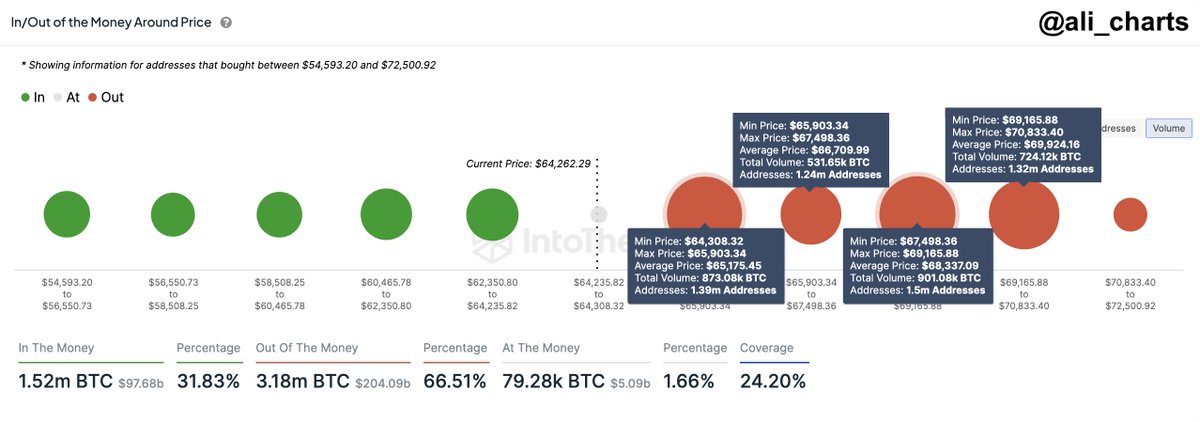

As an experienced crypto analyst, I’ve seen my fair share of market fluctuations and supply dynamics in the Bitcoin market. Based on the current data and analysis provided by Ali Martinez, it appears that there is a significant supply barrier around the $64,300 to $70,800 price range for Bitcoin. This means that a large number of investors bought BTC within this price bracket, creating a potential selling pressure point when the price falls below this level.

As a crypto analyst, I’ve examined the current Bitcoin market and identified a potential risk for further price downturn. The reason lies in the distribution of Bitcoin supply surrounding its current price level.

This Bitcoin Price Range Holds A Critical Supply Barrier

As a researcher studying cryptocurrencies, I’ve come across an intriguing perspective from renowned crypto analyst Ali Martinez in a recent post on the X platform. He posits that Bitcoin’s price may experience further declines based on the average cost basis of several Bitcoin investors.

As a researcher studying cryptocurrency market trends, I’ve come across some intriguing data from IntoTheBlock. Approximately 5.45 million Bitcoin addresses have purchased around 3.03 million coins at prices between $64,300 and $70,800. This significant purchasing activity has resulted in the creation of a pivotal supply barrier within that price range, as pointed out by Martinez.

Based on the context provided, a supply barrier in cryptocurrencies refers to a specific price level where a substantial quantity of coins or tokens were previously transacted. In the given graph, it seems that Bitcoin has a notable resistance level situated above its current value, as indicated by the size of the dots.

As a crypto investor, I closely monitor the Bitcoin price range where significant supply exists. If the price drops below this level, I may consider selling my BTC holdings within that range to minimize losses. This mass selling could put additional downward pressure on the Bitcoin price, potentially leading to a more severe correction.

Additionally, a massive transfer of assets from exchanges to cold wallets and persistent price drops might dampen investor confidence, instigating mass sell-offs among other market participants. In turn, these selling waves could further fuel the declining Bitcoin price trend.

At present, Bitcoin is priced approximately at $64,460, representing a minimal gain of only 0.2% over the previous 24-hour period.

Bitcoin Miners Are Capitulating

Recently, Bitcoin miners have joined typical investors as contributors to the current selling pressure in the Bitcoin market. According to the latest on-chain data.

As an analyst, I’ve examined the data from IntoTheBlock, and I can tell you that Bitcoin miners have disposed of over 30,000 BTC, which is equivalent to around $2 billion at current values. This rate of decline in the miners’ reserves is the fastest we’ve seen in over a year.

The sell-off in the market was attributed to miners’ decreased profits due to the latest halving event in April 2024, which reduced their reward from 6.25 Bitcoins to 3.125 Bitcoins.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD CLP PREDICTION

- USD PHP PREDICTION

- USD ZAR PREDICTION

- USD COP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- RIDE PREDICTION. RIDE cryptocurrency

2024-06-23 12:56