As a seasoned crypto investor who has witnessed the rollercoaster ride that is Bitcoin since its inception, I can’t help but feel a sense of both excitement and caution as I observe the latest surge in capital inflows into BTC, signified by the new all-time high of the Realized Cap.

Recently, on-chain data indicates that the Bitcoin Realized Capitalization has reached a brand-new record high (peak), suggesting substantial investments have been pouring into the market.

Bitcoin Realized Cap Has Just Set A New Record

As per information from the on-chain analysis company Glassnode, there has been a notable increase in investments flowing into Bitcoin, as suggested by the pattern seen in its Realized Capitalization.

In simpler terms, the “Realized Cap” for Bitcoin refers to a method used to calculate the total value of all coins in circulation based on the price at which they were last traded on the network. This last transaction is often the last time the coin was exchanged, so the price at that time can be seen as its current cost basis. In essence, the Realized Cap is the sum of the original purchase prices (cost basis) of all Bitcoins in circulation.

One perspective on this model is viewing it as a reflection of the overall investment capital contributed by investors towards the cryptocurrency. On the other hand, the traditional market capitalization, which determines the total worth of all BTC in circulation at the current market price, signifies the current value that the holders are carrying.

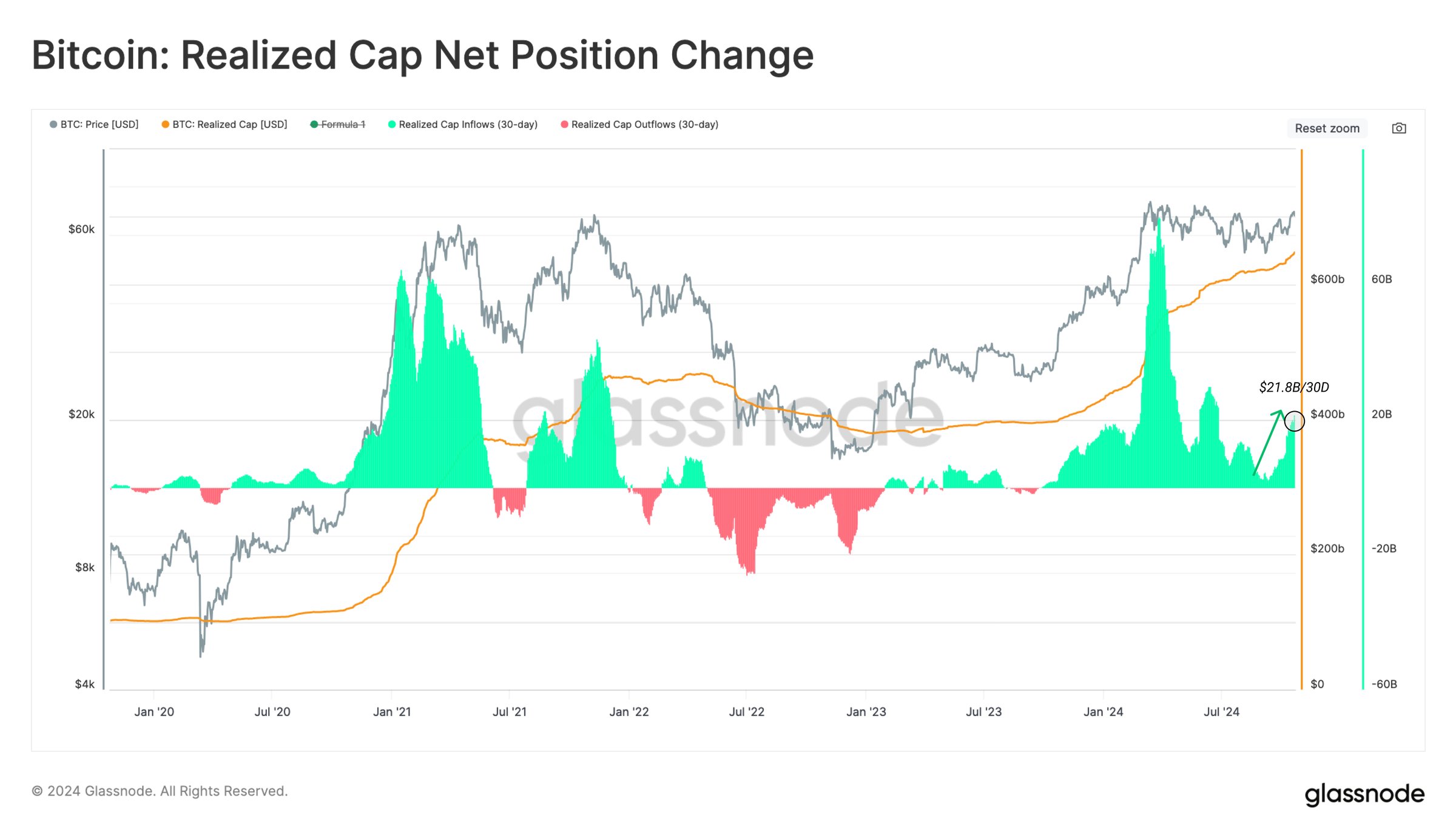

Presently, I’d like to draw your attention to the chart provided by Glassnode, which illustrates the progression of the Bitcoin Realized Capitalization and its 30-day variation over the last couple of years.

It’s clear from the graph that since early 2023, the Bitcoin Realized Capitalization has predominantly shown an upward trend, with its 30-day net change consistently being positive (or “green”).

For most of last year, the growth of the indicator was sluggish, but it picked up speed as we neared 2024. In the first quarter of this year, the metric achieved a new peak, with its 30-day change showing positive numbers that exceeded the record highs of the 2021 bull market surge.

The Realized Cap measures the total investment made by all investors, and its 30-day change signifies the movement of capital entering or leaving the asset. The graph shows that Bitcoin’s all-time high earlier this year aligns with the highest inflows into the coin, suggesting a strong correlation between price peaks and increased investments.

After the asset peaked and consolidated, demand softened noticeably, causing Realized Cap to decelerate. However, there’s been a recent reversal in this trend, with the 30-day net change in the metric showing an uptick again.

Over the last four weeks, the value of the indicator has increased by approximately $21.8 billion, reaching an all-time high of more than $646 billion. This growth indicates a rise in liquidity within the asset class, and substantial investments are believed to be driving the price upward, as observed by Glassnode.

BTC Price

As a researcher observing the cryptocurrency market, I’ve noticed that despite the robust influx of capital, the Bitcoin rally appears to have slowed down for now. The coin’s current trading value hovers around the $68,000 mark, indicating a pause in its upward trajectory.

Read More

- EUR ARS PREDICTION

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- FIS PREDICTION. FIS cryptocurrency

- POWR PREDICTION. POWR cryptocurrency

- EUR VND PREDICTION

- CHR PREDICTION. CHR cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- YNE PREDICTION. YNE cryptocurrency

2024-10-26 22:11