The escalating tensions between Israel and Iran have caused a slump in both traditional stock and digital cryptocurrency markets, as prospects for a swift truce seem less probable.

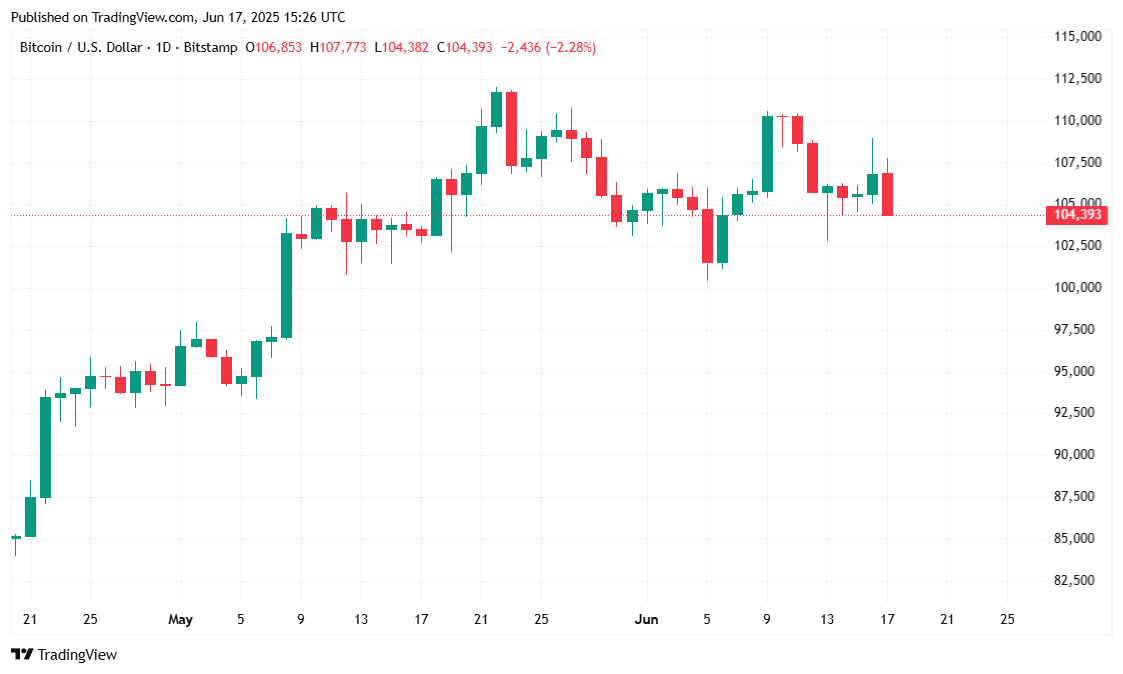

Israel-Iran Tensions Weigh on Bitcoin, Price Drops to $104K

The death toll continues to rise as the conflict between Israel and Iran reaches its fifth day, with Iran reporting a tragic loss of 224 lives, and in Israel, there have been confirmed deaths totaling 24. Major global stock markets are showing declines, and the value of bitcoin has dropped approximately to $104,000 at the time of this report.

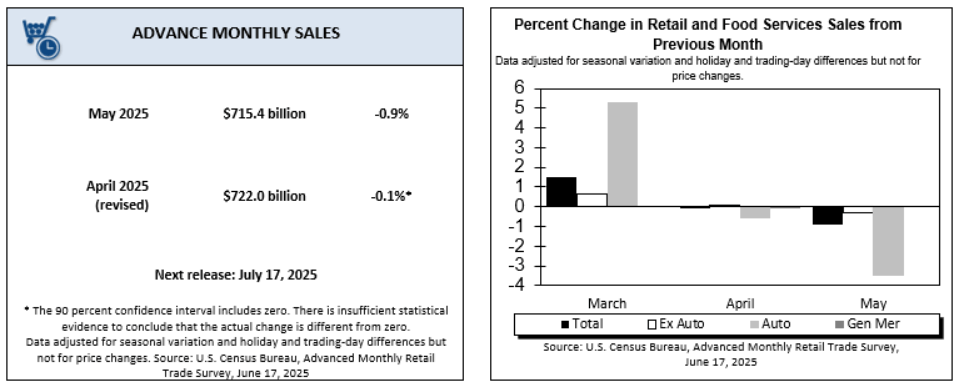

To add insult to injury, retail sales in the U.S. fell by 0.9%, worse than the 0.7% economists polled by research firm Factset had predicted. The U.S. Census Bureau published its monthly advance estimates of retail and food services sales for May 2025 on Tuesday, which totaled $715.4 billion, down from $722 billion in April.

Israel claims to have struck three key Iranian nuclear sites and Israeli Prime Minister Benjamin Netanyahu is not ruling out a potential assassination of Iran’s Supreme Leader Ali Khamenei. “It’s not going to escalate the conflict. It’s going to end the conflict,” Netanyahu told ABC News in an interview.

Meanwhile, U.S. President Donald Trump appears content playing on the sidelines. “I have not reached out to Iran for ‘peace talks’ in any way, shape, or form,” Trump wrote on Truth Social. “If they want to talk, they know how to reach me.”

The president met with G7 leaders in Canada on Monday but left early to work on issues “much bigger” than a potential Israel-Iran ceasefire. It had been previously reported that Trump’s departure was because he wanted to focus on ending the ongoing conflict, but the president vehemently denied the reports.

Overview of Market Metrics

In the last 24 hours, Bitcoin experienced a drop of approximately 2.96%, reaching $104,318.16 at the time this report was made. This decline represents a weekly loss of about 4.42% for the cryptocurrency. Throughout the day, it fluctuated between $104,218.46 (lowest point) and $108,915.38 (highest point).

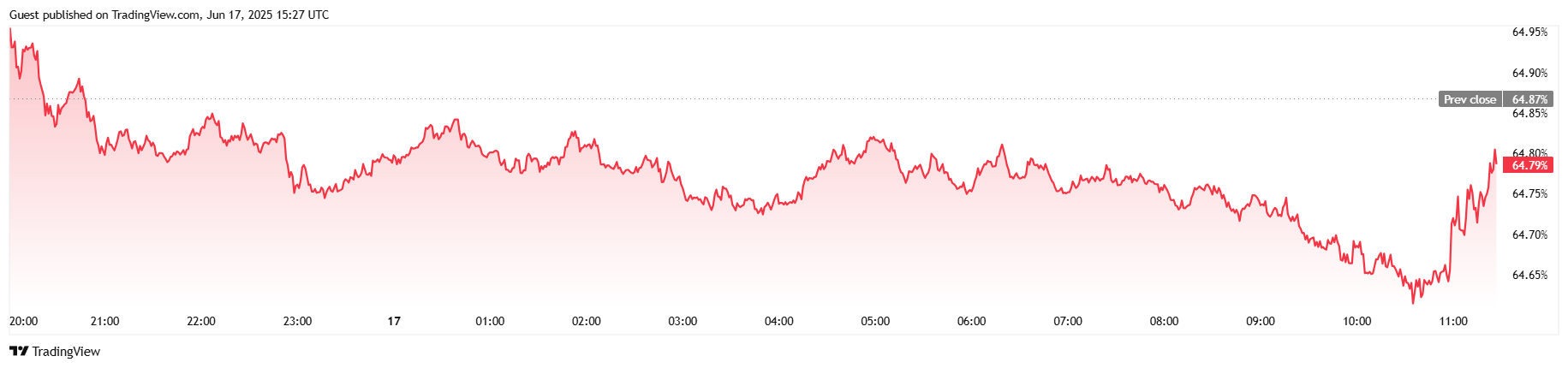

Despite the price drop, trading volume surged by 19.56% to $52.89 billion as traders repositioned in response to ongoing volatility triggered by current Middle East tensions. Bitcoin’s total market capitalization rose slightly to $2.09 trillion, up 2.22% from the previous day but BTC dominance slipped marginally to 64.78%, down 0.12% from yesterday.

Futures market data from Coinglass shows a 2.81% decline in BTC open interest, which now sits at $70.84 billion. The downturn also triggered $7.67 million in total liquidations, with $7.3 million wiped from long positions. Short traders saw only $371,610 in losses. The cryptocurrency will likely continue to seesaw in tandem with developments around the ongoing Israel-Iran war.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-06-17 19:43