As a seasoned analyst with over two decades of experience in the financial markets under my belt, I find it intriguing to observe the dance between stablecoins and Bitcoin. The recent surge in Bitcoin price back to $57,000 has piqued my curiosity, leading me to delve deeper into on-chain data.

In the past day, the value of Bitcoin has significantly increased, returning to approximately $57,000. Here’s a potential explanation for this rise, based on blockchain analytics.

Exchanges Received Large Stablecoin Deposits Ahead Of Bitcoin Rally

On X’s latest post, IntoTheBlock, a leading market intelligence platform, delves into the substantial increase of stablecoins flowing into cryptocurrency exchanges in recent times.

In this context, the measure we’re focusing on is called “Exchange Netflow.” This term refers to the total difference in the quantity of a specific digital currency entering or leaving wallets linked to centralized exchanges. To find its value, you just need to subtract the outgoing transactions from the incoming ones.

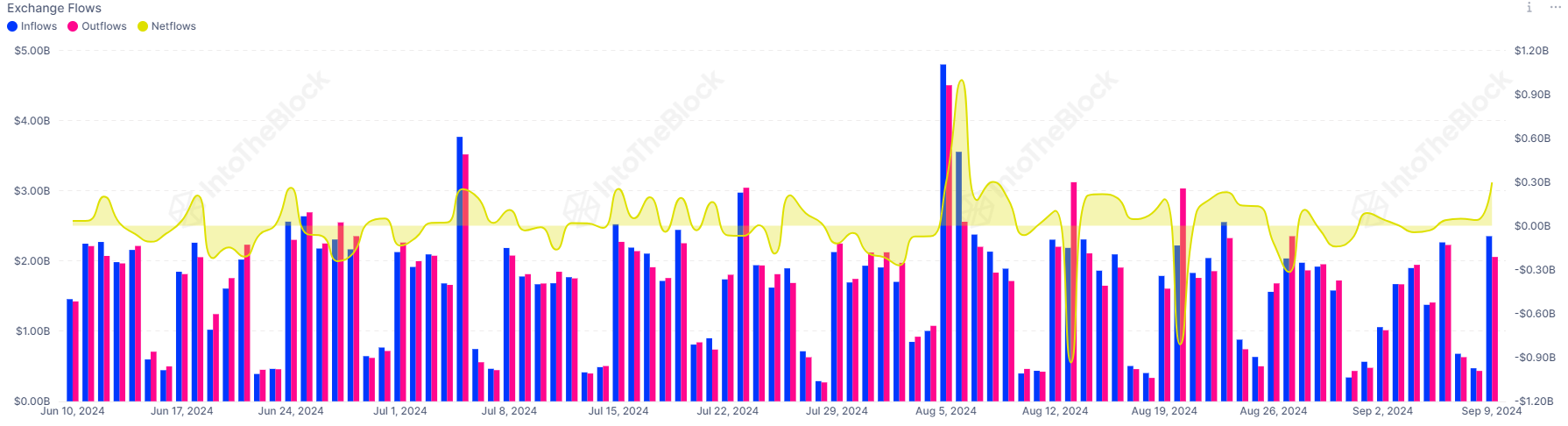

The following chart, provided by IntoTheBlock, demonstrates the ongoing pattern of the total inflow and outflow from exchanges involving all stablecoins over the last several months.

The graph shows that the Exchange Netflow for stablecoins has been quite high positively lately, suggesting that investors are heavily depositing their funds into these platforms, a substantial inflow.

Typically, individuals move their digital assets from personal storage wallets to exchanges when they plan to trade. Since selling Bitcoin and similar cryptocurrencies can potentially lower prices, high exchange inflow (Netflows) might indicate unfavorable conditions for the asset’s value.

In this specific scenario, the digital currencies at hand are known as stablecoins, unlike traditional cryptocurrencies that can be highly unpredictable. The main reason people hold stablecoins is for purposes other than speculation.

Typically, people maintain stables because they offer stability by being tied to a consistent dollar value, thus providing an alternative to the fluctuations common in other sectors.

As a researcher, I’ve observed that holders of stablecoins often harbor an intent to explore the unpredictable realm of the financial market. If they were content with keeping their funds in fiat currency, they likely wouldn’t have chosen to invest in stablecoins in the first place.

When these investors believe it’s appropriate to re-invest in the unstable cryptocurrencies, they might move them to exchanges. This transfer could lead to an increase in demand for Bitcoin and other coins, thereby potentially increasing their prices. Consequently, a growing number of stablecoins being transferred out from exchanges (positive stablecoin Exchange Netflows) can serve as a positive indicator for the unstable cryptocurrencies.

Yesterday, approximately $300 million was put into cryptocurrency exchanges by investors, suggesting a potential surge in interest to purchase digital assets such as Bitcoin.

Afterwards, Bitcoin surged over 3% and crossed the $57,000 threshold. Considering the circumstances, it’s plausible that some stablecoin purchasers contributed to this price increase.

Keeping tabs on Stablecoin Exchange Netflow may prove valuable in the coming days, given that increased net deposits might signal a possible prolongation of Bitcoin’s price rise.

BTC Price

Currently, Bitcoin has seen some improvement over the last 24 hours; however, its present value of around $57,200 remains far from the prices it reached during the last week of August.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- EUR INR PREDICTION

2024-09-11 03:42