As a crypto investor with some experience under my belt, I find the recent trend among Bitcoin short-term holders quite intriguing. According to data from CryptoQuant, these investors have seen a significant decrease in their realized profits, which could be a sign that they’re becoming less eager to sell and lock in gains.

The data indicates that Bitcoin short-term investors have recently experienced a drop in their total profits from selling their coins. This could signal that their enthusiasm for realizing profits is waning.

Bitcoin Short-Term Holders Are Realizing Much Fewer Profits Now

I, as an analyst, would interpret CryptoQuant’s findings by Axel Adler Jr in this manner: In my analysis of the data presented on X, it appears that Bitcoin investors who purchased their coins within the last 155 days have been realizing relatively smaller profits lately.

Based on statistical analysis, investors who keep their coins for extended periods tend to be less inclined to sell them. However, since short-term holders (STHs) are relatively new market participants, it is unlikely that they will hold onto their assets for a prolonged time.

Due to their feeble commitment, investors in this group are prone to swiftly dispose of their assets when significant events unfold in the industry, be it a surge or a downturn.

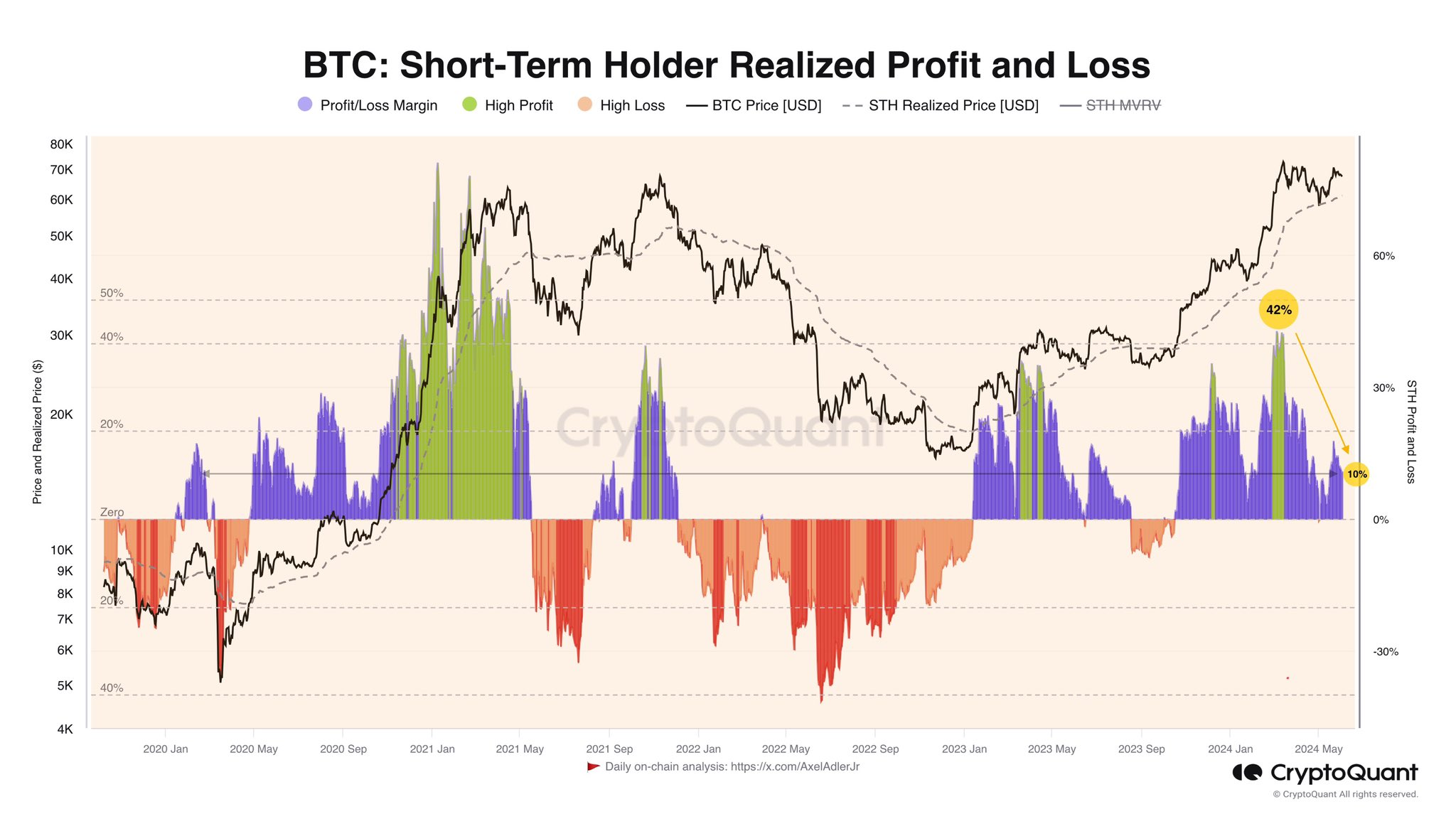

More recently, as the prices approached all-time highs (ATH), these volatile investors chose to cash out, resulting in the trend depicted in the “Realized Profit and Loss” chart below. This indicator illustrates the total gain or loss they have realized during this period.

In the graph, you can see that the Bitcoin STH Realized Profit and Loss metric surged to significantly positive heights during the rally leading up to the all-time high price. Specifically, this indicator reached a value of 42% at the height of the profit-taking frenzy.

After observing a downturn in cryptocurrency prices, I’ve noticed that the indicator’s value has decreased to around 10%. According to my analysis.

Short-term investors have experienced a 32% decrease in their realized profits, indicating a reluctance to sell and secure gains. This suggests they believe the market will continue to grow and choose to hold onto their investments rather than cash out at present levels.

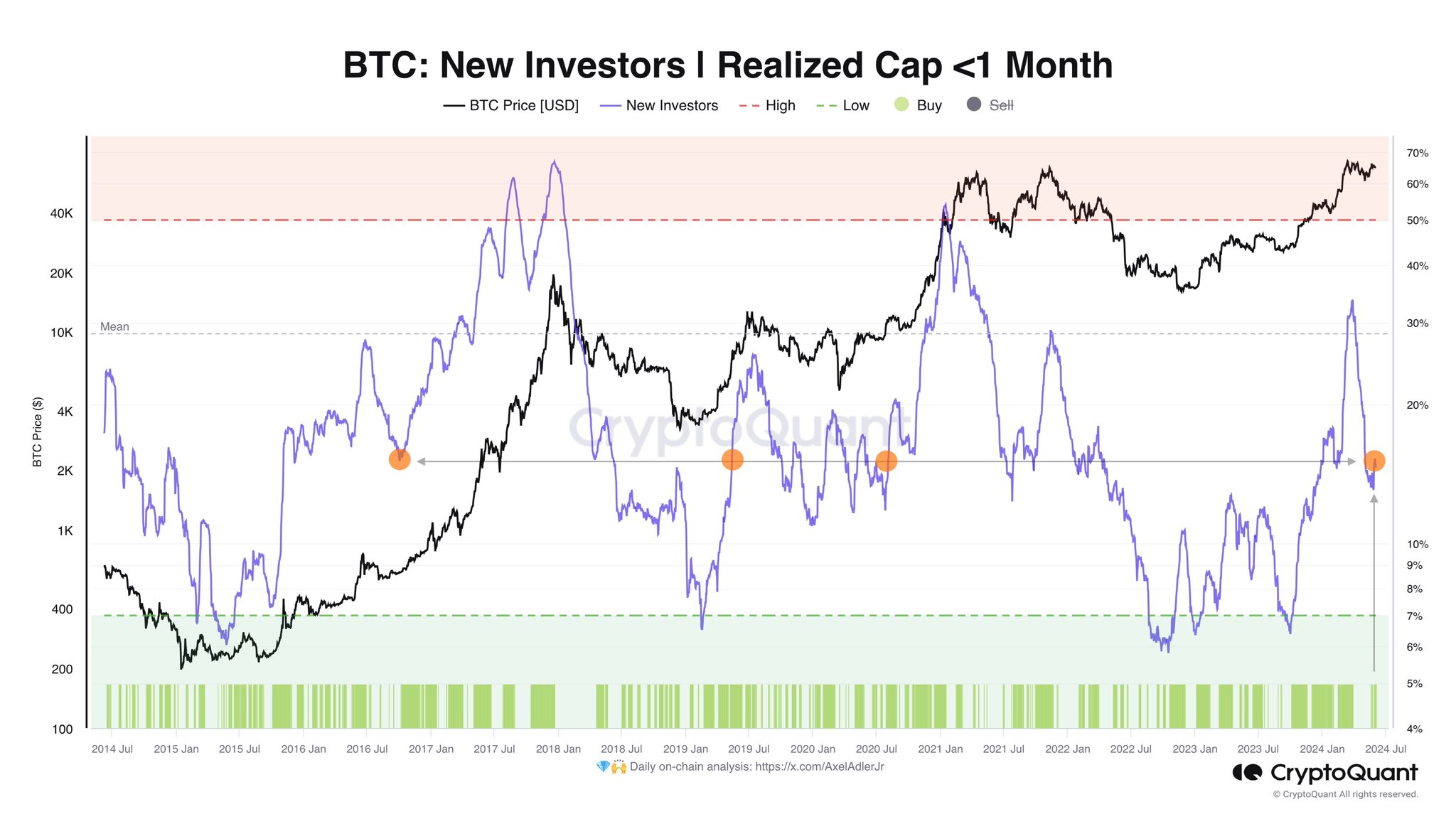

“Axel noted in a previous post that an encouraging trend for Bitcoin lately is the increasing number of investors who have held their coins for less than a month. This development, while positive, may not be the only one.”

The “Realized Cap” represents the overall investment made by the investors into the asset based on the transaction history recorded on the blockchain.

Based on the data represented in the following graph, I noticed that the metric was previously trending downwards for young investors, including those in the long-term investor category. This observation implies a potential decrease in newfound enthusiasm towards this asset.

As a crypto investor, I’ve noticed an intriguing development with the Realized Capitalization for this particular group of coins or tokens. It appears that there’s been a recent reversal in this metric, which could be interpreted as a potential influx of new demand entering the cryptocurrency market.

BTC Price

At the time of writing, Bitcoin is trading at around $69,200, down over 1% in the past seven days.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- PNG PREDICTION. PNG cryptocurrency

2024-06-04 08:11