As a seasoned researcher with over two decades of experience in financial markets, I’ve witnessed numerous market cycles and trends. The recent movement of Bitcoin, particularly the surge in activity among the OG whales, has caught my attention.

During the last 24 hours, Bitcoin has dropped below the $100,000 threshold again, with on-chain information suggesting that original big whale investors are becoming more active.

Bitcoin OGs Have Transferred Massive Amounts Recently

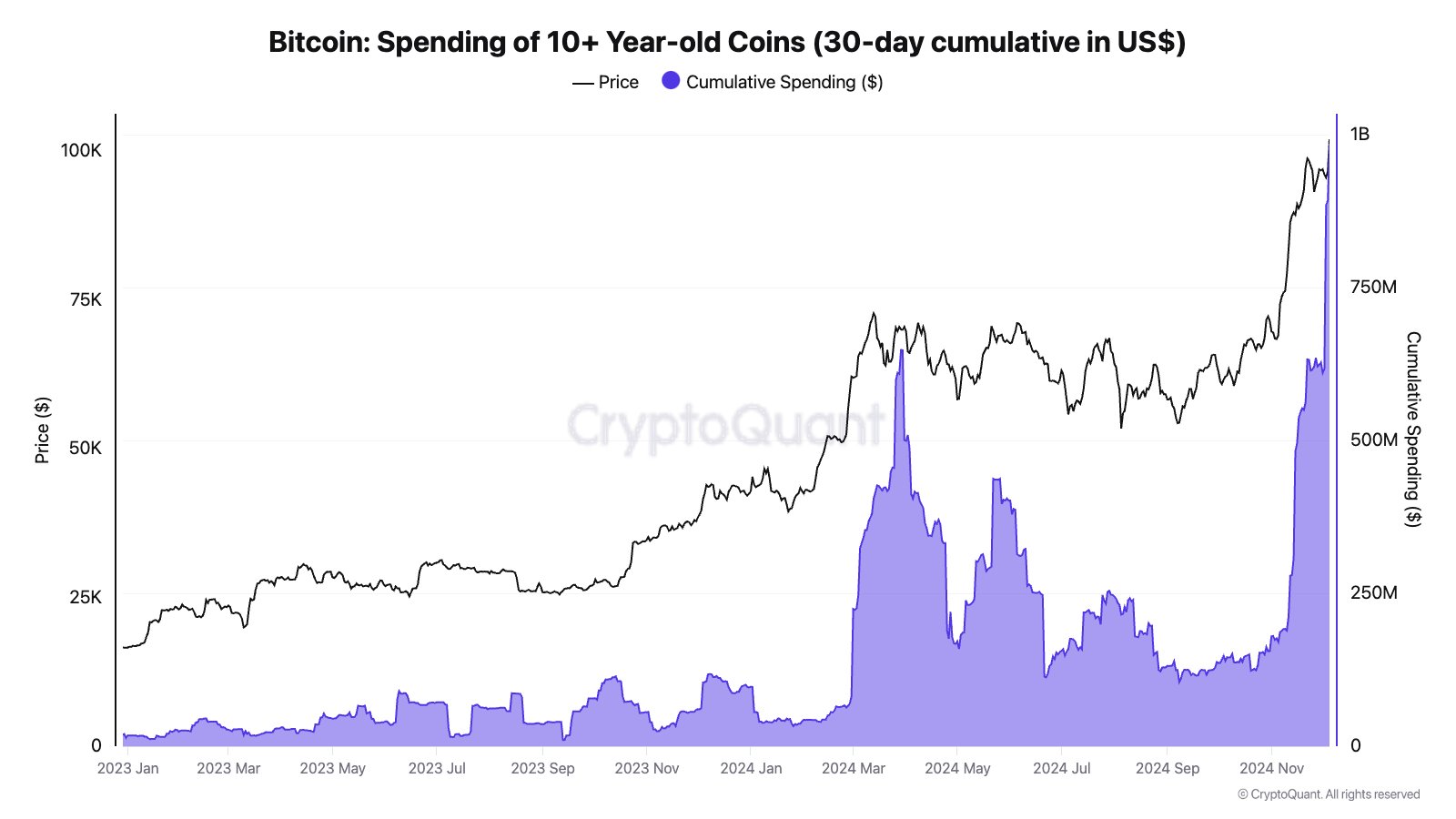

In a new post on X, CryptoQuant Head of Research Julio Moreno has discussed the trend in the 30-day cumulative spending of the 10+-year-old Bitcoin tokens.

This graph shows the cumulative count of Bitcoin (BTC) coins transferred by long-term investors, those who have held their coins for at least a decade, over the past month, as observed on the BTC blockchain. The data has been presented by the analyst.

It’s clear from the graph that investors aged 10 years or older have transferred a large quantity of cryptocurrencies since there’s been a significant increase in their prices over the last month.

Over time, it’s been observed that the chance of investors choosing to sell their investments decreases as they hold onto them. This probability significantly increases if they keep their investments beyond 155 days, making such investors known as “Long-Term Holders” or LTHs.

Regardless, an investor’s determination to hold onto their coins strengthens as they age, especially for those coins that are more than a decade old. In our discussion, we’re focusing on these “LTHs,” or Long-Term Holders, whose tokens are considered ancient even by the group’s standards.

Although these investors appear to be quite seasoned, it can be challenging to determine their unwavering commitment. It might seem paradoxical considering the previous information, but it’s also a statistical tendency that coins older than 7 years may have reached that age more likely due to being misplaced rather than through long-term holding (HODLing).

A token is considered “lost” when its holder fails to access their wallet due to forgetfulness or losing the necessary keys. Often, these tokens leave the active circulation and remain lost, but there’s a chance they might be found again sometime in the future.

Some investors who’ve been buying up historical coins during this recent market surge could potentially be tapping into a hidden trove – maybe it’s their own collection or someone else’s – implying that they might not have actively chosen to ‘HODL’ (hold) these coins before.

Despite some sellers exiting the market now, it seems that they might be the long-term investors who have been holding onto their cryptocurrency since 2014 or earlier. Given that they’ve set their sights on a $100,000 target, they appear content enough to finally let go of their coins.

The accumulated spending over a 30-day period from coins older than 10 years came incredibly close to surpassing $1 billion, right before the recent dip in the market. It’s plausible that some of these sales could have contributed to this market downturn.

BTC Price

Currently, Bitcoin is being exchanged for approximately $97,700 per unit, representing a decline of over 5% in its value within the past 24 hours.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Secret of Dylan and Corey’s Love Lock in Lost Records: Bloom & Rage

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- USD DKK PREDICTION

- 8 Best Souls-Like Games With Co-op

2024-12-07 15:41