As a seasoned analyst with over two decades of experience in the financial markets, I find the current trend in Bitcoin’s realized profit-taking quite intriguing. The significant drop in daily profits being realized to exchanges, now down to $277 million per day, is indeed a noteworthy development.

Information from the blockchain suggests that Bitcoin investors have significantly reduced their profit-making activities since the peak last month, which might be a promising indicator for Bitcoin.

Bitcoin Realized Profit To Exchanges Now Down To $277 Million Per Day

As reported by Glassnode, a company that analyzes blockchain data, there’s been a notable decrease in Bitcoin traders cashing out their profits over the past two weeks.

To monitor the process of investors cashing out their profits, the analytics company employs the “Realized Profit to Exchanges” indicator. As the name implies, this metric calculates the overall sum of profit that investors are actually receiving from exchange transactions, often referred to as ‘realizing’ their profits.

On the blockchain, profit is considered earned when a token that was previously purchased at a lower price than its current market value is transferred. However, not every movement on the network represents a trade. To clarify, only the incoming transfers from exchanges are taken into account by Glassnode in calculating this metric.

Users tend to move their cryptocurrencies onto such platforms for trading purposes. Therefore, the influx of profits from these exchanges may provide a more reliable representation of the profit-taking trends within the sector.

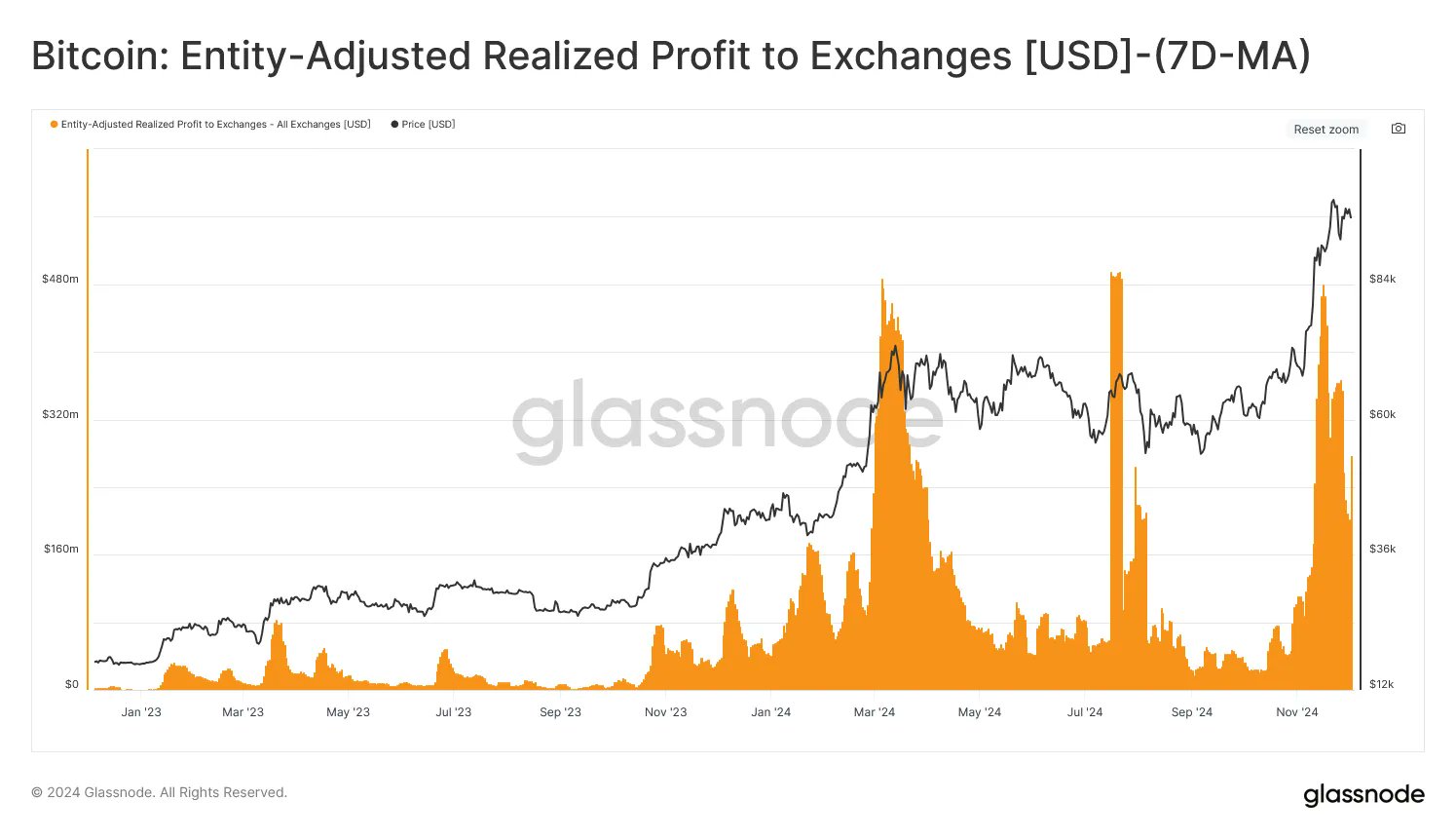

Here’s a graph displaying the progression over the past few years of the 7-day moving average (MA) for the Bitcoin Realized Profit sent to Exchanges, as presented by the analytics company.

Reflecting on the data presented in the graph, I observed a substantial spike in the 7-day Moving Average of Bitcoin Realized Profit to Exchanges over the past month. This trend aligns with the recent Bitcoin price surge to record-breaking heights. It appears that investors were cashing out sizeable profits during the peak of this rally.

It’s important to know that in this context, we’re utilizing the “Entity-Specific” indicator, which focuses solely on transactions taking place between distinct groups of addresses identified by Glassnode as belonging to the same investor.

After reaching an all-time high of over $99,000, Bitcoin’s price has entered a period of stabilization or consolidation. Observing the graph, it seems clear that this pause in the bullish trend has resulted in reduced activity related to profit-taking among investors.

As a crypto investor, I’ve noticed that daily realized profits to exchanges have noticeably decreased, now sitting at approximately $277 million per day. This figure is a significant 42% drop compared to the peak of around $481 million daily on November 16th.

This year, Bitcoin experienced two significant periods of widespread selling, similar in magnitude, which both resulted in market peaks for cryptocurrencies. The recent decrease in profit-taking for the asset, even as its price remains elevated, might indicate that this upward trend could persist.

BTC Price

At present, Bitcoin is holding steady within its current price range of consolidation, with values hovering approximately around $95,900.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

- Top 5 Swords in Kingdom Come Deliverance 2

- EUR AUD PREDICTION

- USD DKK PREDICTION

2024-12-05 02:12