As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. The recent surge in Bitcoin’s retail volume, as shown by the data, is reminiscent of the excitement and fervor that often accompanies such periods of volatility.

The latest on-chain statistics indicate a significant spike in Bitcoin transactions among small investors, coinciding with its rise to a fresh record price level.

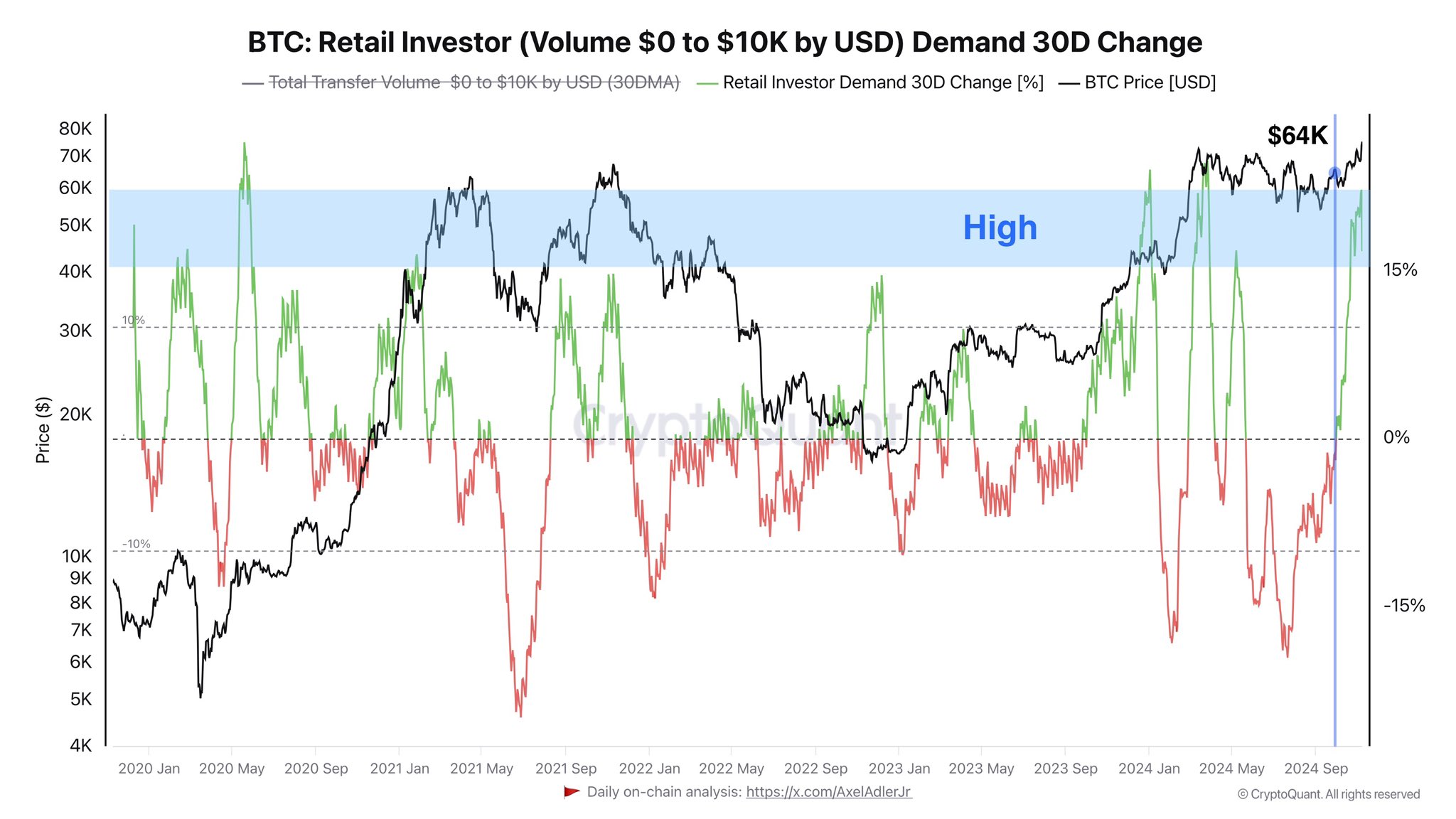

Bitcoin Retail Volume Is Up More Than 15% Over Last 30 Days

According to a recent article by Axel Adler Jr on X, there’s been an increase in demand from individual Bitcoin investors, who make up the segment with the least amount of holdings in the overall BTC community.

A good method to assess the activity of these investors is by observing the number of transactions they execute. Since their investments are relatively small, they don’t typically carry out large transfers, making it feasible to monitor their activity just by tracking transaction data with a value under $10,000.

As an analyst, I’d like to draw your attention to the graph I’ve presented, illustrating the 30-day variation in retail investor transfer volumes over the past few years from my perspective. This chart offers valuable insights into the shifting trends of this crucial metric.

According to the chart, the daily Bitcoin transaction volume initially decreased by approximately 30 days ago, but following an uptick in the cryptocurrency’s value, it has reversed and is currently spiking at high, positive levels. This upward trend indicates that investor interest in Bitcoin has significantly increased recently.

It’s not surprising that individual investors are drawn to the Bitcoin network during periods of volatility, as they often find such instances thrilling due to the potential for high returns.

The graph indicates that, much like previous years, this group experienced a surge in demand coinciding with the initial quarter’s market rally. In 2021 and on various other instances during the bull run, similar patterns were noticeable as well.

Historically, rallies that haven’t attracted significant retail participation often don’t last very long because the influx of investors usually keeps such trends going. Looking at it from this angle, the current rally seems stable since retail volume has grown by over 15% in the past month.

Another indicator for measuring demand related to Bitcoin is the Coinbase Premium Index. This metric keeps track of the difference between the Bitcoin prices listed on Coinbase (USD pair) and Binance (USDT pair).

The data shown by this indicator doesn’t represent the interest from individual retail investors, but rather it stems from American institutional investors who are heavily involved with Coinbase.

According to Julio Moreno, the head of research at CryptoQuant, the Bitcoin Coinbase Premium Index has lately spiked into positive territory.

A high value for the index indicates that Bitcoin is being traded at a greater price on Coinbase than on Binance, implying that American whales are exhibiting an interest and demand for the cryptocurrency.

BTC Price

Bitcoin is looking to explore another high as its price has surged back to the $75,900 mark.

Read More

- Fidelity’s Timmer: Bitcoin ‘Stole the Show’ in 2024

- Luma Island: All Mountain Offering Crystal Locations

- Tips For Running A Gothic Horror Campaign In D&D

- USD BRL PREDICTION

- FIS PREDICTION. FIS cryptocurrency

- How to Claim Entitlements In Freedom Wars Remastered

- Scream 7: Should Detective Wallace Come Back?

- Minecraft May Be Teasing a Major New Feature

- Here’s How Bitcoin Price Could React To Potential US DOJ Sell-Off, Blockchain Firm Explains

- The Penguin Season 2 Not Being Greenlit Is Very Strange

2024-11-08 15:41