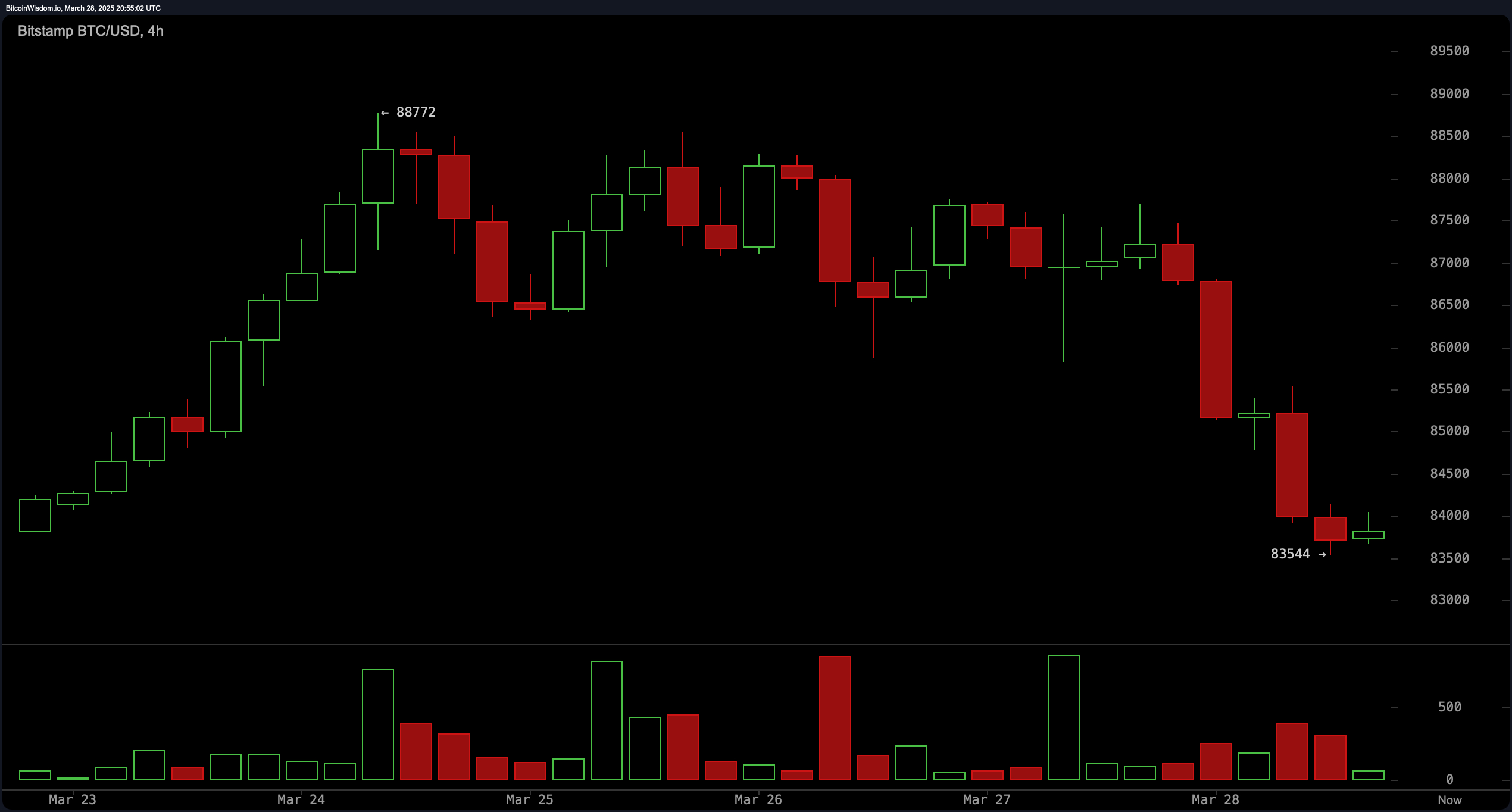

Mark my words, ladies and gents, Bitcoin done tripped, fell, and landed smack dab at $83,544 on Friday. Blame it on them newfangled financial sorcery tricks—or good ol’ fashioned meddling—from them Trump tariffs targeting Big Pharma. Add a pinch of inflation anxiety (30 years in the makin’!) and voilà, chaos is served. 🍲

The Great Bitcoin Tumble: A Financial Circus 🐒

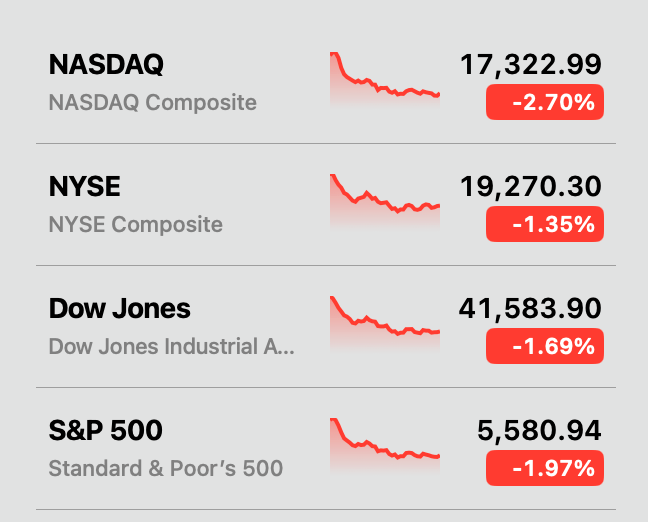

Over on the markets, cryptos were doing their best impression of a runaway horse—bolting and bucking all the way down with Wall Street. By the time the dust settled, numbers looked like they got into a fight with a porcupine: poked full of losses. March’s consumer sentiment data, trade showdowns courtesy of Trump, and inflation—oh my!—all decided to throw a rager together.

The crypto economy ain’t looking too spry either, tumbling 4.14% in the past 24 hours and landing at a whopping $2.73 trillion (a small fortune for your average feller—but a papercut for these markets). Bitcoin, holding the reins for 61% of that pile, is as stubborn as an old mule—stuck below the $84,000 mark like it’s got chewing gum on its boots. Meanwhile, global cypto trading volumes hit $91.4 billion today, with Bitcoin causin’ $31.53 billion of all that ruckus. Yeehaw.

Meanwhile, our friendly neighborhood `Fear-o-Meter’ (CFGI) is coughing up a “33/100” score—where “fear” officially downgraded to “we’re-all-gonna-die” levels. As for Bitcoin’s trading partners, the heavy hitters include good ol’ USDT, FDUSD, and USD. But wait! South Korea jumped into sixth place with its wand-waving wizard money (Upbit says Bitcoin’s sittin’ pretty at $85,113)—higher than the world’s average. Guess they didn’t get the memo about crashing.

Much as it pains me to write it, Coinglass reports a hefty $445.25 million of liquidations today. That’s a heap of folks crying into their morning coffees about lost derivatives—and BTC long traders accounted for $107 million of them. Now, I ain’t no Wall Street feller, but when Bitcoin’s moves start mirroring Wall Street’s, it’s enough to make even the sturdiest cowboy reach for his whiskey bottle. 🥃

All told, the crypto herd wanders a rocky trail, caught between the storm clouds of inflation, sticky trade politics, and an unholy heap of speculation. Traders nowadays might be as nervous as a long-tailed cat in a room full of rocking chairs, but hey, maybe that’s what builds character, huh? Or maybe just migraines. Only time will tell. 🤷♂️

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- Nine Sols: 6 Best Jin Farming Methods

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Invincible’s Strongest Female Characters

2025-03-29 00:27