As a seasoned researcher who has spent countless hours analyzing market trends and cryptocurrency movements, I find the analysis provided by James Van Straten about Bitfinex whales particularly intriguing. The correlation between their long positions on the platform and Bitcoin‘s price action is undeniably interesting.

According to this analyst, the actions taken by the large investors (Bitfinex whales) in the Bitcoin market tend to predict changes in the price of Bitcoin itself.

Bitfinex Whales Have Shown Smart Money Behavior In Recent Years

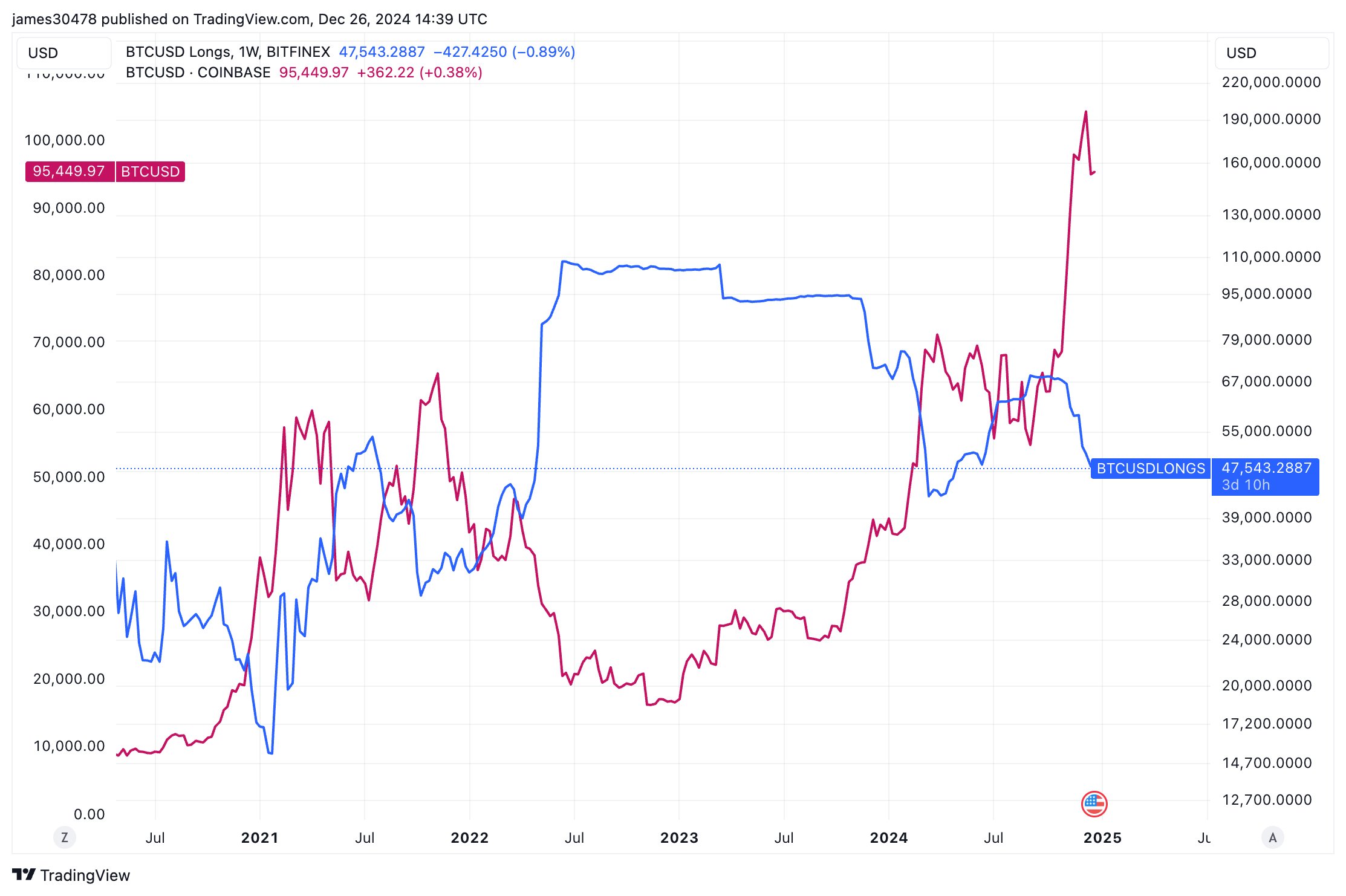

In his latest update on platform X, analyst James Van Straten delves into the increasing popularity of long Bitcoin holdings on the digital currency exchange, Bitfinex. Here’s the graph he provided:

Over the past few years, the shifts in Bitfinex’s long positions relative to Bitcoin’s price have displayed some intriguing patterns. It seems that the transactions on this platform often precede changes in the asset’s price.

According to Van Straten’s observation, the significant investors on Bitfinex have shown to be reliable signs of Bitcoin price trends. In the 2022 market downturn, these big players took advantage by establishing substantial bullish investments and holding onto them until the year 2024 arrived.

In the early part of the year, I found myself cashing out on significant portions of my crypto holdings as the market surged. However, this mass selling seemed to set off a chain reaction that led to a subsequent drop in the value of these assets.

In the consolidation period, the large investors (whales) on Bitfinex started to establish new long positions gradually. When the latest bullish trend emerged, these massive players once more demonstrated shrewd financial moves by cashing out their profits.

Because this profit-making incident originated from this group, the price of Bitcoin has again displayed tendencies suggesting a bearish trend. To date, the long positions on Bitfinex haven’t turned around their downward trajectory, which suggests that the large investors believe the current market circumstances are not favorable for initiating new bullish investments.

It’s plausible that the “Bitfinex whales” might make an error regarding cryptocurrency this time, but given their historical accuracy in predicting market trends, a significant increase in their long positions could be indicative of Bitcoin resuming its upward trajectory.

Regarding cryptocurrency exchanges, it’s been noticed that the overall Exchange Reserve (the quantity of Bitcoin kept in the wallets of all centralized platforms) has gone up lately, according to an analysis shared in a recent CryptoQuant update.

Typically, investors primarily utilize exchanges for selling activities, which means a surge in deposits might not bode well for the cryptocurrency’s value.

Over the recent surge in the Exchange Reserve, a collective sum of 20,000 Bitcoins has flowed into various platforms. This influx might serve as an additional hurdle for Bitcoin as it strives to regain its bullish trend.

BTC Price

Over the last seven days, Bitcoin’s trend appears to be holding steady near the $96,000 level, indicating little change in direction.

Read More

- REPO: All Guns & How To Get Them

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- LUNC PREDICTION. LUNC cryptocurrency

- REPO: How To Play Online With Friends

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- How to Reach 80,000M in Dead Rails

- BTC PREDICTION. BTC cryptocurrency

2024-12-28 06:41