As a seasoned analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market trends and cycles. However, the recent surge in Bitcoin’s demand as indicated by the Apparent Demand metric has left me genuinely intrigued. The parallels between this spike and the one we witnessed earlier this year, leading up to Bitcoin’s all-time high, are undeniable.

Over the last 24 hours, Bitcoin has surged past $71,000, with indications from on-chain analysis suggesting a substantial rise in the desire for the digital currency.

Bitcoin Apparent Demand Has Spiked To Notable Positive Levels Recently

In a recent analysis by an expert at CryptoQuant, it’s been noted that Bitcoin demand seems to be increasing once more. The key indicator being monitored for this assessment is called “Apparent Demand,” which measures the gap between the minting of new Bitcoins and fluctuations in its stored supply.

The only way to produce BTC is by adding new blocks to the chain and receiving block subsidy as compensation, so the asset’s production is equated to the amount that the miners are getting in rewards every day, known as the Issuance.

Bitcoin’s “stock” could be regarded as a component of its active circulation, which consists of coins that have remained stationary for over a year. Therefore, any modifications to the stock would represent the total number of tokens transitioning from or leaving this specific age group.

Here’s a graph I’ve got here, showcasing the apparent demand for Bitcoin from the beginning of 2024. As a crypto investor, it’s always insightful to keep an eye on such trends.

According to the graph, the perceived demand for Bitcoin dipped close to the neutral point during the initial stages of consolidation the asset experienced. However, more recently, its worth has significantly increased, reaching noteworthy highs.

Following the recent surge, the indicator has matched the peak level seen in February of this year. As we can see from the chart, a similar situation previously led to Bitcoin reaching a fresh record high (ATH).

To date, the surge in demand we’ve seen has been accompanied by a rise in the cryptocurrency’s price, pushing it beyond $72,000. If the current trend persists through the remainder of the year, there’s a good chance that Bitcoin could experience even more growth if its demand continues to increase.

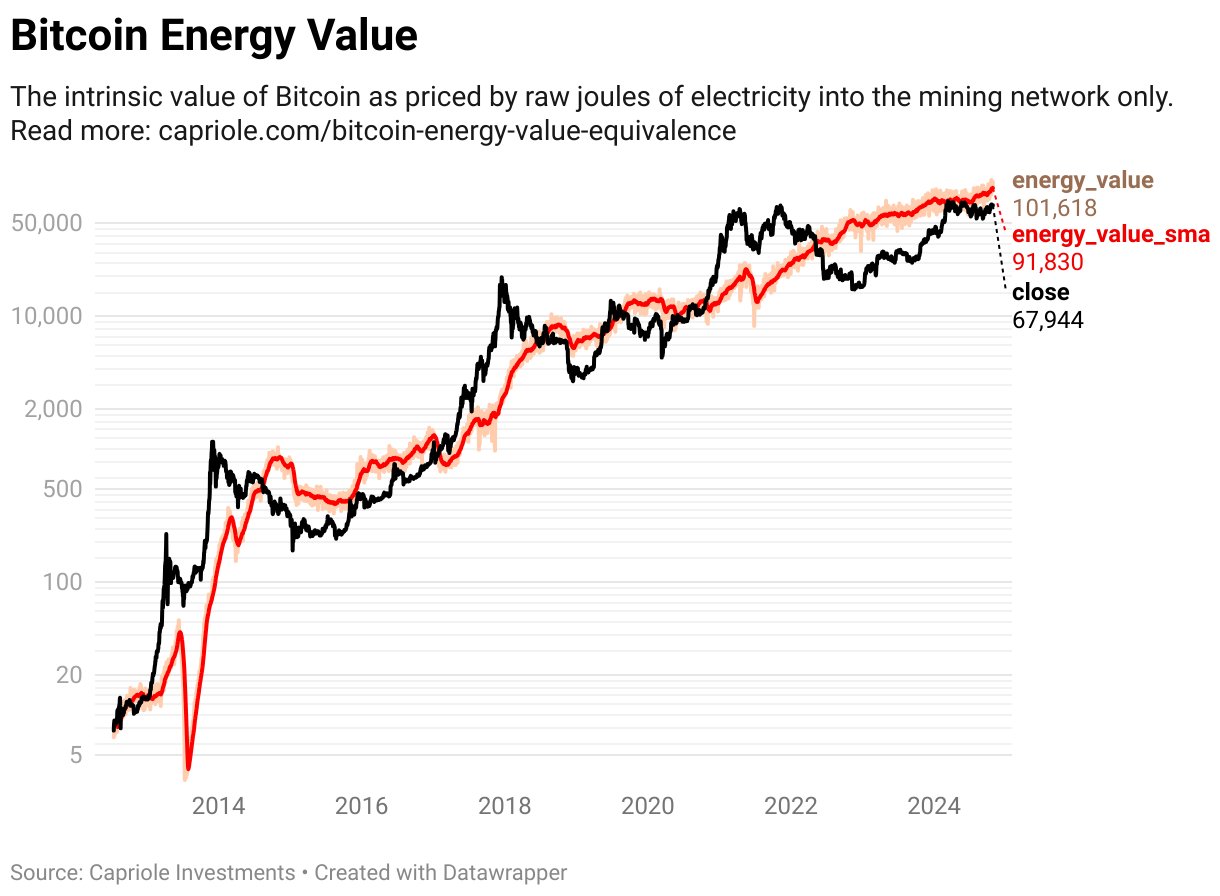

Recently, the monetary value of each unit of Bitcoin, often referred to as its energy value, surpassed the $100,000 mark. This information was shared by Charles Edwards, the founder of Capriole Investments, in a recent post.

As a researcher, I’m referring to “Energy Value” as a model for cryptocurrencies that estimates its fair worth based on the energy (measured in Joules) expended during its production. This energy specifically pertains to the power miners use to run their computing machines, which are tasked with BTC mining.

Here is the chart for the metric shared by the analyst:

This graph indicates it’s the initial occasion where the Bitcoin Energy Value surpassed this specific threshold.

BTC Price

At the time of writing, Bitcoin is trading at around $72,400, up almost 8% over the past week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- APU PREDICTION. APU cryptocurrency

- USD GEL PREDICTION

- MNT PREDICTION. MNT cryptocurrency

- JST PREDICTION. JST cryptocurrency

- EUR CAD PREDICTION

- GLMR PREDICTION. GLMR cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

2024-10-30 18:11