As an experienced analyst, I have closely monitored the Bitcoin market and its related indicators for quite some time. The recent trend in the Bitcoin Coinbase Premium Gap is a crucial data point that can provide valuable insights into institutional investor behavior on the exchange.

The data indicates a decline in Bitcoin sellers on the cryptocurrency platform Coinbase, potentially signaling a brief price rebound.

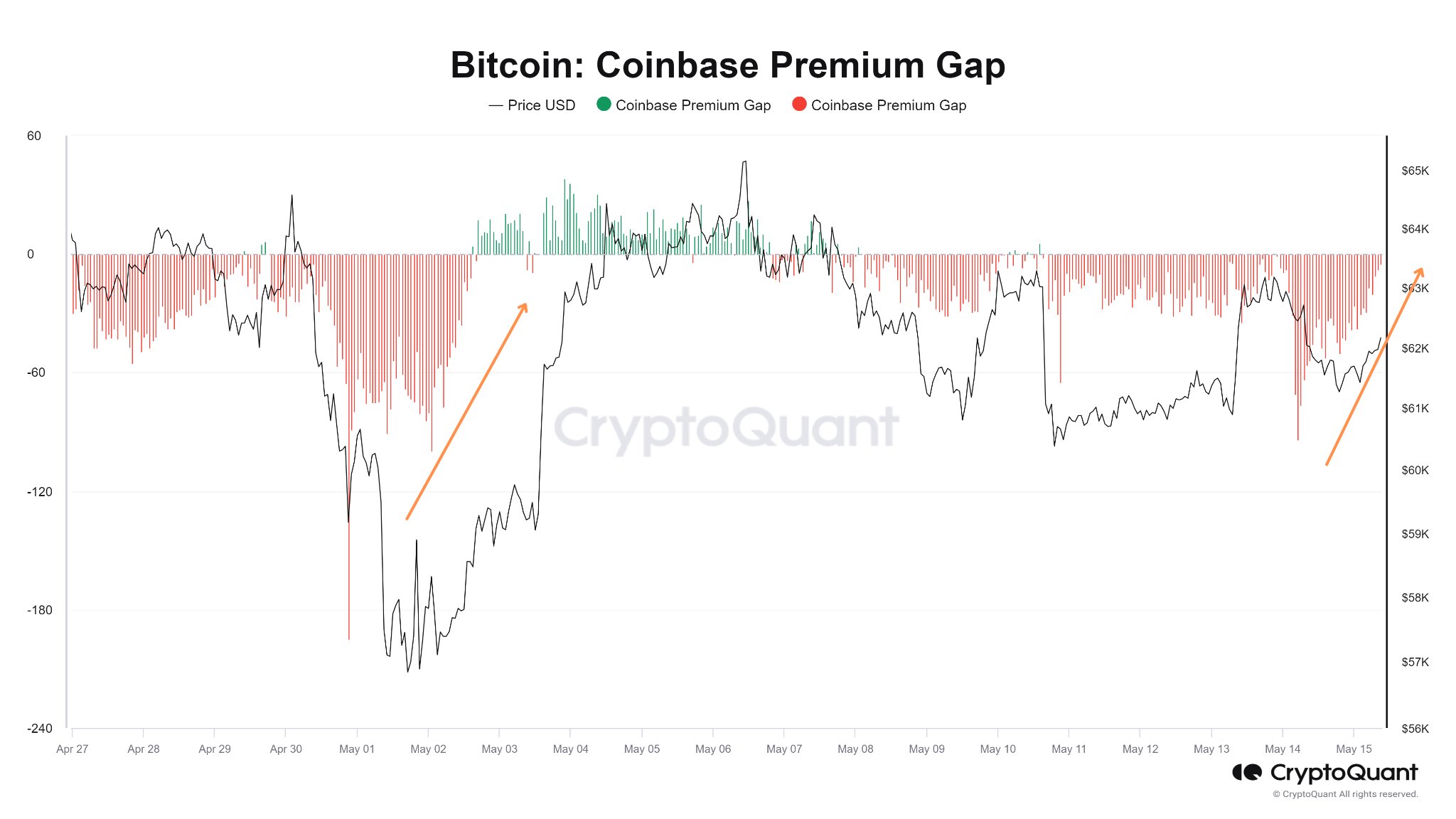

Bitcoin Coinbase Premium Gap Is Approaching Neutral Mark Again

As a crypto investor, I’ve been following the insights of analyst Maartunn closely. In his latest post on X, he pointed out that the Coinbase Premium Gap has significantly widened since it dipped into negative territory yesterday. The term “Coinbase Premium Gap” signifies the variance in Bitcoin pricing between Coinbase, using USD, and Binance, utilizing USDT as the currency pair.

If the value of this particular indicator is positive, it signifies that the cryptocurrency’s price on Coinbase is currently more than on Binance. This situation suggests stronger buying demand (or weaker selling pressure) on Coinbase compared to Binance.

Alternatively, a negative value implies that there could be more demand to sell Coinbase’s asset compared to Binance due to its lower price there.

As a crypto investor, I’d like to draw your attention to this chart displaying the recent developments in the Bitcoin Coinbase Premium Gap. This gap represents the difference between the Bitcoin price on the Coinbase exchange and the global average Bitcoin price. An increasing gap may indicate supply and demand imbalances or market inefficiencies, which could be worth exploring further.

Based on the graph before you, the Bitcoin Coinbase Premium Gap has shown a negative value during the recent period. This signifies that more Bitcoin was sold on Coinbase than on Binance.

Coinbase is frequently chosen by large US investors, making it well-known within the US institutional investor community. In contrast, Binance attracts a global user base. As a result, the differences in pricing on these two platforms can offer insights into the investment patterns of American “whale” investors.

As a researcher studying market trends, I’ve observed that the latest readings showing negative values for these large entities suggest they have been engaging in selling activities. A glance at the chart reveals that these investors exhibited comparable behavior in the past as well.

As an analyst, I’ve observed that when the selling pressure waned and the Coinbase Premium Gap reversed, the cryptocurrency’s price bounced back in the short term. Over the past day, this indicator has displayed a comparable pattern, with its value drawing nearer to the neutral threshold.

As a researcher studying market trends, I’ve observed a possible signal that institutional traders might have finished their recent selling spree. Consequently, this situation may present a brief window of upward price movement for investors.

Recently, there’s been a striking increase in Bitcoin Open Interest – the quantity of ongoing contracts for this digital asset – according to Maartunn’s recent X post. This surge was brought to our attention.

Typically, a surge in open interest for Bitcoin implies heightened market activity and potential price instability. The unexpected 9% spike could potentially trigger a sharp correction or mass sell-offs among investors.

BTC Price

Bitcoin has recovered over the past day as its price has now crossed the $64,800 mark.

Read More

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- PNG PREDICTION. PNG cryptocurrency

2024-05-16 08:11