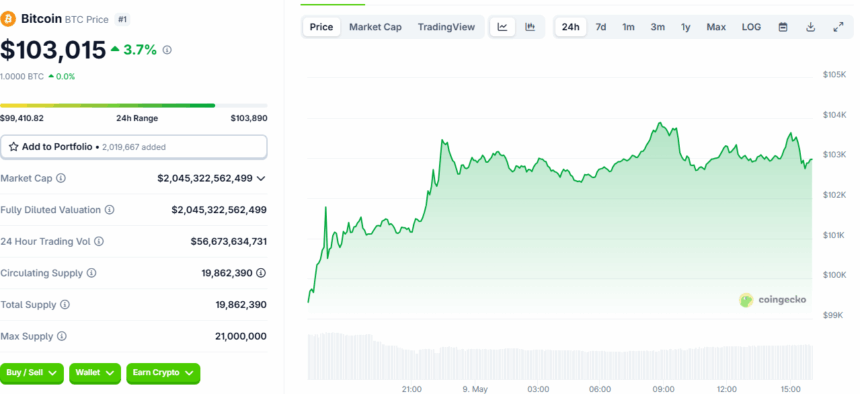

Oh, what spectacle unfolds on the digital stage, where the tale of Bitcoin doth rise like Don Juan at a masquerade ball! Forsooth, gentlefolk, within but three evenings, the grand Bitcoin vaulted itself from the doldrums—starting at a modest $94,000 (for the humble peasant) and today, with the dash and flourish of a young suitor, outstripping itself past $103,890.

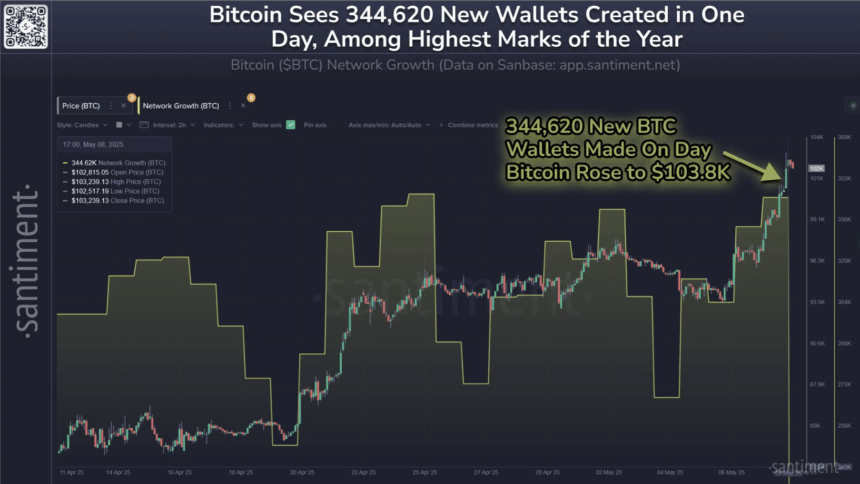

As we speak (that is, on this fine May 9th), our noble Bitcoin cavorts at $103,114, causing investors to faint in the galleries! But wait, the plot thickens: on the eighth day of May, an army of no fewer than 344,620 fresh purses—nay, wallets!—sprang forth as if summoned by Molière’s own quill. I daresay, even the most hard-bitten miser from L’Avare would swoon at such plenty.

‘Twas on the fourth of May, as if by the force of dramatic necessity, that these wallets began multiplying. The common people, usually content to watch from the wings, leapt in like eager extras desperate for stage time! 📈

Our learned friends at Santiment, never ones to miss a good soliloquy, declare that the Bitcoin stage witnesses an 8.13% leap in new addresses, 8.79% more active dramatis personae, and—cue gasps—an 11.35% revival of wallets previously empty as a tragic hero’s purse!

With every rise, the house grows fuller: newcomers and returning thespians alike! Once prices strutted across $103,000, the action was thick enough to make even Scapin sweat. Picture: wallets being funded, transactions pirouetting, a true ballet of greed and opportunity! 🕺

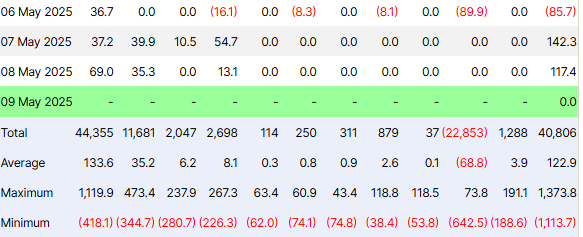

Behind the velvet curtain, calamity befell the short sellers—those gloomy Cassandras predicting Bitcoin’s demise. A tragic sum of $343.99 million in positions rendered naught within a day—$320.96 million of that from the short-witted shorts, hoisted by their own petard! Behold, a short squeeze: as prices climb, these critics are forced to buy back—so much slapstick, Chaplin himself would blush. 🤡

The scene grows ever livelier, for the noble ETFs—those stately dowagers of Wall Street—raked in $142.3 million in a single day! The house of ARK 21Shares collected $54 million, Lady Fidelity received $39 million, and old Lord BlackRock picked up $37 million—with IBIT returning the next day to gobble up $69 million more. Brava! 🎩💰

And so, as the curtains close on this act, Bitcoin stands above even Amazon on Fortune’s ladder, its cap swelling to $2.040 trillion—fifth among all the world’s assets. Only Gold, Microsoft, Apple, and NVIDIA now block its ascent. But beware, for as Molière knew, every farce has its twist. Will the mighty Bitcoin steal the show, or is the next pratfall waiting in the wings?

Read More

- Invincible’s Strongest Female Characters

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Gold Rate Forecast

- USD ILS PREDICTION

- How to Reach 80,000M in Dead Rails

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

2025-05-09 19:08